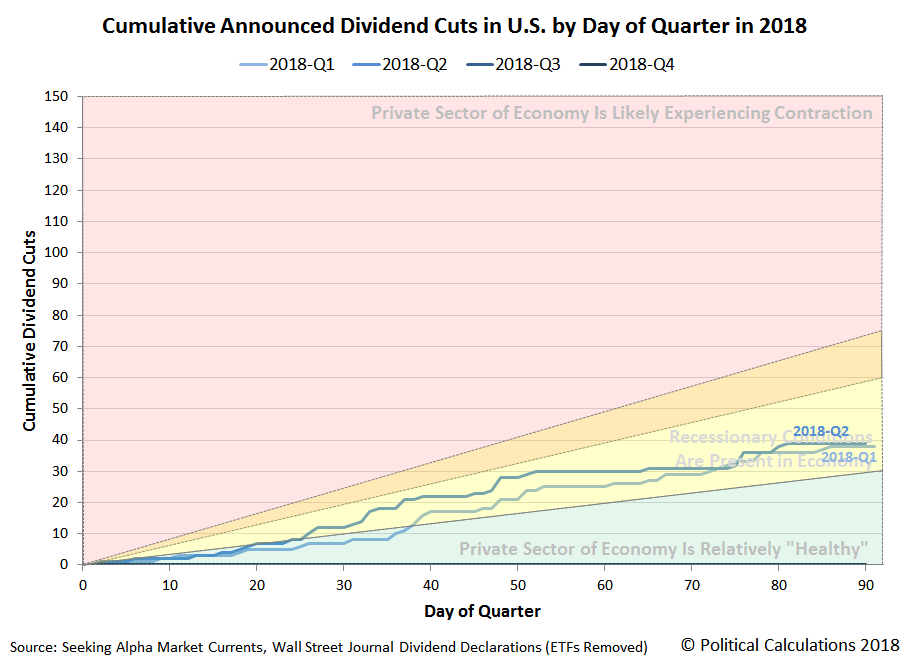

Snapshot Of Cumulative Dividends Cuts Through The End Of 2018-Q2

We're completing the picture that our real-time sampling of dividend cuts during the second quarter of 2018 has been painting. Through Wednesday, 27 June 2018, with 2018-Q2 all but over, this remarkably simple measure of the near-real time health of the private sector of the U.S. economy is signaling that while some recessionary conditions are present, overall, things have been pretty good for publicly-traded U.S. businesses.

How good? Our first chart compares the nearly completed 2018-Q2 against the preceding quarter of 2018-Q1, where we find a similar number of firms cutting dividends in both quarters in our sampling:

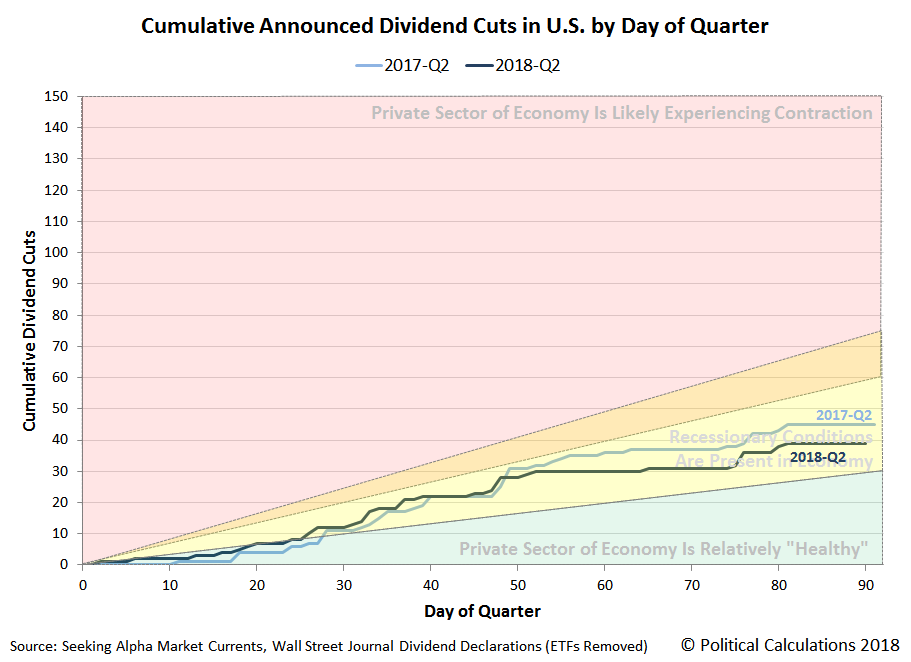

2018-Q2 however saw fewer dividend cuts reported via our primary sources for real-time dividend cut announcements than did the year-ago period fo 2017-Q2, which suggests that business conditions have improved year over year.

Since our last snapshot of cumulative dividend cuts during 2018-Q2, there have been just nine additions to our list of firms announcing reductions in their dividends. Here's the short list:

- Permian Basin Royalty Trust (NYSE: PBT)

- Pacific Coast Oil Trust (NYSE: ROYT)

- Arlingon Asset Investment (NYSE: AI)

- Mesa Royalty Trust (NYSE: MTR)

- Anworth Mortgage Asset (NYSE: ANH)

- PermRock Royalty Trust (NYSE: PRT)

- LaSalle Hotel Properties (NYSE: LHO)

- Capstead Mortgage (NYSE: CMO)

- San Juan Basin Royalty Trust (NYSE: SJT)

This short list, which spans the calendar month of June 2018, is itself is a very positive indication since it captured fewer than 10 dividend cuts announced during the month, which the threshold we use to identify when recessionary conditions are present in the U.S. economy.

Looking over these firms, we find that they're predominantly made up of oil and gas trusts that distribute dividends as a percentage of their earnings that fluctuate on a monthly basis and of real estate investment trusts (REITs) or financial firms whose earnings are sensitive to changes in interest rates, which have been negatively affected by the Fed's recent series of rate hikes.

Data Sources

Seeking Alpha Market Currents. Filtered for Dividends. [Online Database]. Accessed 27 June 2018.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed Accessed 27 June 2018.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more

This is likely dated information. $ROYT just raised their dividend dramatically. MoM-Div fluctuates on $BNO price & CAPEX spend.