Should Gold Have A Role In Your Overall Portfolio?

My short answer is yes. Generally speaking, the amount should be between 5% and 10% for diversification purposes.

Gold doesn’t provide as much diversification as some other assets in ordinary time periods. Event studies show that in the greatest equity market collapses in the history of 6months or more and when the endurance of the US market and dollar as the safe dollar haven of the future has fallen into question, the price of gold has always risen. In other words, I don’t advocate an allocation to gold because I think it’s an above-average long-term investment. It has a long-term expected return near zero. It’s a defensive holding to mitigate huge and unexpected losses in the equity portfolio at a time you can least afford it.

So, given the need for an allocation to gold, what is the best way of doing so? In retail brokerage accounts?

SInce 2003, it has become easy to buy shares of Exchange-Traded Products (ETPs) that are essentially depository receipts on gold. There are four major gold ETPs: GLD - SPDR Gold Trusts, IAU - iShares Gold Trust, BAR - Granite Shares Gold Trust, and GLDM - SPDR Mini Gold Trust. All four ETPs use a grantor trust structure which for IRS purposes is classified as pass-through security. In each case, underlying gold bars are held in vaults around the world.

Here's one important fact taxable investors need to know as a consequence of the classification of pass-through securities. The capital gains tax rate may be considerably higher than for normal funds. Gold and hence shares of each of these funds is considered a collectible with a distinct and usually is taxed at a higher rate.

Since all four funds are based on the value of the gold they hold, any differences in investor returns is generally a function of the expense ratio as shown in the chart below:

This table of annualized returns for 1- 3- 5- and 10-year periods ending 02/12/2021 based on NAVs according to ETF.com

The differences in the returns mirror the differentials in expense ratios. Launched in August 2017 by upstart GraniteShares to compete on the basis of fees, BAR is definitely the disruptor of the group and still the lowest cost provider at 17 basis points. Blackrock lowered its fee to 25 basis points in 2017 in response to the competitive threat. SPDR kept GLD at its fee of 40 basis points while launching a new fund, GLDM with M standing for "Mini shares", at 18 basis points.

Once again, if you already own GLD and have embedded capital gains, they would be taxed at the generally higher collectible rate so you may choose to hold those shares. Moreover, if you are a short-term trader, especially a long-short high-frequency trade, GLD with more than a billion dollars in average daily trading volume is probably your most comfortable choice.

However, for any investors buying new shares and intending to hold them for more than a few weeks, I recommend buying BAR, the gold ETP I hold in my personal accounts. For those who prefer brand names, especially those wishing to stick with the SPDR family, GLDM is a practically identical alternative with an expense ratio just 1 basis point higher. I find it hard to justify recommending to pay 8 basis points more to buy and hold IAU and impossible to recommend paying 23 basis points more to buy GLD. All four have more than $1 billion AUM and trade at an average spread of one penny according to ETF.com. Therefore, exit liquidity should not be an issue.

The diversification benefits of gold GLD when the equity market goes into free fall through an ETP such as BAR, IAU, or are tempered by two unfortunate realities. The first is the capital gains tax treatment mentioned above. The second shortcoming is that gold does not pay a dividend so there is no dividend income stream derived from the ETP that holds it. Another method to access a gold-like return stream that some investors use is to buy an ETF that holds a portfolio of the stocks of gold mining companies. iShares has the ETF with the highest AUM, RING. Ring does have a higher expense ratio, 0.39% rather than 0.25%.

Has RING delivered gold-like returns the past five years and does it pay a dividend? The answer is that the returns of RING have been superior while following a remarkably similar pattern. Comparing RING with IAU for the period ending December 31, 2021, the one-year NAV return was 23.99% as compared with 16.90% for NEM. The analogous 5-year NAV returns were 23.58% and 8.77% respectively. Additionally, RING pays a yield that at yearend was 0.75%. That is hardly a robust income stream but it is better than zero.

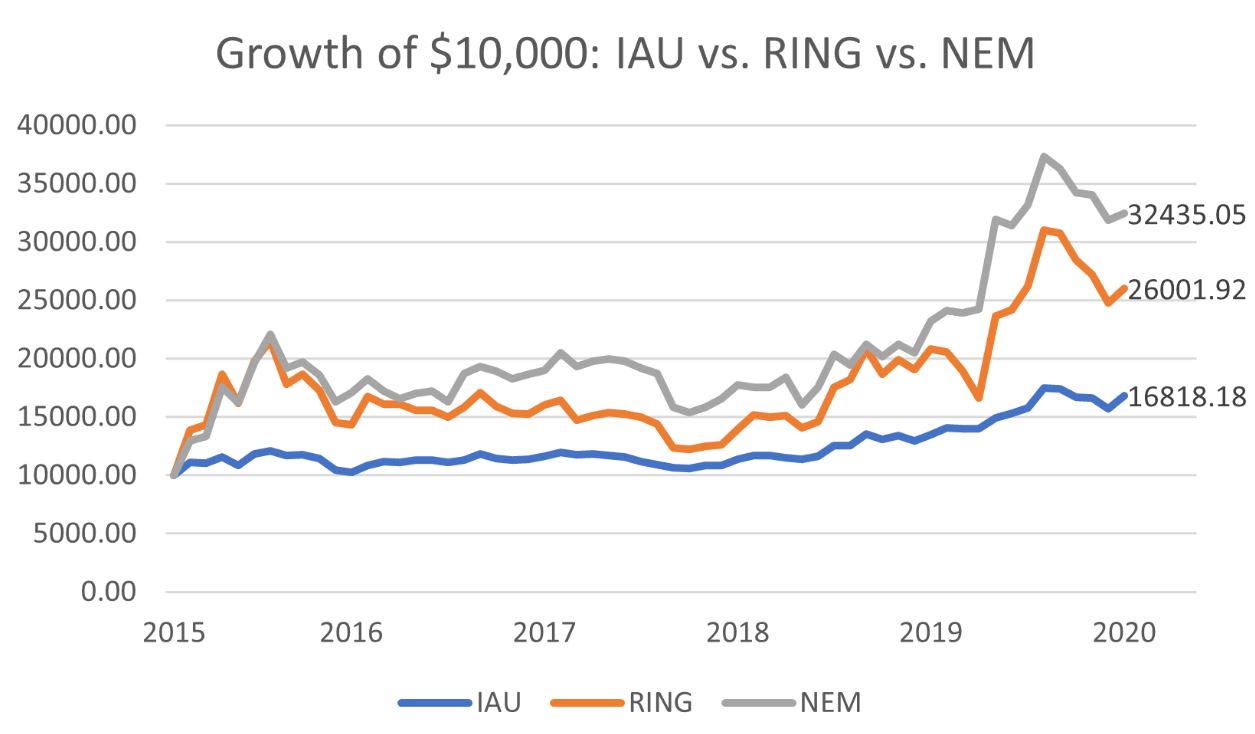

Let’s look at another alternative. The largest holding in RING, nearly 20%, is NEM, Newmont Corp. Indeed, from the time I started in the industry until the launch and subsequent acceptance of GLD and other ETPs to access gold bullion, NEM was the most frequent stock bought to access exposure to gold. During the same 5-year period NEM had a price appreciation of 25.3% accompanied by a 2.4% yield. As to tracking, the correlations between GLD, RING, and NEM during this period ranged from 0.94 to 0.96, very close tracking for three different ETFs. This chart reflects the growth of $10,000 invested in all three between December 31, 2015, and December 31, 2020. It also reflects the fact that RING was more volatile during this period than IAU and NEM were more volatile than RING. So during this period, an investor would have improved both capital appreciation and income considerably by simply buying Newmont in lieu of IAU. It also shows that all three were highly correlated during this period.

However, volatility cuts both ways. If it sometimes pays off to own more volatile security when the precious metal is rising in price, it follows that it is probable that the fall of NEM may be greater if a subsequent downturn occurs. That’s precisely what has happened in the first quarter for the stock. It has dropped nearly 10% since yearend. Pulling its ValuEngine report, we can see that Newmont’s annualized volatility is nearly 30%. It gets 3 Vs from ValuEngine, an average rating, for its current outlook even though its 3-year expected return is negative. It should also be noted that during gold’s five-year bear market from 2011-2015, Newmont’s price had fallen more than 20%.

Once again, timing is everything in the market. NEM and RING tracked IAU closely for the past 5 years but that has not been true of all 5-year periods in the past. Still, for those seeking income, NEM provides a tempting alternative to IAU and BAR. I will also note guardedly that another method of deriving income from IAU is to sell IAU call options known as a covered call strategy and considered more conservative than a naked long holding. However, IAU options are thinly traded and the timing of the rolls can be tricky. If you or your financial advisor is an expert at options strategies, this may be worth exploring. If not, then consider the above three options for diversifying your equity holdings.

Remember all of the above only makes sense if the largest portion of your overall portfolio is in US Equities or US Equity ETFs such as VTI, the Vanguard Total US Equity Market portfolio, my personal favorite for core long-term US equity exposure. Otherwise, it's just speculation on the price of gold which I definitely do not recommend.

Disclaimer:Options strategies are not appropriate for all investors. If you are inexperienced at using options, do not attempt to implement the covered call strategy described in the study ...

more