Should You Sell Stocks Now?

In this article, I will further specify the level of bullishness in the market which, I feel, doesn’t represent reality. It has made sense to be bearish this year, but logic doesn’t matter when your contrarian portfolio has had a bad year. It doesn’t give you any solace. I have been wrong all year long. In fact, two of the biggest crashes this year, I felt were overdone. The market needs to fall because stocks are mispriced and the economy is weak. It shouldn’t fall because elections like the Brexit and Trump victory because they could be construed as positives. I would even say the EU breaking up would be a positive in the long-run. It certainly would be for Italy as GDP has fallen 8% since it was created.

The market had been doing nothing for two years. While the bears would argue the economy was slowing and earnings were deteriorating, so the market should have been declining, they were able to maintain their positions. The past 6 weeks account for all the gains we’ve seen in the past two years as the shorts have been demolished. There can’t be many investors who are net short left in the market. That’s a bearish sign.

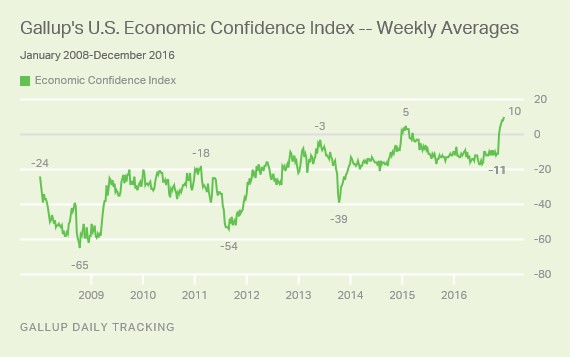

The chart below tells you all you need to know about the market. Gallup’s economic confidence index is the highest it’s been in the past 9 years. That increase is all about Trump since there hasn’t been a major shift in the economy.

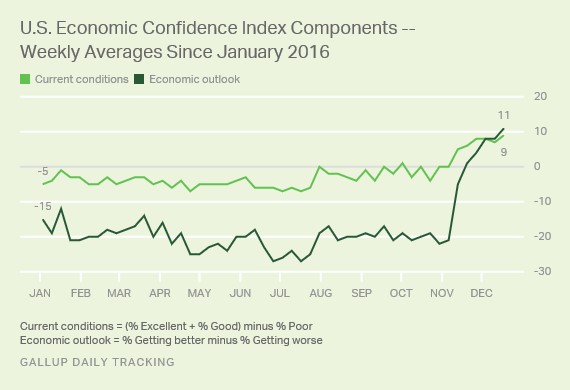

The chart below shows the components of the chart above. The economic outlook instantly rebounded after the election. The American people expect Trump to walk on water. The expectations cannot be much higher. Much of this has to do with the mood of Republicans who are satisfied now that their guy is leading the country. Let’s see if this translates into spending this holiday season. This chart could be a misdirection as it’s possible for a shopper to be optimistic about the future of the economy, but cautious about her spending.

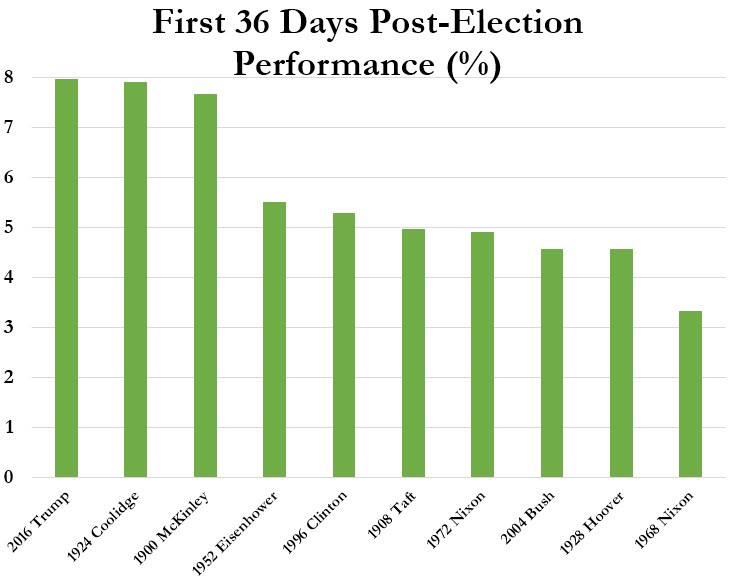

The chart below is the best representation of how out of whack the optimism is in the stock market. We’ve surpassed the returns see by Calvin Coolidge. That being said, the results of the Coolidge administration proved that rally to be warranted. I would argue the situation is much different than 1924. There was a deep deflationary recession from 1920-1921. The Dow Jones Industrials Average fell 47% from November 1919 to August 1921. The last correction of that size was 8 years ago, so this bull market is much older. The Shiller PE in December 1924 was 9.31 which is about a third of what it is now as its at 28.01. The market is three times more expensive now.

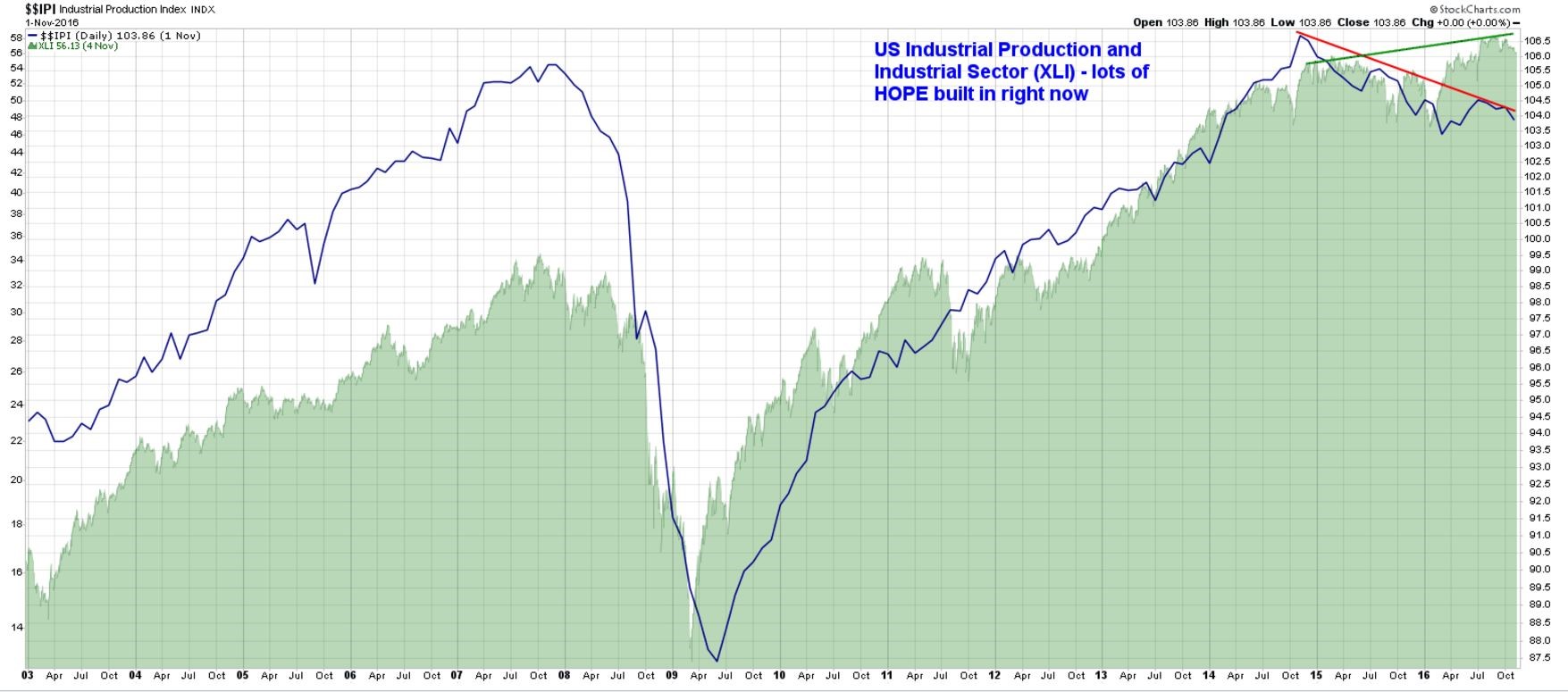

The chart below shows how industrial production has diverged from the industrial stocks. Investors are pricing in a Trump stimulus already. I don’t see why you’d buy these stocks now even if Trump comes through with everything that’s anticipated. If you bet Trump pulls through and he does, you get little reward. If he doesn’t, you have a great deal to lose.

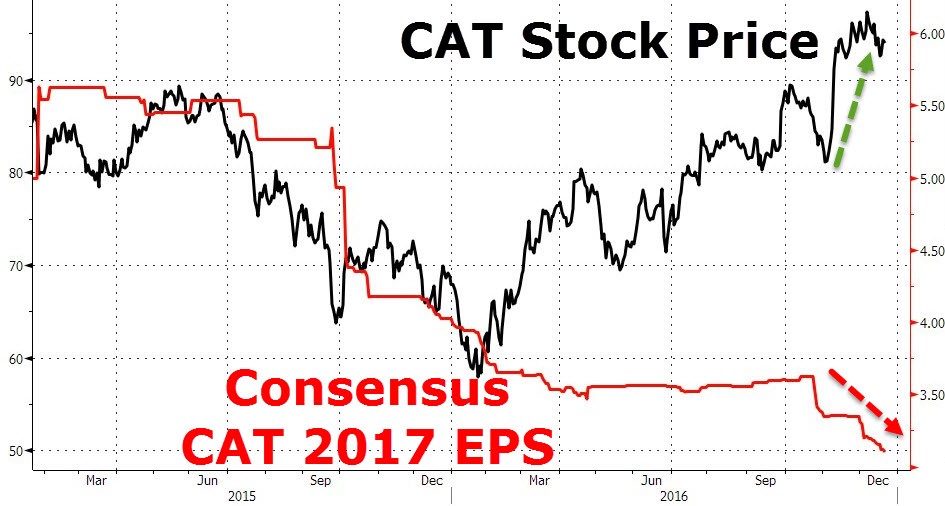

One stock I’ve focused on is Caterpillar (CAT) which I have shorted and lost money on. It’s quite frustrating to see a company constantly lower expectations only to see its stock rally. Some bullish investors are now being trained to believe the fundamentals don’t matter. Caterpillar is a cyclical stock so it should be expensive at the troughs of the economy, but its valuation should be impacted by the length of this downturn. The company has had 48 consecutive months of declining retail sales and the stock is near its 52-week high.

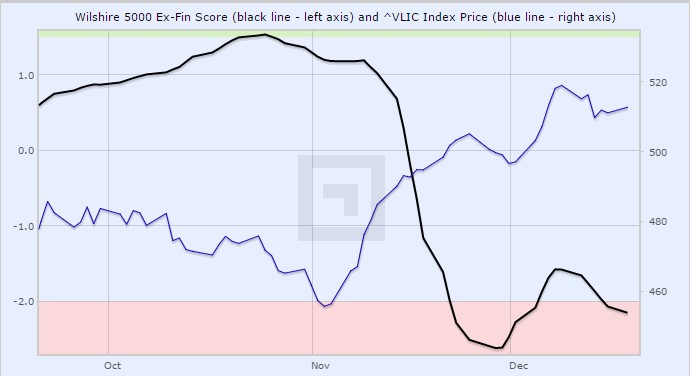

This rally which is ignoring fundamentals may be reason why insider selling has picked up in November as you can see from the black line below. Financials, industrials, and energy are the biggest sectors being sold by insiders. Maybe they don’t agree with the optimism seen in the market. The have in-depth knowledge of their businesses, so they would know if sales have ticked up.

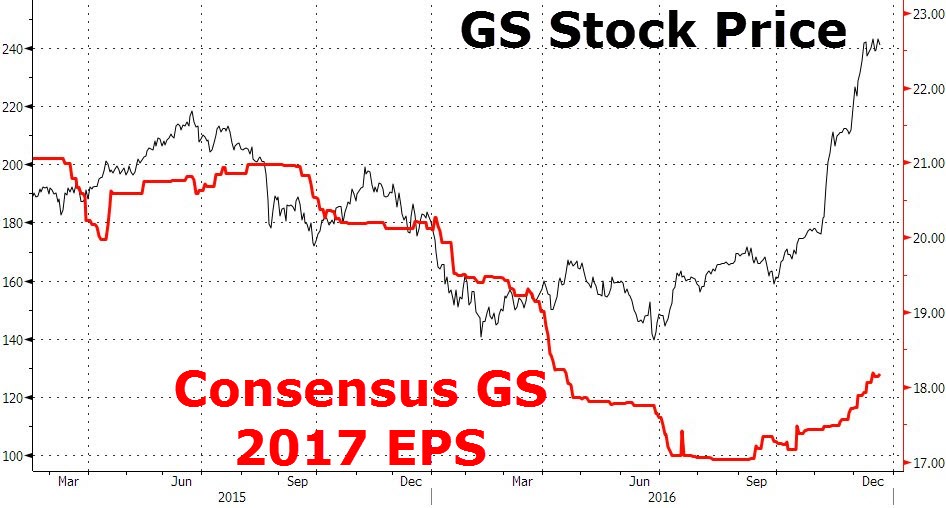

One of the stocks insiders are likely selling is Goldman Sachs (GS) which is responsible for about 20% of the Dow gains seen in this Trump rally. The Dow is has not been down two days in a row for 8 weeks. The two levels traders will be focused on is Goldman Sachs’ all-time high of $247 and 20,000 for the Dow. We may see both levels reached in the next few days in the midst of the euphoria.

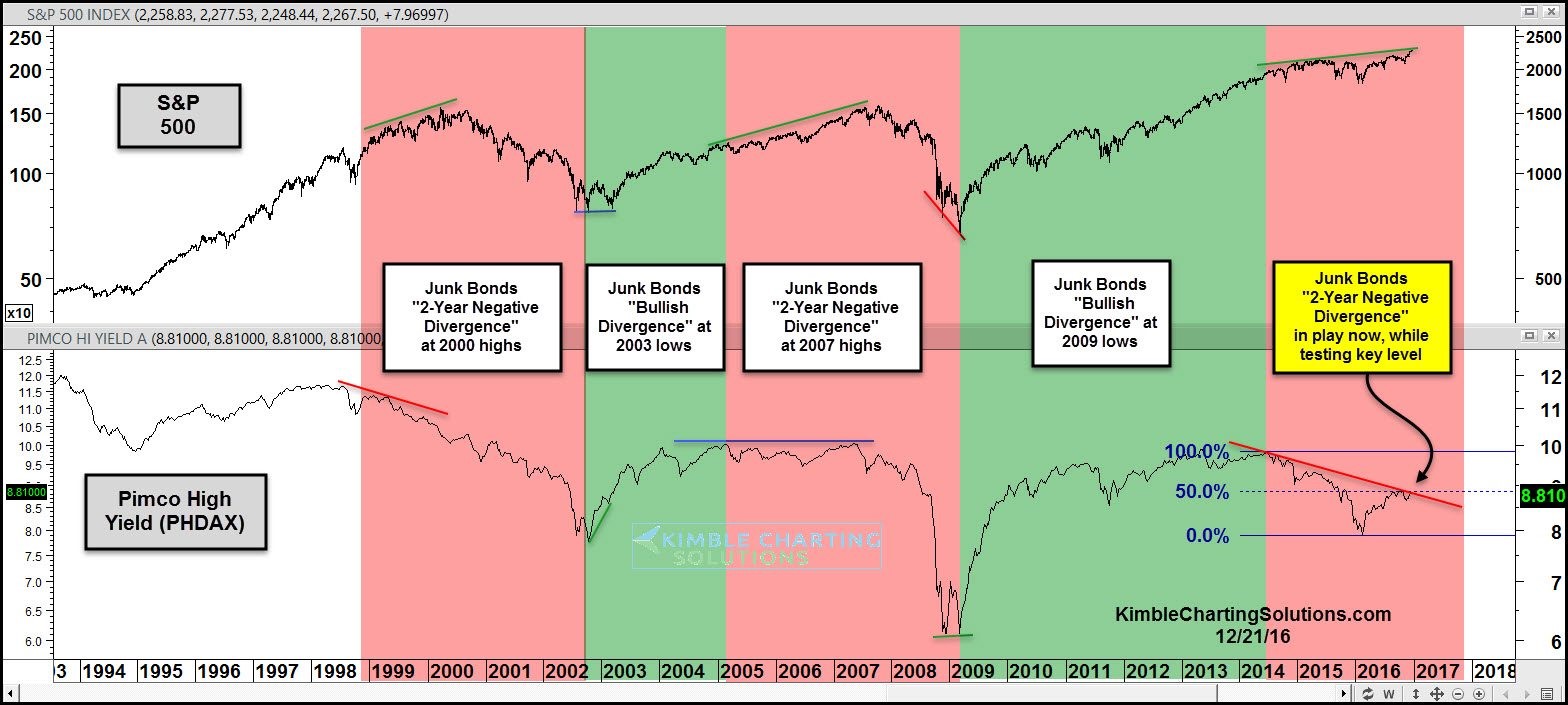

The chart below shows how junk bonds diverged from stocks prior to the past two market bubbles. So far this hasn’t translated to a crash in this cycle. Junk bonds have rallied because oil prices have rallied, but we’ll see if the rally in junk holds. All the charts which showed the 2016 environment similar to 2007 and 2000 have been wrong. The market has rallied in the face of bad news. Although, in the bulls’ defense the economy hasn’t fallen off a cliff like the last two cycles.

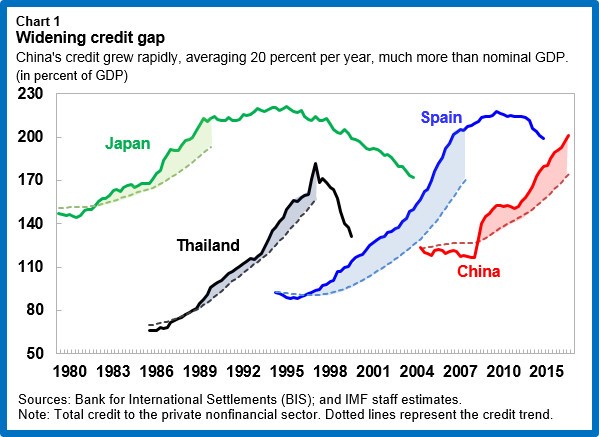

Another negative for the global economy is the Chinese debt bubble. The chart below shows the credit growth beginning similar to previous bubble economies. When credit grows this fast in relation to GDP, a sharp deleveraging usually occurs afterwards. The non-financial private credit growth to GDP is about to reach the peak rates seen in Spain and Japan. The state owned enterprises have a lot of debt that needs to be restructured. This will hurt Caterpillar earnings in the future as Chinese demand for natural resources plummets.

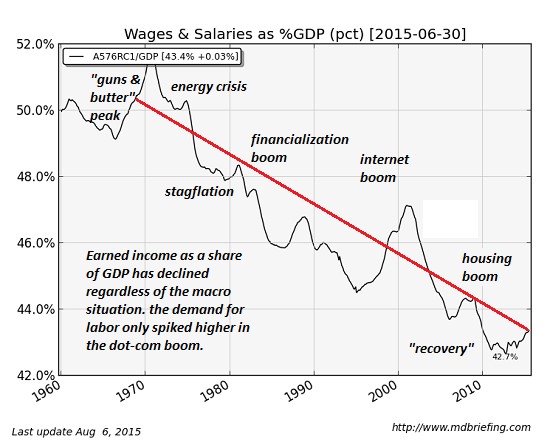

The chart below is what Trump is up against. There has been a 4 decade decline in salaries as percentage of GDP as the economy has become addicted to Federal Reserve bubbles which has increased financialization of the economy. It’s ironic that Trump, the populist, has been the biggest boon for Wall Street of any president, in terms of stock performance.

Conclusion

I wouldn’t own stocks in 2017 because euphoria has reached such a stage that cannot last much longer.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more

Thanks for sharing. Merry Christmas