Solid 20Y Auction Prices At Highest Yield On Record

Image Source: Unsplash

Moments ago, the Treasury sold $16BN in 20Y paper in a solid, if hardly memorable, auction.

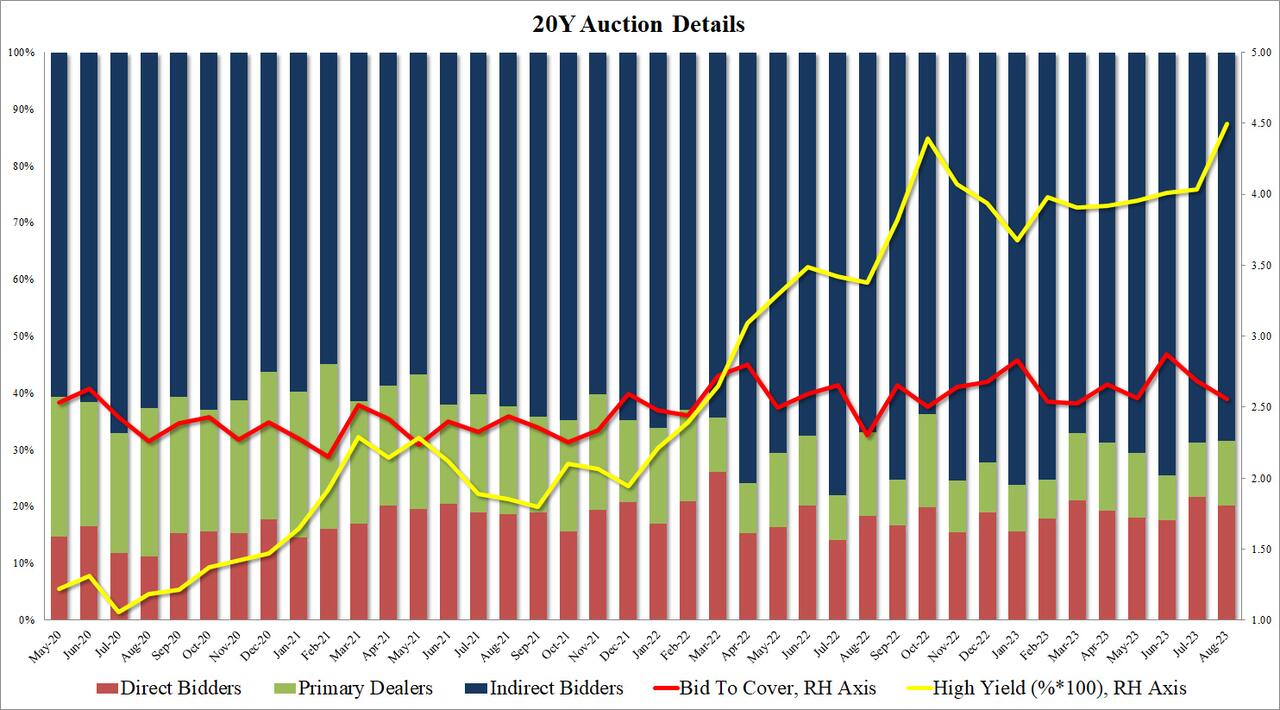

The high yield of 4.499% was the highest on record since the 20Y auction was introduced in May 2020.It tailed the When issued 4.490% by 0.9bps, the biggest tail for the tenor since October 2020.

The bid to cover of 2.56 was below last month's 2.68 and below the six-auction average of 2.64.

The internals were average: indirects were awarded 68.4%, just below last month's 68.7% and below the recent average of 70.8%; and with Directs taking down 20.2%, or just above the recent average of 19.3%, Dealers were left holding 11.4%, above last month's 9.6% and above the recent average of 11.4%.

Overall, a solid if certainly not memorable or spectacular auction, whose tail can be explained by the lack of concession in a session which has seen yields tumble across the board following a spate of poor US eco data, slamming the hopes of the "highers for longers."

(Click on image to enlarge)

More By This Author:

WTI Rebounds After Big Surprise Crude Draw; SPR Grows For 3rd Week

US PMIs Signal Stagflation: Service-Sector Slump, Price-Pressures Mount

Tesla Shares Slip After Report That Company Has Lowered German Gigafactory Production Targets

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more