Small Gains At 50-Day MA For Russell 2000

Image Source: Unsplash

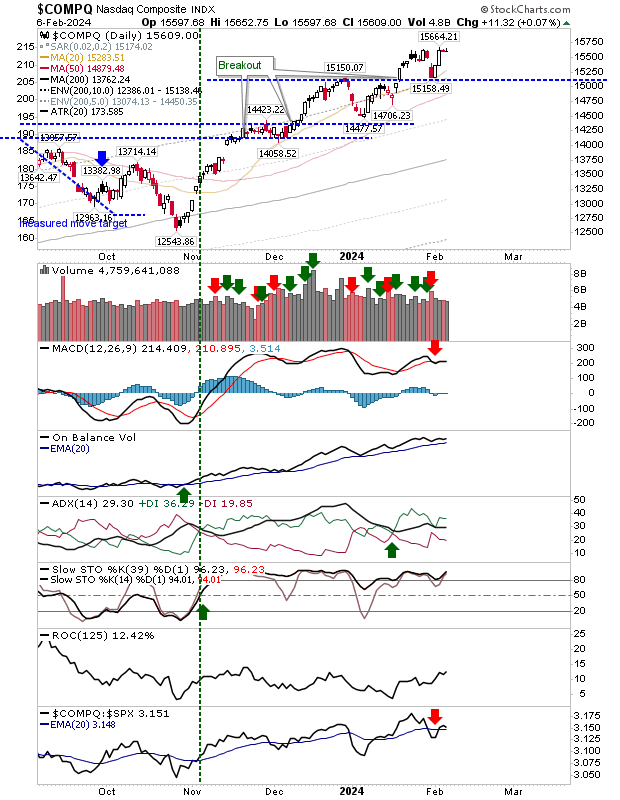

A bit of a non-event for the S&P and Nasdaq as both indices closed with tight doji near their highs. There isn't a whole lot more to add for these indices.

The Russell 2000 (IWM) managed to deliver a little more upside with a successful test of its 50-day MA. However, the volume was well down on what I would like to see for a successful support test.

I follow J.C. Parets and he has noted the breadth weakness in this rally. This is apparent in the Percentage of (Nasdaq) Stocks above the 50-day MA, 200-day MA, Bullish Percents Index and Summation Index, all of which are showing a bearish divergence.

Given the breadth picture (in the Nasdaq), the expectation is that tight trading will eventually give way to selling, or catch bulls off guard with a 'bull trap'. I would expect this selling to spill across indices, but let's see what the market brings.

More By This Author:

The Week Closed With Strong Gains On Higher Volume AccumulationBullish Hammer For Russell 2000 At 50-Day MA

Day Trade In Nasdaq 100 Delivered; What Next?

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more