Someone Is Buying Insurance

In an article I penned for last week’s Barron’s, I asserted that investors shouldn’t fight the tape, but instead insure against it. The current market environment is clearly “risk-on”, as we see major indices at or near all-time highs and an ever-present demand for speculative and often volatile stocks. Yet the evidence shows that someone has been buying insurance against a 10% correction in the S&P 500 (SPX), even though – or perhaps because – we haven’t seen one in months.

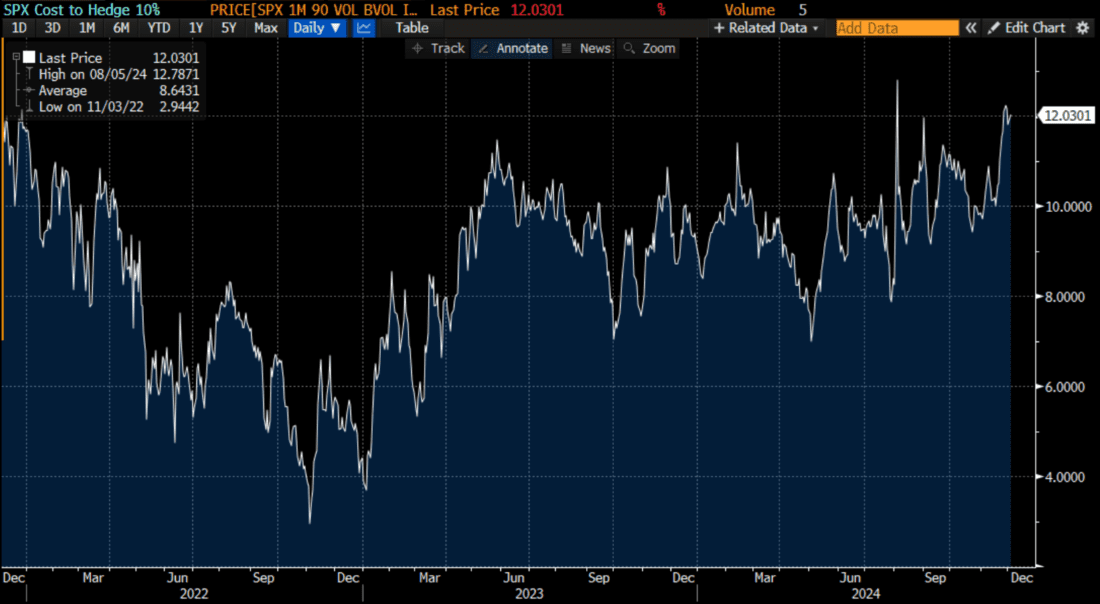

The “cost to hedge” against a 10% correction is around the highest levels that we’ve seen in three years. This is an index I created that subtracts the cost of at-money SPX options with one month to expiry from options with 90% moneyness (i.e. 10% below market) with the same expiration. Below market options typically have higher implied volatilities than at-money options – that is the familiar downside skew – but in arithmetic terms, the difference has become quite substantial:

SPX Cost to Hedge 10%

(Click on image to enlarge)

Source: Bloomberg

Implied volatilities reflect demand for the options in question, so it is clear that someone is demanding out-of-the-money puts.One month,10% below market options currently trade with a roughly 22 implied volatility while their at-money counterparts are around 10%. Since longer-term SPX options are more popular with institutions than retail investors, one must assume that there are institutions seeking to hedge their holdings.

Two caveats:

- These findings imply caution, not an imminent worry on the part of institutions.Those investors might be simply seeking protection for some of their holdings even as their net exposure is quite long.

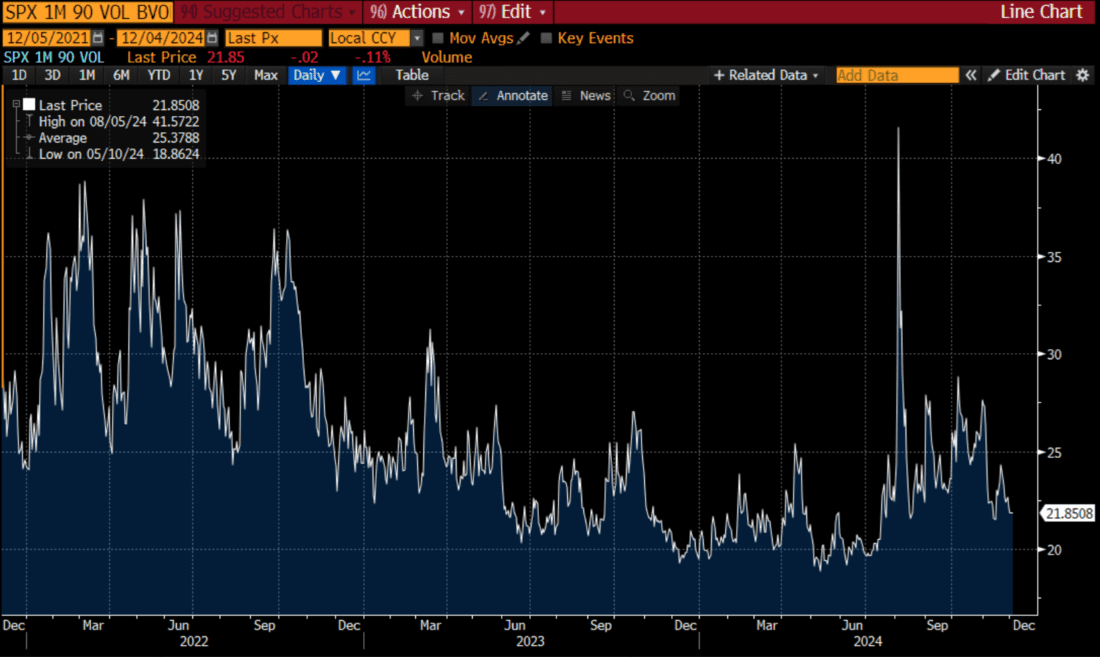

- Because we’re looking at the relative relationship between two moving targets, the absolute level of implied volatility for those protective puts could be relatively low.And indeed it is:

Implied Volatility for SPX Options with 1-Month to Expiry and 90% Moneyness

(Click on image to enlarge)

Source: Bloomberg

Thus, in absolute terms, it is indeed not all that historically expensive to hedge one’s holdings.Perhaps that’s why some may be seeking to do just that, even if things seem wonderful right now.

More By This Author:

Stocks Post Black Friday Rally

More Tariffs? Ho Hum…

PMIs Post Bifurcation Of Economic Fortunes

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more ...

more