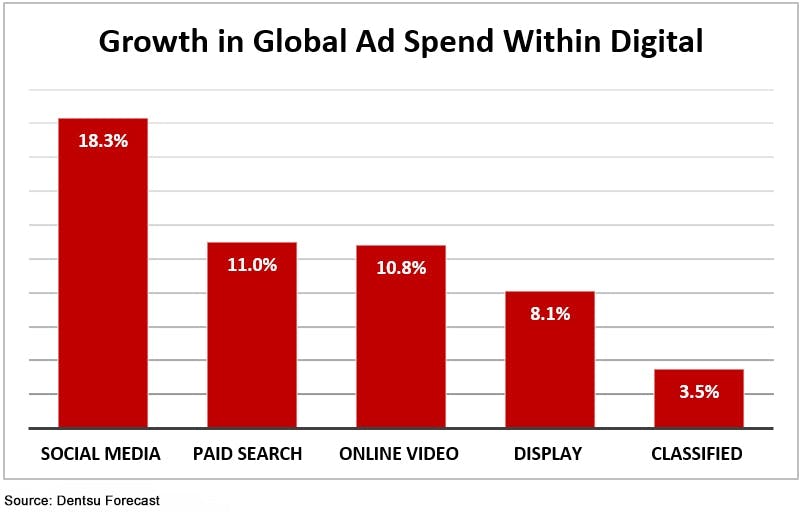

Social Media Projected To Lead Global Ad Spend In 2021

Global digital ad spending is projected to grow 10.1% YoY, powered by 18% growth in social media, according to a report from Dentsu, an advertising and public relations company based in Japan.

In China, social media ad spending is forecast to rise 29.6%.

Source: David Marlin

In the U.S., digital ad spending is projected to grow 17% YoY after only 5% growth in 2020, according to estimates from Credit Suisse. Based on these numbers, ad-tech companies like Facebook (FB), Pinterest (PINS), Snapchat (SNAP), and Twitter (TWTR) should continue to benefit from growth in digital ad spending in 2021.

For Q1 2021, Snapchat reported first quarter results that exceeded expectations for revenue, earnings per share, and global daily active users. The company also delivered positive Free Cash Flow for the first as a public company.

Like many stocks that did well in 2020, tougher comps for Pinterest started in March. We anticipate a small deceleration YoY due to tougher comps, with strong international growth. Despite usage trends being mixed, if we see an ad rebound, revenue can still climb higher.

For Twitter, we anticipate a solid quarter, but not on the same level as Snapchat and Pinterest due to recent download data. Twitter daily active users are trending up, but downloads struggled in March more than Snapchat and Pinterest, which faced equally difficult comps. We also expect solid results from Facebook due to less impact from privacy changes at Apple than expected and strong spending in digital advertising.

Below we look at Snapchat’s Q1 2021 results and preview Pinterest, Twitter and Facebook. But first, we take a closer look at download and monthly active user trends.

Downloads and MAUs Struggle Against Tougher Comps

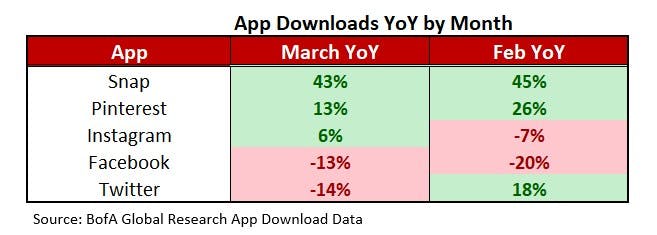

Social media downloads were mixed in Q1, with Snapchat and Pinterest showing the strongest download trends YoY.

Source: David Marlin

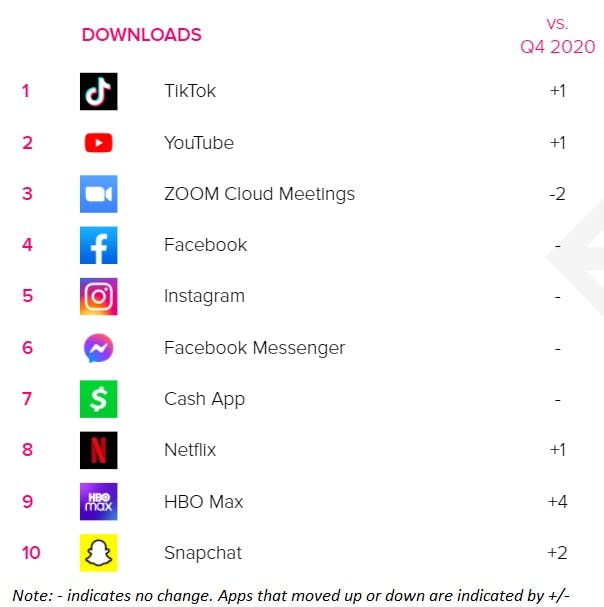

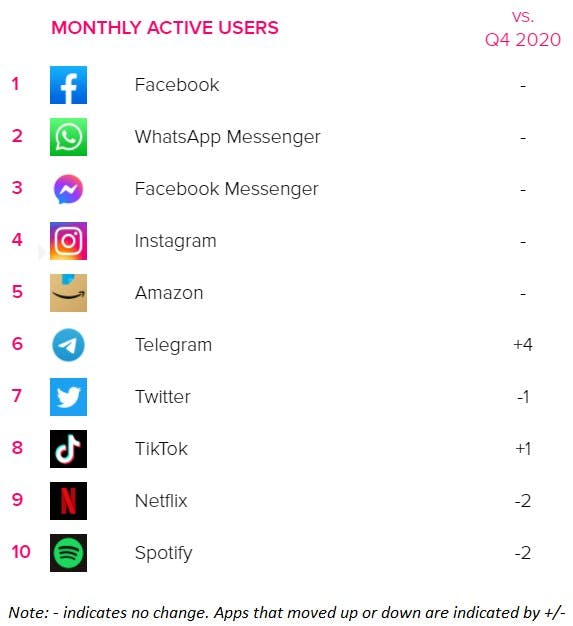

Next we look at the top 10 apps in the U.S. in Q1 2021 by download and MAU. Facebook, Instagram, and Facebook Messenger continued to be top apps by download and MAU.

Snapchat appears on top 10 charts for downloads and MAU. The app moved up two spots in downloads with no change for monthly active users. Pinterest and Twitter made it to the bottom of the chart for monthly active users, with Pinterest moving down one spot, indicating less engagement. Twitter saw no change in monthly active users.

Q1 2021: Top Apps in the US by Downloads vs Q4 2020

Q1 2021: Top Apps in the US by MAU vs Q4 2020

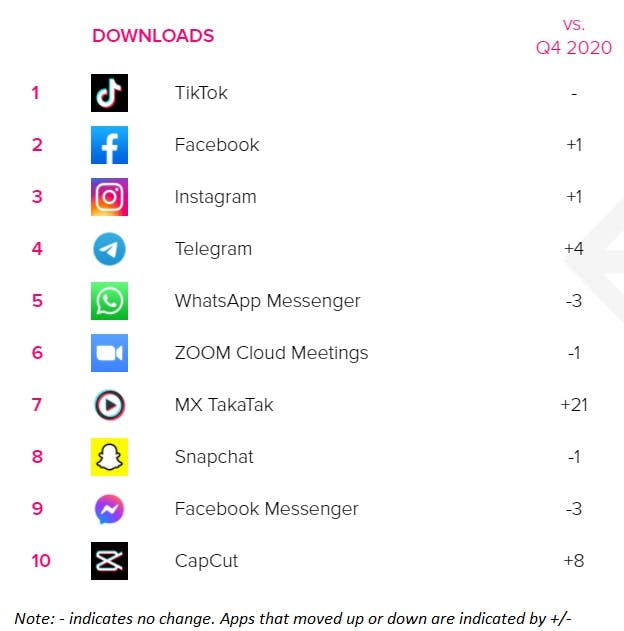

Next we look at the top 10 apps worldwide in Q1 2021 by downloads and MAU. Globally, Facebook, Instagram, and Facebook Messenger continue to be top apps by download and MAU. While Snapchat was a top downloaded app globally, it is down slightly from Q4 2020. Outside of the Facebook family of apps, only Twitter made it onto the list of top global apps by MAU and it was down slightly from last quarter.

Q1 2021: Top Apps Worldwide by Downloads vs Q4 2020

Next we take a closer look at Snapchat, which reported April 22 after market.

Snapchat: Active Advertiser Base Doubles

Snapchat executives struck a bullish tone in its Q1 2021 earnings report, noting that engagement trends remained positive as users began socializing in larger groups. The company’s active advertiser base approximately doubled year-over-year in Q1, and traditionally strong categories, such as theatrical films, have started to return.

Revenue increased 66% YoY to $770 million versus $740.89 million consensus. Non-GAAP EPS of $0.00 beat by $.05 and GAAP EPS of $(0.19) beat by $0.01. Global DAUs grew to 280 million, up 22% YoY, versus 274.5 million consensus.

ARPU was $2.74 versus $2.71 consensus. Net loss and Adjusted EBITDA were $(287) million and $(2) million in Q1 2021, compared to $(306) million and $(81) million in the prior year, respectively.

Operating cash flow improved by $131 million to $137 million in Q1 2021, compared to the prior year. The company also achieved its first quarter as a public company of positive free cash flow. Free Cash Flow improved by $131 million year-over-year to reach $126 million.

Common shares outstanding plus shares underlying stock-based awards totaled 1,629 million at March 31, 2021, compared to 1,589 million one year ago.

Looking forward, Q2 2021 revenue is estimated to be between $820 million to $840 million, up 80% to 85% YoY. Adjusted EBITDA is estimated to be between $(20) million and breakeven, compared to $(96) million in Q2 2020. Daily active users are expected to reach 290 million users, up 22% YoY.

For the full year, the company plans to invest in its ad platform to drive improved relevance and ROI; scale sales and marketing to support global advertising partners; and build innovative ad opportunities, including video and AR.

Nearly 30% of consumers use mobile AR apps, with 59% reporting weekly use, according to a 2021 report by ARtillery Intelligence with Thrive Analytics.

A report from Futurum Research sponsored by SAS puts the number of smartphone owners using AR at more than 50%, with 69% saying they expect to use AR/VR/MR this year to sample products, and 63% saying they would use the technology to visit a remove venue, location, or event this year.

Pinterest: US Growth Slows, International Strength Continues

For Q1 2021, Pinterest is guiding for revenue growth in the low 70% range YoY with non-GAAP operating expenses at a similar level compared to last quarter. The consensus estimate is $473 million in revenue, up 74% YoY, according to YCharts.

For the full year, executives are expecting positive trends due to investments in new tools like shopping and automation; international expansion; and monetization into Latin America during the first half of the year, according to the last earnings report. Latin America is forecast to see 10.2% YoY growth in digital ad spending this year, after an 18.4% drop last year, according to the report from Dentsu.

Pinterest app downloads were up 26% YoY in February versus 13% YoY in March, according to data from SensorTower, which provides market insights for the global app economy.

In the U.S., downloads were up 5% YoY in February and down 5% YoY in March. Pinterest showed strong international growth, with international downloads up 29% YoY in February and 15% YoY in March.

![]()

For Q1 2021, Pinterest DAUs were up 14% YoY worldwide and 7% QoQ, according to data from SensorTower.

In the U.S., DAUs were up 6% YoY and down 2% QoQ., while international DAUs were up 17% YoY and 10% QoQ.

(Click on image to enlarge)

Pinterest announced Wed that the existing partnership with Shopify has been extended to 27 additional countries, including Australia, Brazil, and the U.K. The company also added two new ecommerce features, multifeed support for catalogs and dynamic retargeting, which allows marketers to target individual consumers.

The partnership with Shopify offers merchants a quick way to upload catalogs to Pinterest and turn products into shoppable Product Pins. Pinterest said the number of catalog feed uploads on its platform increased by over 14 times worldwide from March 2020 through March 2021, and 97% of top searches are unbranded, according to Adweek.

In the last earnings report, Pinterest executives warned about potential headwinds from less engagement due to economies reopening. The company also discussed changes in privacy and tracking data, which was a major topic of discussion for all four social media companies during the last earnings reports.

Due to the nature of Pinterest—the company is able to capture first party data on queries, saves, and board creation—Pinterest is less exposed to privacy changes, according to Pinterest CFO Todd Morganfeld.

Twitter Ramps Up Hiring, Expenses

Twitter is guiding for total revenue of $952 million at the midpoint, with GAAP operating income between ($50) million and break even. The consensus estimates for Twitter is $1.026 billion in revenue, up 27% YoY, according to YCharts.

Executives struck a bullish tone in the last earnings report, with plans in 2021 for significant hiring and new features to boost revenue. Executives anticipate growing total costs and expenses 25% or more this year due to hiring in engineering, product, design, and research, and the final buildout of a new data center. Still, Twitter is projecting revenue to grow faster than expenses—based on its assumption that the global pandemic continues to improve and the impact from privacy changes associated with iOS 14 are modest.

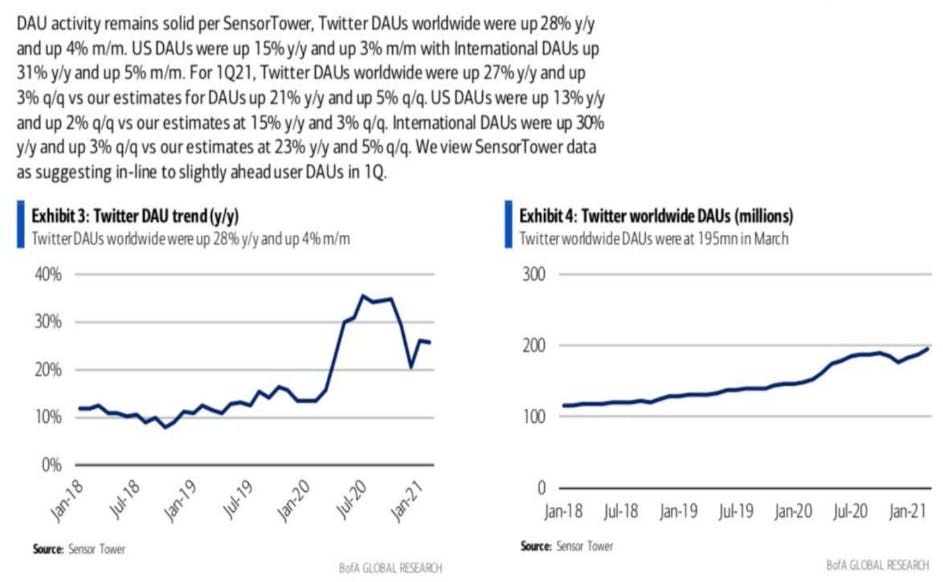

Twitter faced more difficult comps in March and downloads were down 14% YoY, versus up 18% in February, according to data from SensorTower. International markets saw a stronger decline, down 15%, compared to the U.S., down 7%.

(Click on image to enlarge)

During the last earnings call, Twitter guided for 20% YoY growth of monetizable monthly active users for Q1, and no change to the pre-pandemic goal of growing mDAU 20% or more over multiple years. Users who joined Twitter last March when shelter-in-place orders began have stayed with Twitter better than previous groups, according to the call.

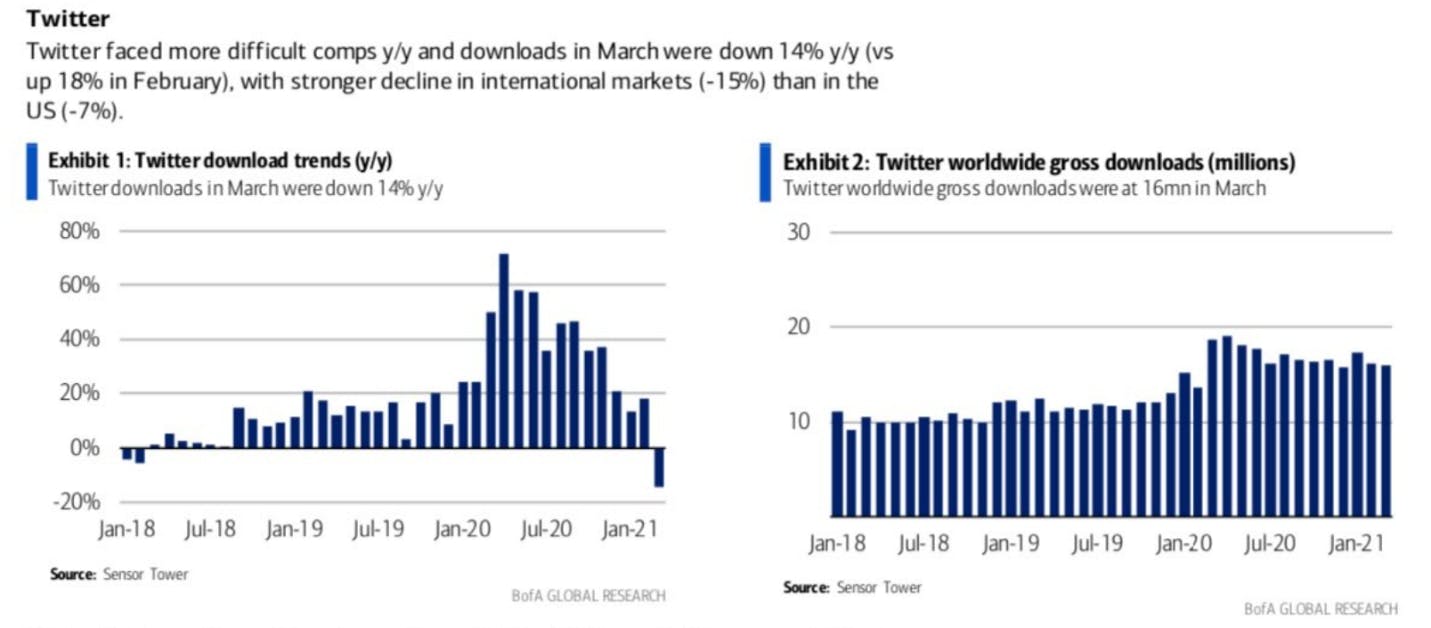

In March, Twitter DAUs worldwide were up 28% YoY and up 4% month over month, according to data from SensorTower.

For Q1 2021, Twitter DAUs were up 27% YoY and up 3% QoQ. In the U.S., DAUs 13% YoY and 2% QoQ, with strong international growth of 30% YoY and 3% QoQ.

(Click on image to enlarge)

To prepare for privacy changes associated with iOS 14, the company last quarter released mobile app promotion, which helps advertisers drive engagement on Twitter, and Twitter Click ID, which helps track conversions.

Twitter CFO Ned Segal expressed confidence at the Morgan Stanley Technology, Media, and Telecom Conference March 3 as the company prepares for privacy changes, and noted that much of the data Twitter collects is not tied to a device ID.

This year, Twitter plans to leverage data for better ad targeting, increase revenue from small and medium sized businesses; continue updating MAP; experiment with non-advertising subscription-based revenue, and capture more ad dollars from the multi-billion dollar app advertising industry.

To drive brand recall and favorability, Twitter is also experimenting with branded likes, which should be widely available later this year, according to the company’s Virtual Analyst Day on Feb. 25.

For Facebook, Apple’s IDFA Hurdle Not as Bad as Feared

The consensus estimate for Facebook in Q1 is $23.6 billion in revenue, up 33% YoY.

Facebook struck a cautious tone in its Q4 report. CFO Outlook Commentary warned that the company continues to face significant uncertainty. The business benefitted from two trends that played out during the pandemic: a shift towards online commerce and a shift in consumer demand towards products and away from services, according to the CFO Outlook Commentary.

These trends provided a tailwind to Facebook’s advertising business in the second half of 2020, due to the company’s strength in products and low exposure to services such as travel. A reversal in 2021 of one of both of these trends could be a headwind to advertising growth, according to the commentary.

In January, retail sales were up 5.3%, with every major category of spending seeing gains. In February, retail sales dropped by a seasonally adjusted 3.0% and rebounded 9.8% in March.

Retail sales are expected to continue growing strongly in April and May, according to Kiplinger’s, which said all sales categories are benefitting from the surge and have surpassed pre-pandemic levels, except for restaurants and department stores.

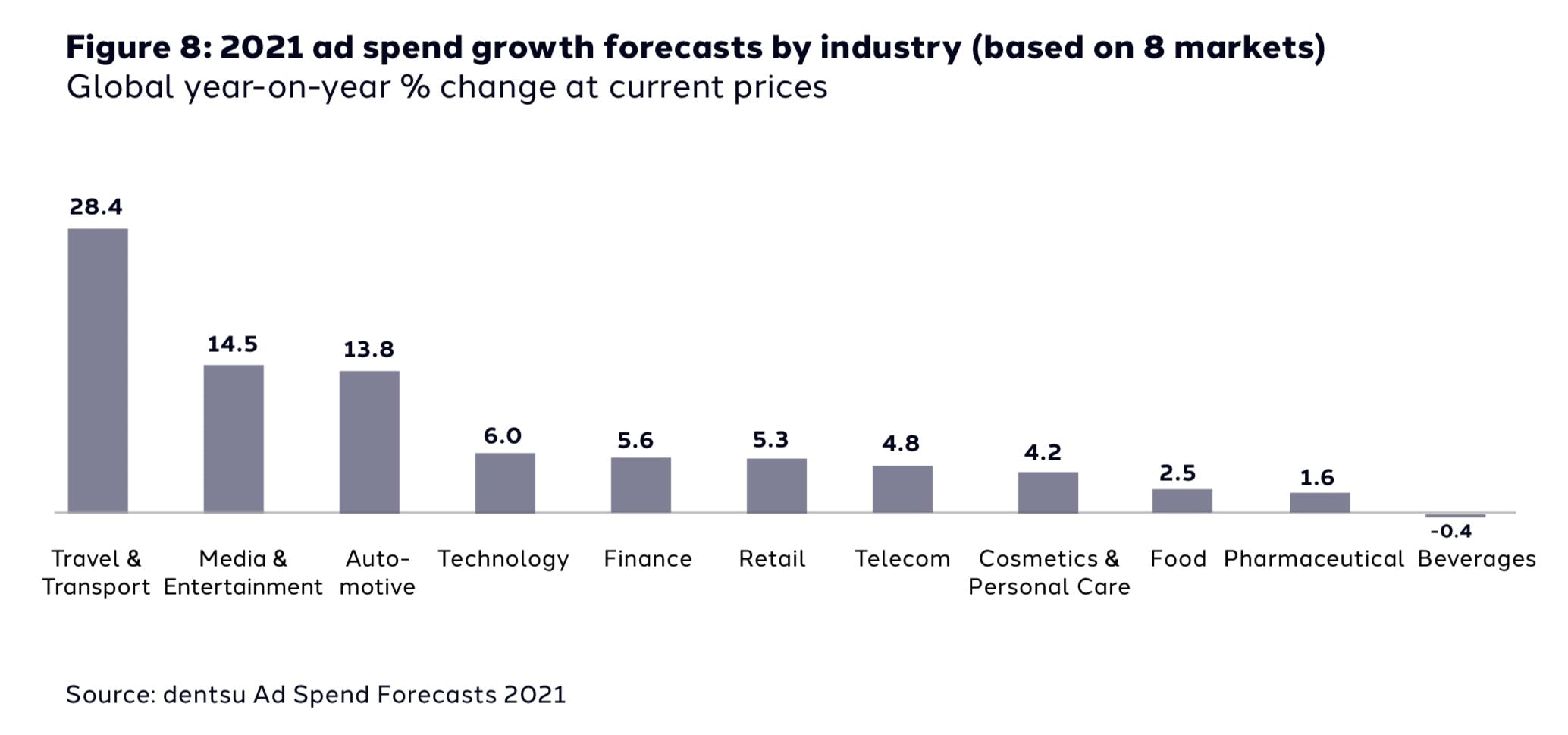

In 2021, sectors that restricted advertising the most due to the pandemic are set for the biggest recovery, with ad spend in travel and transport forecast to grow by nearly 30%, according to the report by Dentsu.

[BK1]Great idea putting Facebook at the end. Most people will read this for SNAP and PINS

(Click on image to enlarge)

Like other winners of the Covid economy, Facebook will face tougher comps in the second half of 2021. However, the company expects total revenue to remain stable or modestly accelerate in the first and second quarters.

“We continue to invest to improve our exposure and travel—sorry, in service areas like travel,” said Facebook CEO Dave Wehner. “But our expectation would be in 2021, we’ll continue to have a similar skew towards products as we’ve had in the past.”

Executives anticipated high opt out rates due to privacy changes from Apple, which attacks Facebook’s core advertising business on iOS. If all personalized ads went away, small businesses would see a 60% cut in website sales, according to the report.

However, the opt-in rate for the default Apple pop-up was 73%, according to a report by Adikteev, an app reengagement platform, which conducted an experiment with thousands of random users in 10 countries from July 22 to August 5.

For Facebook’s ad auctions, pricing depends on impressions. Impression growth slowed in to 25% in Q4 from 35% in Q3. Executives expect that trend to continue into Q1 2021.

My premium subscribers received a 12-page report on Roku And TTD prior to earnings, Snap prior to earnings and tech trade war plays to hedge their portfolios.