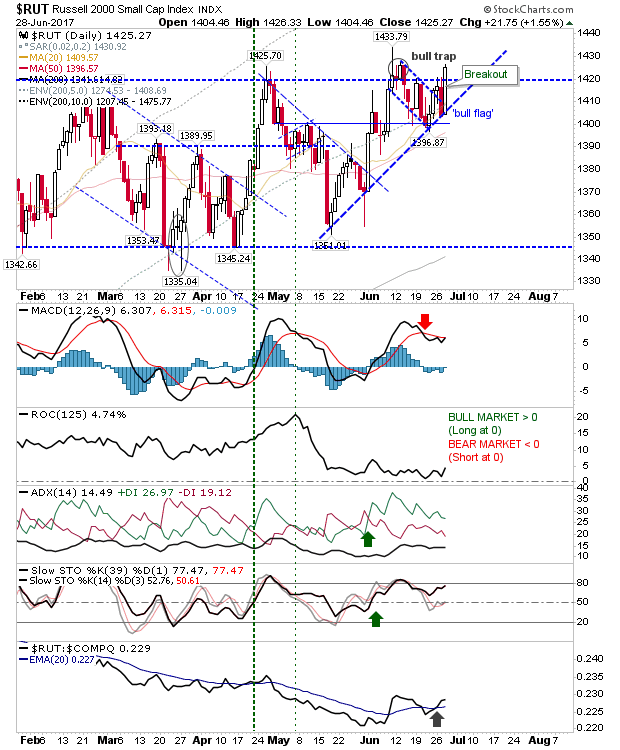

Small Caps Get Their Bounce

The last few months have seen Small Caps trade inside a lengthy sideways pattern but its moment in the shade maybe coming to an end. Today's rally in the Russell 2000 was a picture perfect bounce off rising support. Not only that, it mounted a strong challenge on the early June 'bull trap'. This improved strength has been represented by the continued uptick in relative performance against the Nasdaq. The next watch area will be a new MACD trigger 'buy' to coincide with a negation of the 'bull trap'. Once it gets out of the range it will open up for a new round of speculative investing.

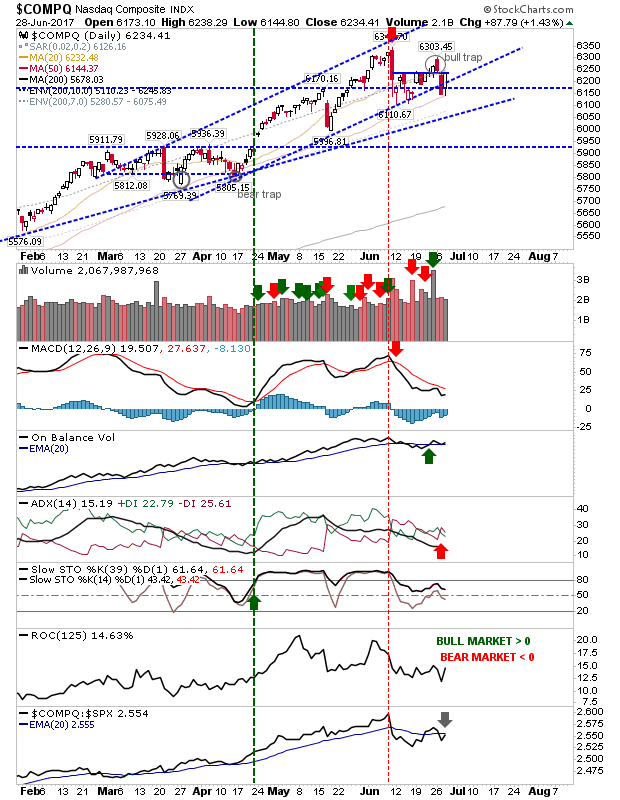

The S&P made back all of yesterday's losses but it hasn't gone as far as to challenge the 'bull trap'. Volume was lighter but the 'buy' trigger in On-Balance-Volume remains intact. The MACD trigger 'sell' remains with the ADX experiencing whipsaw. Watch for a move to challenge the 'bull trap', above which is room to move to channel resistance.

The Nasdaq still has the large bearish engulfing pattern to undo in addition to a recent 'bull trap'. However, today's action was a solid recovery off channel support and the 50-day MA. Technicals are a little mixed with a 'sell' trigger in the MACD and ADX with weakening stochastics offset by a recent 'buy' trigger in On-Balance-Volume.

Tomorrow will be about holding existing positions and seeing what evolves. Longs will have the 2-day low (as of from today and yesterday) to use for stop protection. Shorts will want to see how rallies evolve from here - the Semiconductor Index in particular - before looking to enter new positions.

Thanks for sharing