Solid 2Y Auction Prices On The Screws As Yield Drops For The First Time In 7 Months

Image Source: Pixabay

One day after the biggest intraday reversal in Treasury yields following bullish bond commentary by the two "Bills", markets were closely watching today's 2Y auction to see how the sharp drop in yields would impact demand for short-end paper.

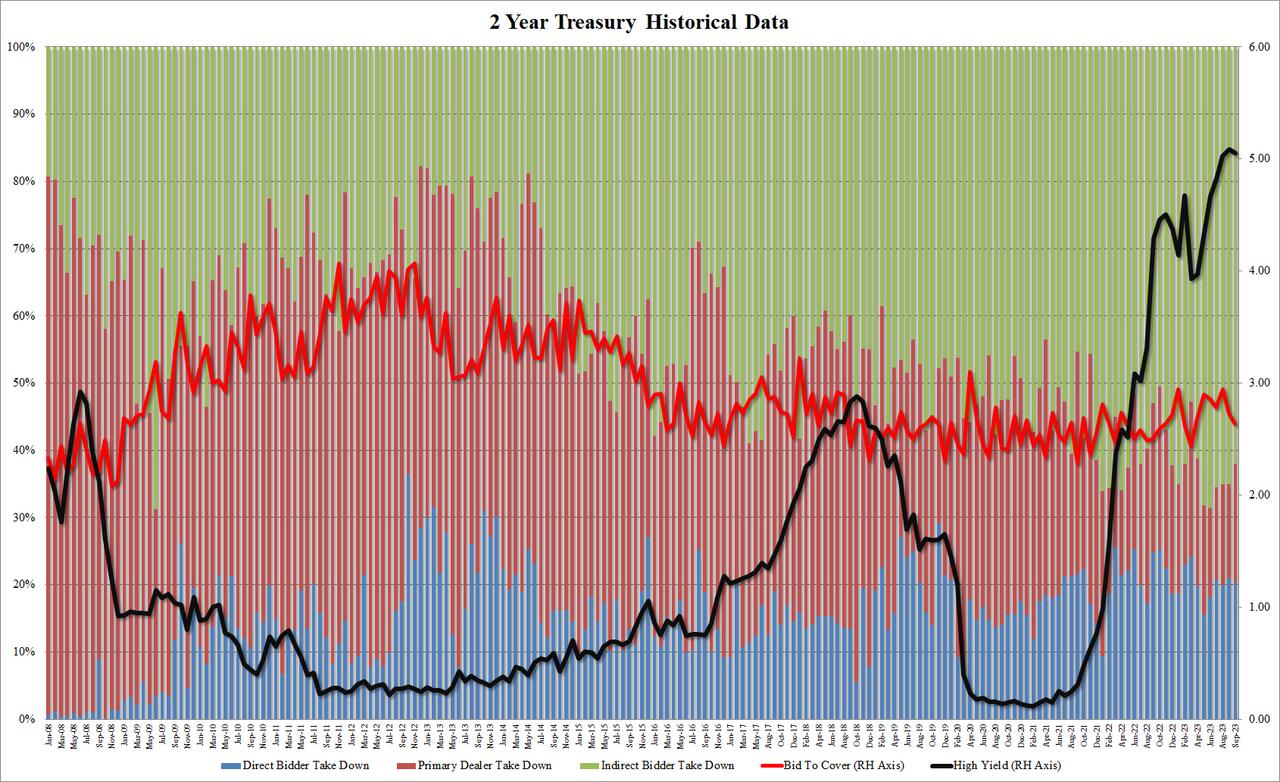

We got the answer moment ago when the Treasury sold $51BN in 2Y notes, in a solid auction that saw the first drop in the high yield since the March bank crisis, when yields tumbled from 4.67% to 3.93%, sparking widespread carnage among the "higher for longer" crowd. To wit, the High Yield was 5.055%, down from 5.08% in September, and priced "on the screws" to the When Issued, which was also at 5.055%, Curiously, this was the 2nd auction pricing "on the screws" in a row, a very rare occurrence.

The bid to cover was less impressive: at 2.636 it was down from 2.738 last month and the lowest since March (of course, it was below the six-auction average of 2.82).

The internals were also subpar, with Indirects taking down 62.1%, down from 65.0% and the lowest since April (vs six-auction average of 65.6%); and with Directs awarded 20.3%, or in line with recent auctions, the Dealers were left holding 17.6%, a big jump from September's 14.0% and the highest since April's 18.9%.

Overall, this was an average auction, with solid demand - especially by foreign buyers - despite some weak metrics here and there, something which wasn't lost on the bond market where the 10Y yield now trades back down to 4.83%, near the lows of the session.

(Click on image to enlarge)

More By This Author:

The Uncancellable Billionaire: Musk's SpaceX Signs Deal To Launch EU SatellitesBitcoin & Bonds Bid After 'Bearish-Bill' Bails; Black Gold & The Buck Breakdown

"Cardboard Box Recession" An Ominous Sign Of Faltering Consumer, Schwab Warns

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more