Silver - The Demand In Action

Although for the last two days gold and silver regained some ground but, generally, precious metals investors feel a lot of pain this year. For example, on July 10 the silver was trading at this year's lowest level so far.

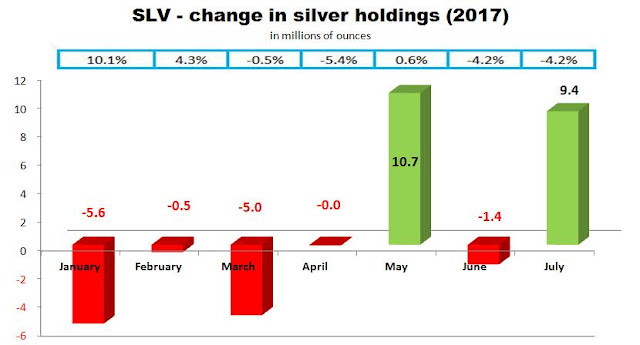

However, it looks like lower prices of silver attracted a bunch of investors who started aggressive accumulation of this metal. The chart of SLV looks very promising:

Source: Simple Digressions

As the chart shows, July is an exception. Generally, Western investors buy silver when its prices are going up. And vice versa. However, in July SLV added as many as 9.4 million ounces of silver at lower prices than those reported in June (a loss of 4.2% - look at the blue row where monthly changes in silver prices are plotted).

I think it is a very positive development for silver bulls.

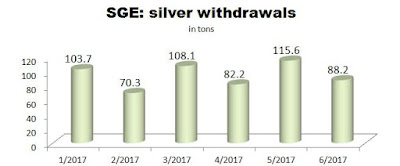

Interestingly, a new pattern is developing - in May the Chinese withdrew the highest amount of silver from the Shanghai Gold Exchange (which should be read as "in May there was the highest demand for silver bullion in China):

Source: Simple Digressions

Note that in May SLV reported the highest inflow of silver into its vaults.

Disclaimer: This article is not an investment advice. I am not a registered investment advisor. Under no circumstances should any content from here be used or interpreted as a recommendation for ...

more