Silver: Fiat Currency Chasing Real Money And Short Supplies Leading To Inflation

Nine-Year Cycle for Silver

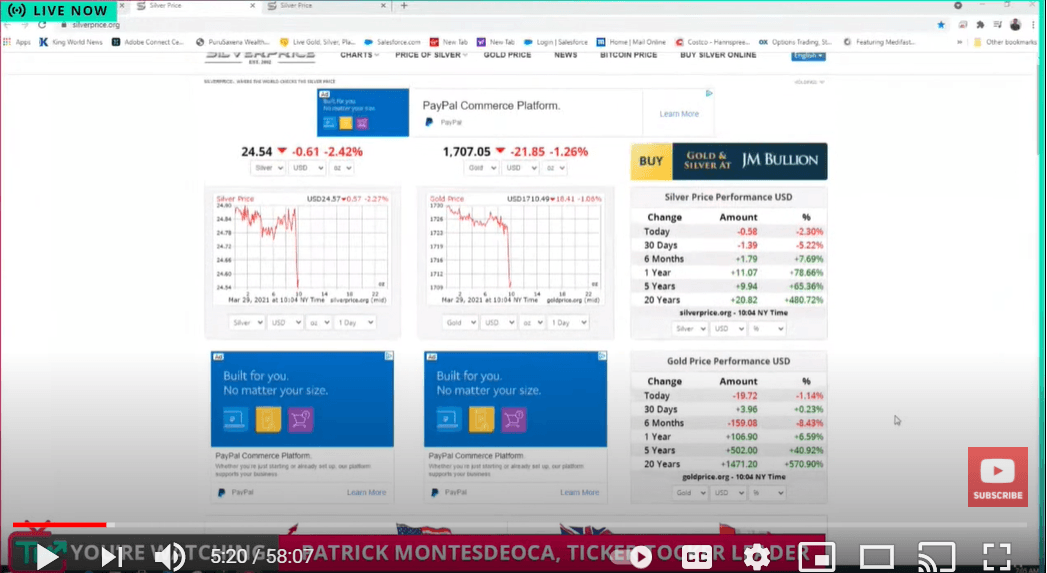

Based on goldprice.org, gold has seen an increase of about 560% over the past 20 years. Silver has seen an increase of about 476%.

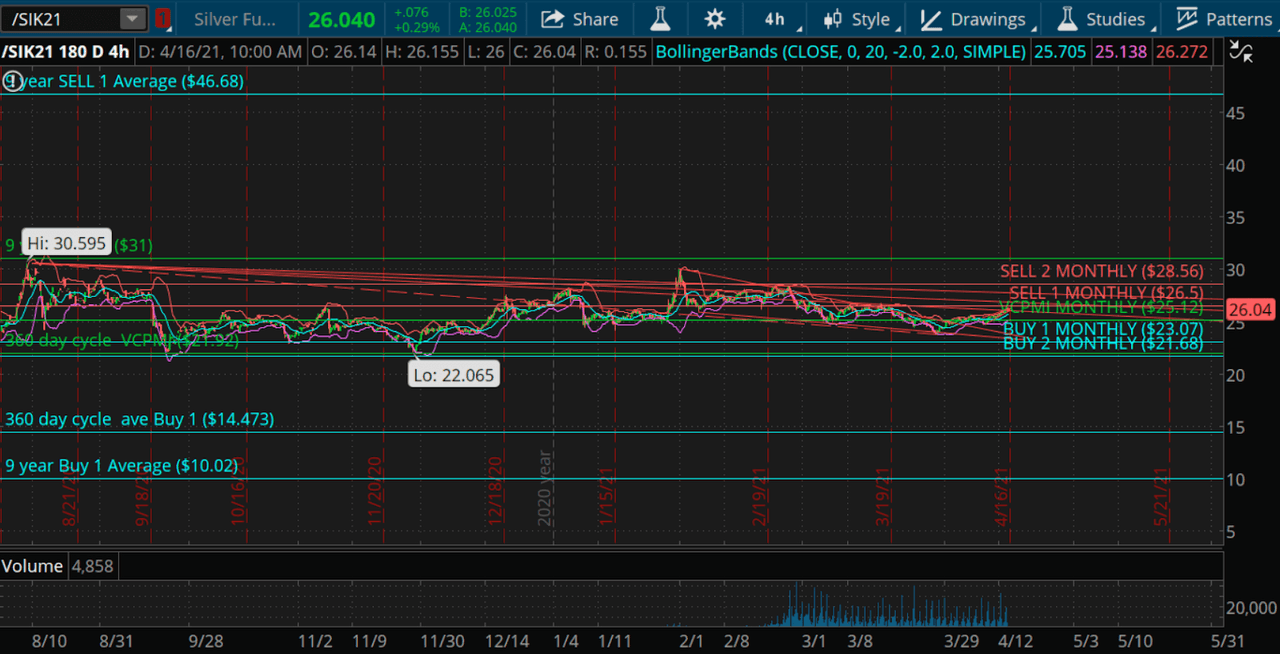

Courtesy: Ticker Tocker

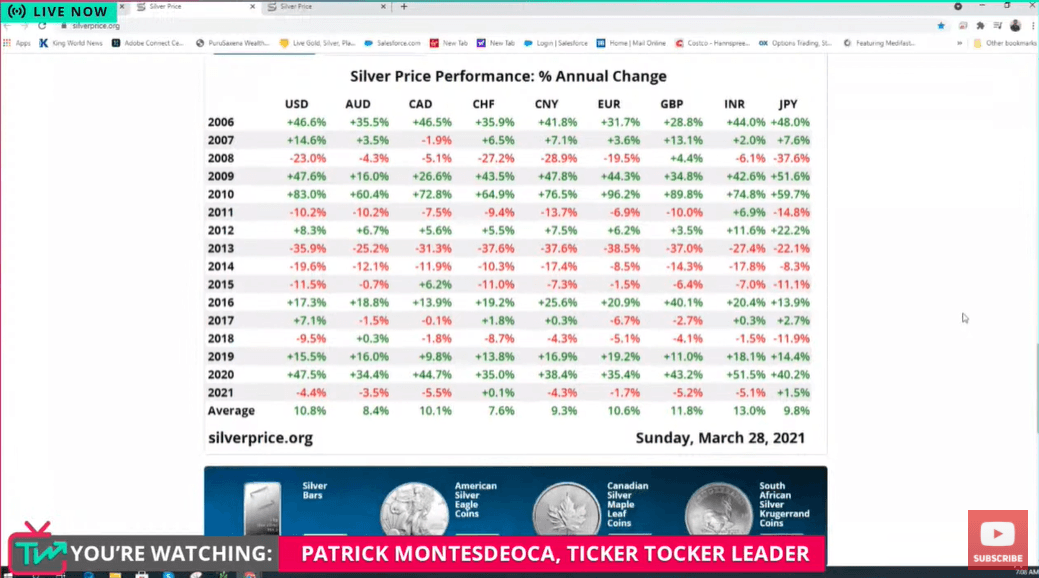

For silver, going back to 1992, the peaks occurred about every nine years. 2008-2009 was the end of the previous nine-year cycle. Each year we see an average increase of a little more than 10%.

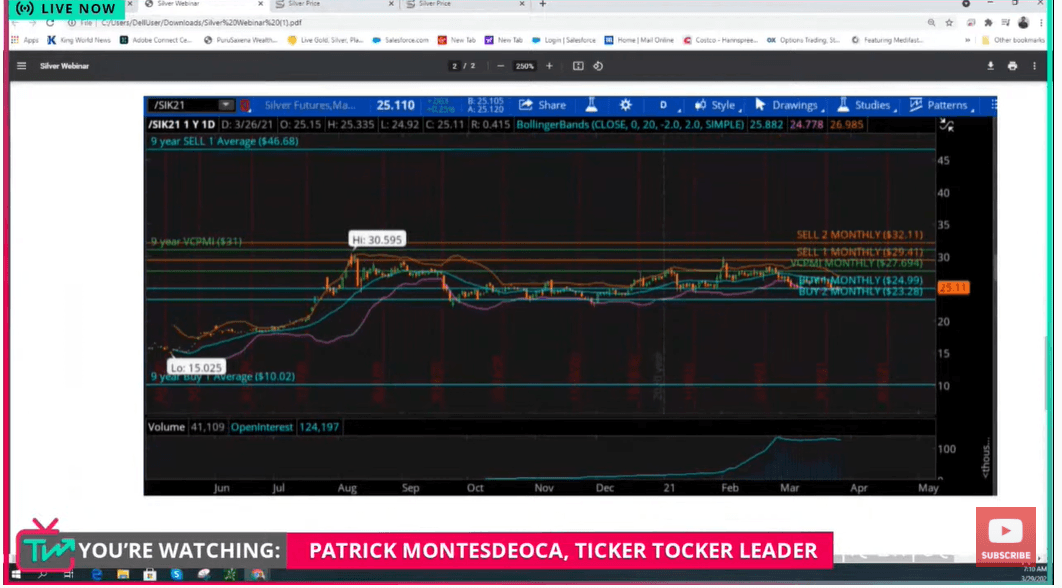

Courtesy: Ticker Tocker

Particularly in silver, we are entering a new paradigm. There is a lot of coverage about the shortage of silver supply, which is an increasing problem. Gold also appears to be experiencing shortages and those shortages seem to be increasing.

Inflation seems to be kicking in, with prices in grains increasing significantly in the past few months. As inflation increases, the dollar will continue to lose value. Real estate is massively inflated, as is the stock market. Where can people put their money? Gold and silver appear to be a good place for investors.

Courtesy: Ticker Tocker

The fundamentals do not bode well for the economy as a whole or for the US dollar. It does not look good for price inflation. We haven’t seen much price inflation. We have seen asset inflation, but not price inflation on Main Street. There will be challenges and one such challenge is how much it is going to take in terms of stimulus to get back to some form of normalcy.

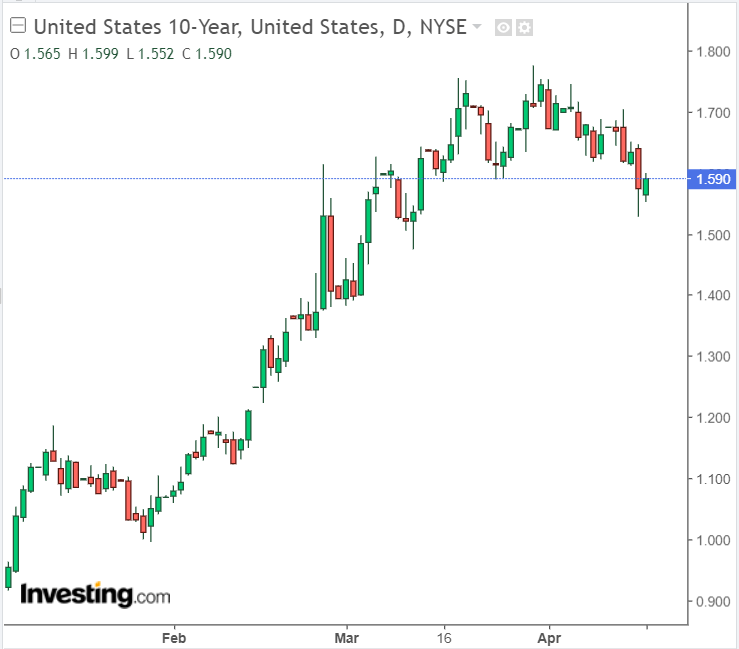

As we return to a more normal economy, we are going to face challenges. No one knows what is ahead. The 10-year note is beginning to indicate that there are some inflationary pressures. Rates have hit 175 as a recent high. The 10-year note is anticipating inflation. But interest rates cannot go up.

In the 1970's, even though we had inflation, the debt was not that much of a problem and the US dollar had just come off the gold standard, so we could print a lot of money. Today, we are in a very different situation. We have massive debt of almost $30 trillion and the US dollar has lost much of its value. As the government prints more and more money, the dollar will continue to lose value and gold and silver are becoming increasingly attractive investments.

Real estate, art, and stocks are at record highs, which signals asset inflation. What we haven’t seen yet is major price inflation on Main Street. The grains are already beginning to show significant increases, which means food prices will rise over the next few months.

It appears that we are going to see more stimulus packages, which means more money will be printed and the US dollar will be worth less and less. All paper currencies are heading toward zero because there is nothing backing them but debt. How much money can you print before the currency is worth nothing?

Price discovery has been skewed across the board. Interest rates have been kept artificially low, so prices have risen exponentially in stocks, real estate, and other markets. We appear to be headed toward yield curve control, which means that the Fed will cap the 30-year bond yield rate from rising. They will allow the short end of the market to inflate as far as it will go.

Most debt is in 30-year bonds, so they cannot allow long-term interest rates to rise much, if at all, or there will be widespread defaults. Therefore, the Fed can’t allow the longer term interest rates to rise, but they can let the short term rates rise. In the 1970's, interest rates rose to 15% in 1981 and gold rose to $850. A similar situation could occur in the near future with interest rates and gold rising in price significantly.

If interest rates rise and US bonds lose their ratings, then you are going to start to see a lot of defaults on loans. In the short-term, we expect interest rates to go up. We are preparing for the Fed to announce yield curve control. Any such announcement will cause gold and silver to explode like we’ve never seen before.

We are seeing what real money is: fiat currencies like the US dollar, or is it gold and silver? Investors are looking for real money and gold and silver are real money. We seem to be reaching the limit of how much fiat currency we can print while still remaining the world’s number one economy. Now that status is being seriously questioned.

The key now is to protect your net worth, especially any assets in US dollars. Silver is an excellent opportunity to hedge against the US dollar and to take advantage of what could be one of the most explosive moves in the silver market in history. Silver is real money. It is also an industrial metal, which will be in greater demand as the economy recovers. But, as real money, silver will greatly benefit from the devaluation of the US dollar.

Courtesy: TD Ameritrade

In silver, we recently tested the 360-day Variable Changing Price Momentum Indicator (VC PMI) average at 25.85 and activated the targets of the nine-year cycle at $46.68 and the 360-day cycle below that at around $31.79. Both levels are in play. The daily, weekly, and monthly signals have all activated buy signals.

Around $25.12 is where the next rally will probably start from, and we expect to see a rally very soon. Worst case scenario, silver may test the December lows, but they are where you should accumulate positions for your long-term core position. One day soon, silver is going to take off and unless you are in it, it will be too late. We recommend trading the short-term gyrations while building a larger and larger long-term position in silver.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more