Shifting Winds

Image Source: Pexels

Don't look now fans, but the stock market appears to have made it through the worst two-month period of the year unscathed. Sure, there were a couple of scary down days in September and October as traders fretted about credit, trade, and endless talk of bubbles. And it is also true that some of the speculative areas experienced bouts of volatility (which is completely normal). But with the S&P finishing October within a whisker of its all-time high, I think we've got to call the market's ability to brush off the negative seasonality a positive.

Although our furry friends in the bear camp will argue that stocks have outrun reality and that the sky is sure to fall soon, I learned a long time ago that it generally isn't a good idea to argue with Ms. Market (as in, "Don't fight the tape") and/or the Federal Reserve ("Don't fight the Fed"). Don't get me wrong, it is totally fine to fret about fundamental issues as they arise (the economy, inflation, earnings, etc.). However, it is important to remember that "markets are never wrong, but people often are."

So, with current earnings coming in well above expectations again, future earnings expected to be robust, the economy growing at a nice clip, and inflation behaving reasonably well, investors can't be blamed for looking on the bright side here.

Seasonal Winds Changing

In case you've been living in a cave, you are also likely aware that the seasonal headwinds the market has been flying into over the past couple of months are about to change direction. Cutting to the chase, history shows that the last two months of the year tend to be strong and that November begins the best six-month period of the year. Therefore, those headwinds are about to become tailwinds.

Now toss in the facts that (a) the mutual fund selling season has largely ended, (b) buy-back windows will open back up soon for most corporations, (c) FOMO could become more pronounced with the S&P closing in on another 20% annual gain, and (d) end-of-year window dressing tends to occur, and well, it's easy to see how stocks "could" continue movin' on up from here.

To be sure, I am not making a prediction here as I'm quite sure Ms. Market doesn't give a hoot about what I think ought to happen in her game. No, I'm simply talking about the "odds" of what could happen as the number of days on the calendar continue to dwindle.

What Do The Cycles Say?

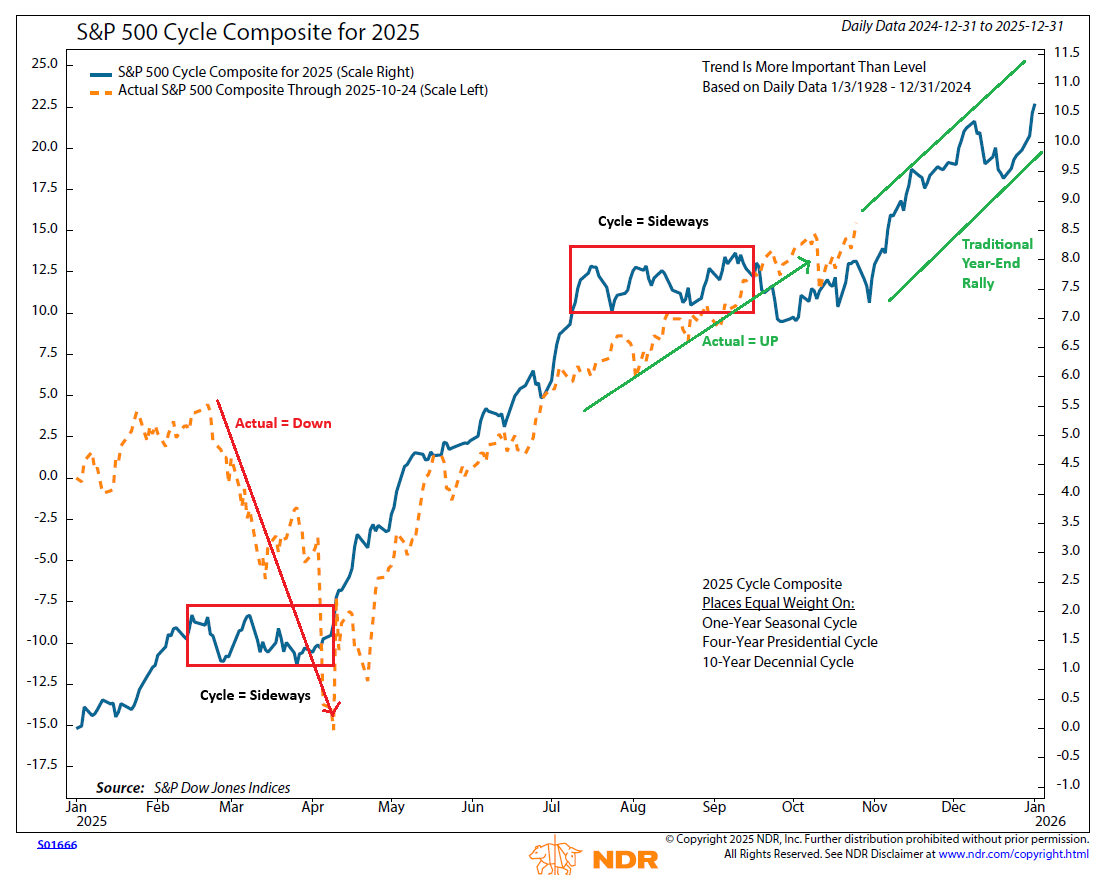

Which brings me to our trusty "Cycle Composite." Even new readers will likely recall that I like to check in from time to time with Ned Davis Research Group's mashup of all the 1-year, 4-year, and 10-year cycles. As I've related a time or twenty, the Cycle Composite provides a projection of the market's trend for the year - at the beginning of each year.

There is little argument that the market can and often does "go its own way" and/or simply ignores the seasonal tendencies. This was certainly the case earlier in the year when the cycles suggested a sideways move during the February through early-April period. But instead, stocks threw a "tariff tantrum" and went straight down.

The good news is I've learned over the years that when the market is "in sync" with the Cycle Composite, the projection can be quite good - as in scary good!

As the chart below illustrates, the market has largely been "in sync" with the historical cycles ever since traders began to realize that the tariff war wasn't going to tank the economy.

(Click on image to enlarge)

Copyright Ned Davis Research Group, All Rights Reserved

Looking ahead, while there are always bumps in the road, the overall trend suggested by the Cycle Composite is up and to the right. Works for me.

But...

Those seeing the market's glass as at least half empty argue that since stocks not only didn't decline but actually advanced during the most recent seasonally weak period, we shouldn't count on the traditional year-end seasonal strength. The thinking in the bear camp is that the market has "pulled forward" the late-year gains and is likely to soon run out of gas since stocks are so richly valued at the present time.

Only time will tell, of course. However, I find it helpful to know which way the winds tend to blow when looking out over the next few months. So, unless/until the fundamentals start to change, my plan is to stay seated on the bull train.

More By This Author:

The Great Rotation? Or...Should We Worry About War?

Recession? What Recession?

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES