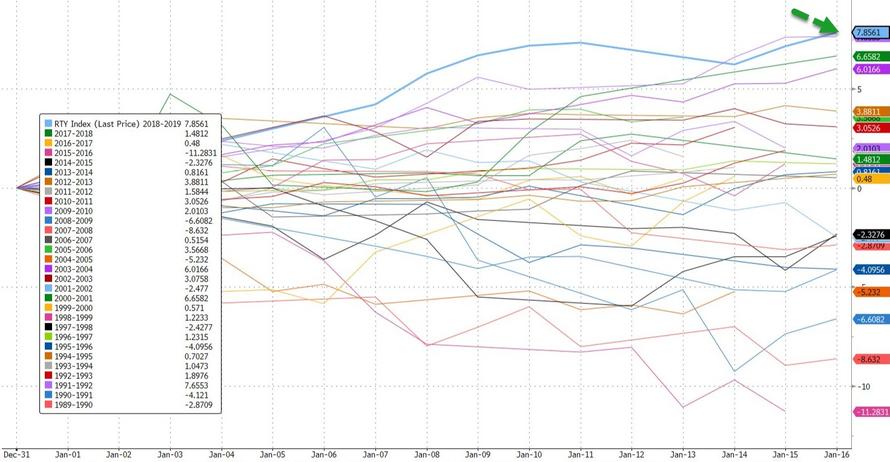

Small Caps Surge To Best Start In 30 Years After Record China Liquidity Injection

According to Bloomberg data this is the best start to a year for the Russell 2000 in at least 30 years.

And at the same time, top-down macro and bottom-up earnings are tumbling?

"Inconceivable?"

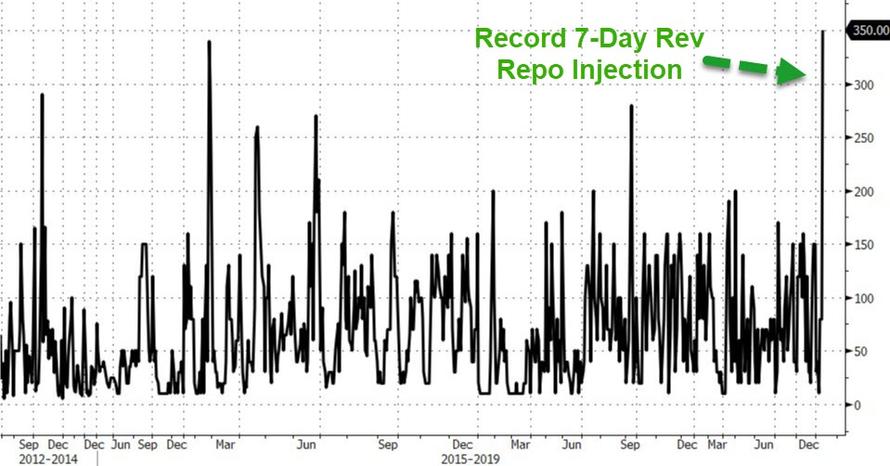

Despite a record liquidity injection overnight...

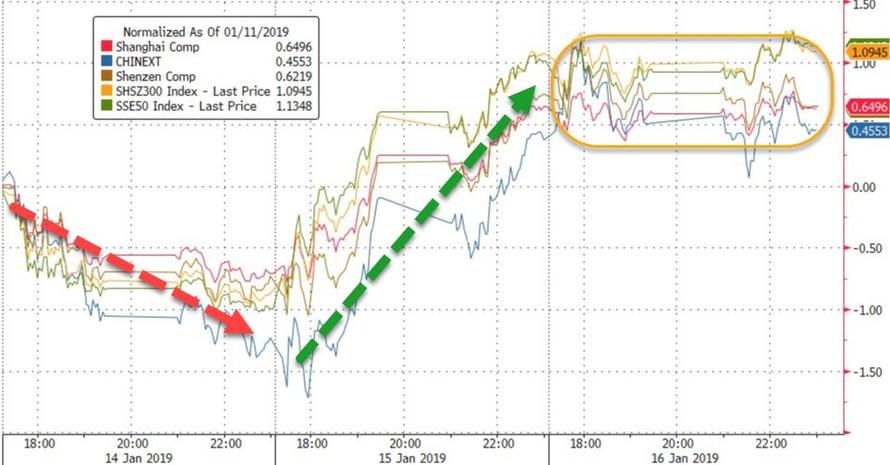

Chinese stocks flatlined...

The FTSE continues to lag in Europe as once again early dips were bought...

US equities surged at the cash open, as Goldman rebounded from initial weakness, surging massively on the day, but that ramp faded into the European close. Of course the EU close prompted a trend reversal and stocks shrugged higher for the rest of the day until Huawei headlines too the shine off...

Nasdaq futures slipped back to unchanged after the Huawei headlines hit tech firms more...

The S&P 500 is now five points away from hitting the top end of the resistance range cited by many market watchers: 2,630. What happens next is anyone's guess. Will stops and short covering kick in, sending the rally into melt-up mode? Or will the bulls who are sitting on fat profits take some chips off the table?

All the majors pushed back above key technical levels today...

Goldman's insane spike higher today accounted for half the Dow's gains...

The Russell 2000 is leading in 2019 among the US majors up 8% YTD (double the 4% rise in the Dow)...

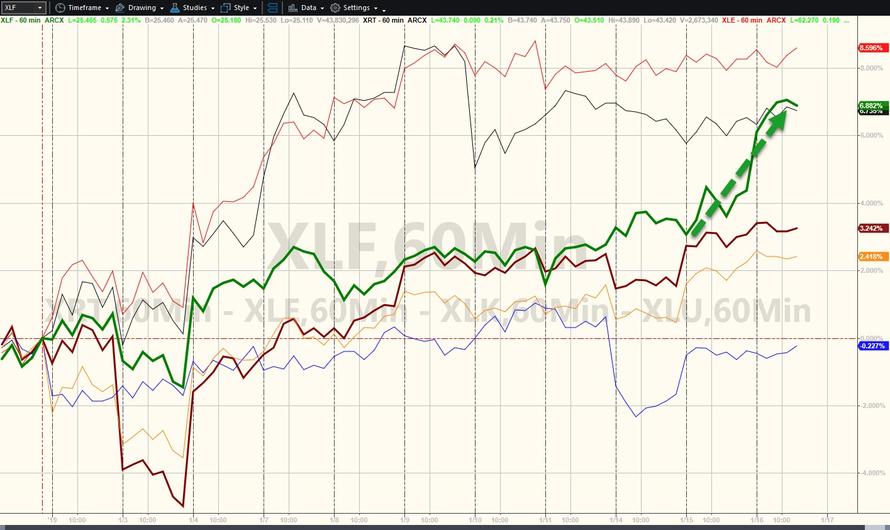

Energy and Retail continue to lead the year but Financials exploded in the last few days on dismal earnings... (Utes still in the red)

SNAP cracked...

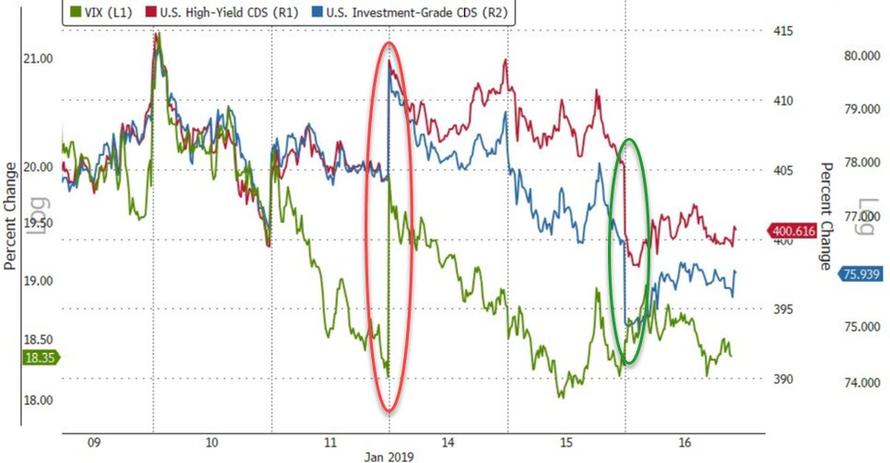

Credit markets compressed notably today, recoupling with VIX...

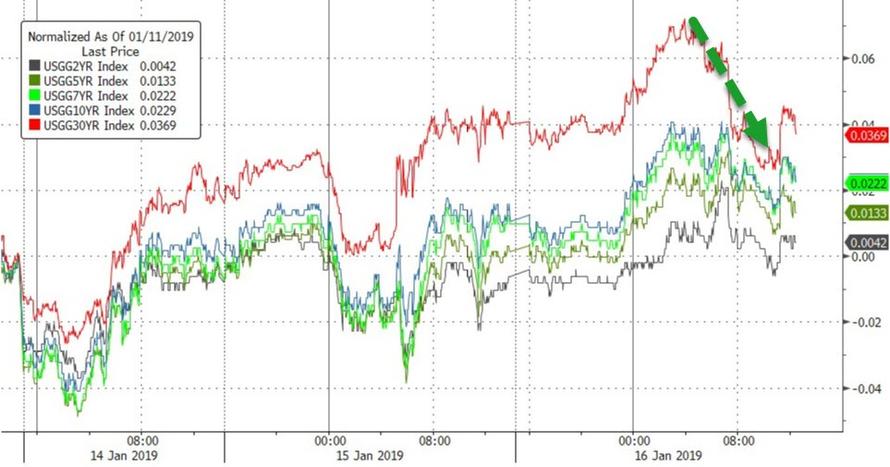

The long-bond outperformed (very marginally lower in yield) with yield dropping back in line with the rest of the curve today...

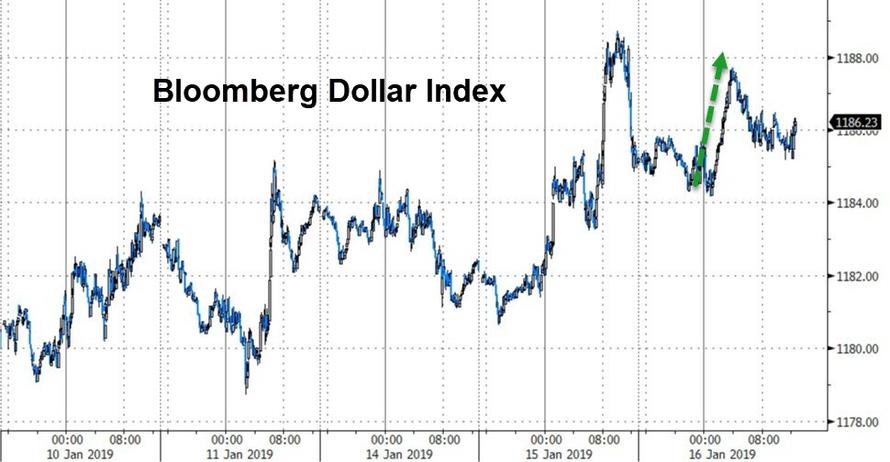

The dollar ramped overnight as Europe opened then drifted back to end modestly higher...

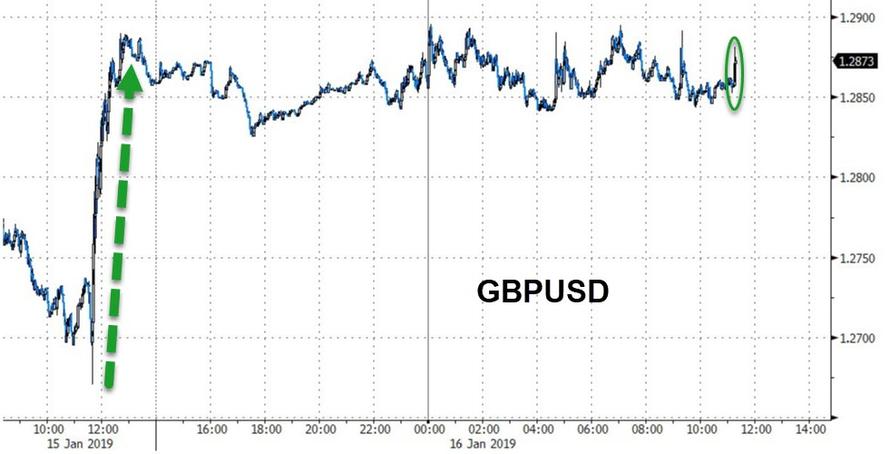

Cable was quiet today with a very modest gain after May won her confidence vote...

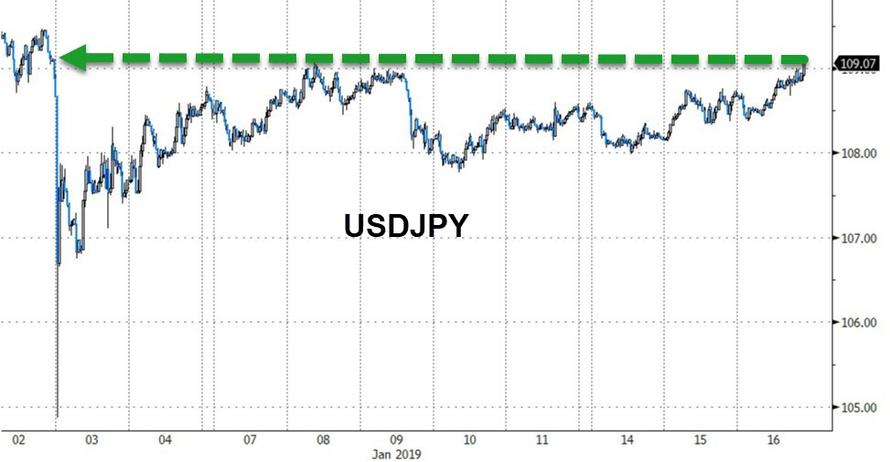

USDJPY retraced its flash-crash...

Cryptos chopped around again...

Gold and copper gained on the day (China liquidity) and the machines ramped WTI back higher after a disappointing production, inventory print for the bulls...

WTI tumbled back near a $50 handle after DOE data then was ramped and double-ramped at the NYMEX close...

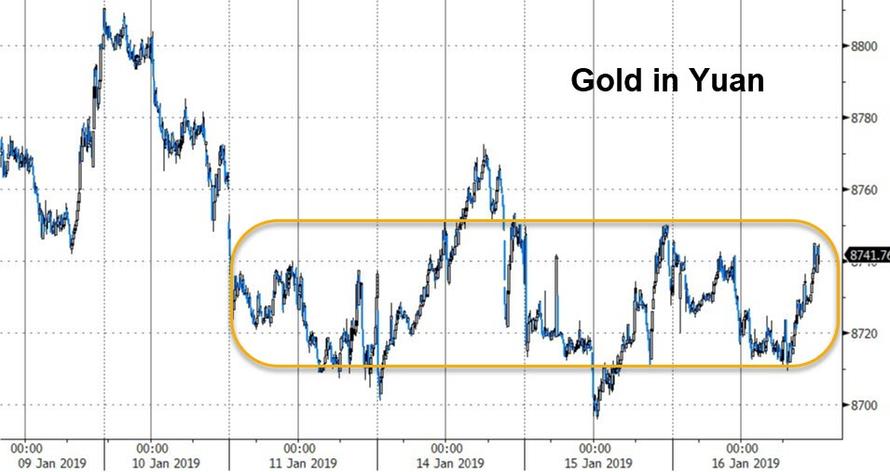

Gold in USDs was modestly higher but continues to flatline in Yuan...

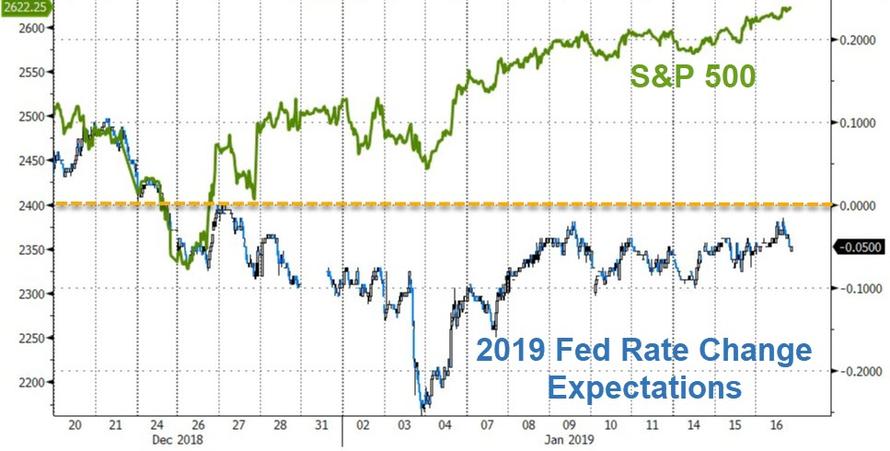

Finally, we note that stocks have over-extended relative to the 'dovishness' or confidence in the economy that the market believes The Fed to represent...

If stocks are right, then why doesn't the market price in at least 'some' hawkishness - some degree of rate-hike in 2019? Or could it be that stocks are wrong?

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more