Shelter Inflation, Stock Picking, And The Surge In Gasoline: A Financial Overview

In a world rich in complexities and laden with economic fluctuations, Warren Buffett’s affinity for risk-free money and the San Francisco Fed’s revelations on shelter inflation are just a few aspects shedding light on the current financial landscape. This post examines crucial financial trends, corporate strategies, and macroeconomic indicators shaping the financial world.

Warren Buffett’s Risk-Free Investment Strategy

Warren Buffett’s Huge Cash Pile

Berkshire Hathaway, led by Warren Buffett, has amassed a tremendous cash pile of $147 billion, including over $97 billion in Treasury Bills. Buffett, known for his keen eye for value, is on a shopping spree for more, buying $10 billion of 3 and 6-month T-bills every Monday. In a world teeming with risk, his love for risk-free money stands out as a unique investment philosophy.

Updates from the San Francisco Fed

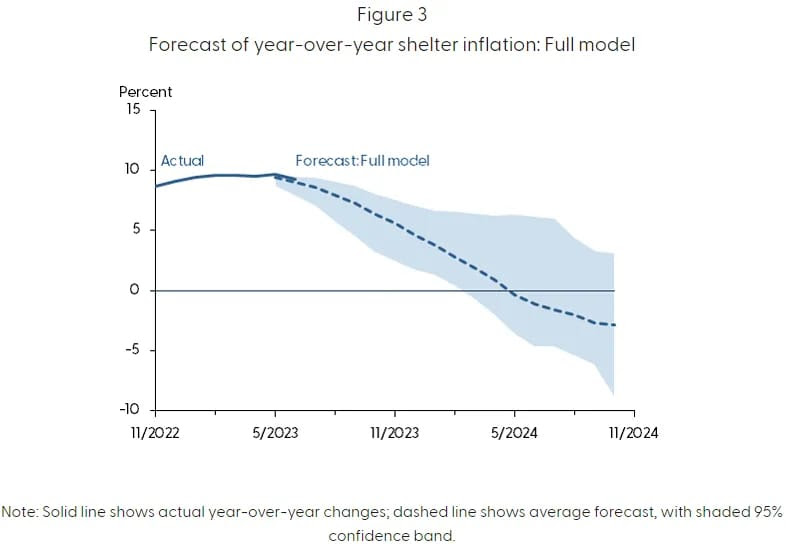

🏘️ A New Perspective on Shelter Inflation

New research from the San Francisco Fed highlights a significant slowdown in shelter inflation, painting a more accurate picture than the Consumer Price Index (CPI) which often lags in reflecting the actual cost of shelter. The baseline forecast points to shelter inflation slowing until late 2024 and possibly going negative by mid-2024, marking the most severe contraction since the Global Financial Crisis.

(Click on image to enlarge)

💳 Rising Consumer Credit and Unanticipated Debt Paydown

Total consumer credit reached $17.8 billion in June, nearly doubling the previous month’s gain. Interestingly, while non-revolving credit rose, revolving credit fell unexpectedly, marking the first drop since April 2020. This indicates that consumers are scaling back purchases to pay down debt, which is currently being hit with the highest average credit card interest rate ever at over 22%.

Spotlight on Sustainable Growth: Brazil Potash

Feeding the Future with Potash

By 2050, the world will need to feed 10 billion people, and Brazil Potash aims to contribute to this mammoth task. The company focuses on producing fertilizer locally in Brazil, giving the world an alternative Potash supplier at a time when global supply chains are at risk. Brazil Potash’s efforts align with the need for sustainable agriculture and growth.

Market Trends and Insights

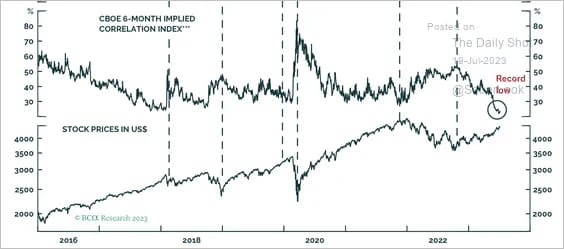

👉 A Stock Picker’s Market

Goldman Sachs states that micro factors explain 71% of a typical stock’s return today, up from 41% a year ago. This change, reflecting the lowest intra-stock correlations in 17 years, signals a stock picker’s market and suggests investors see little risk in the macro outlook.

(Click on image to enlarge)

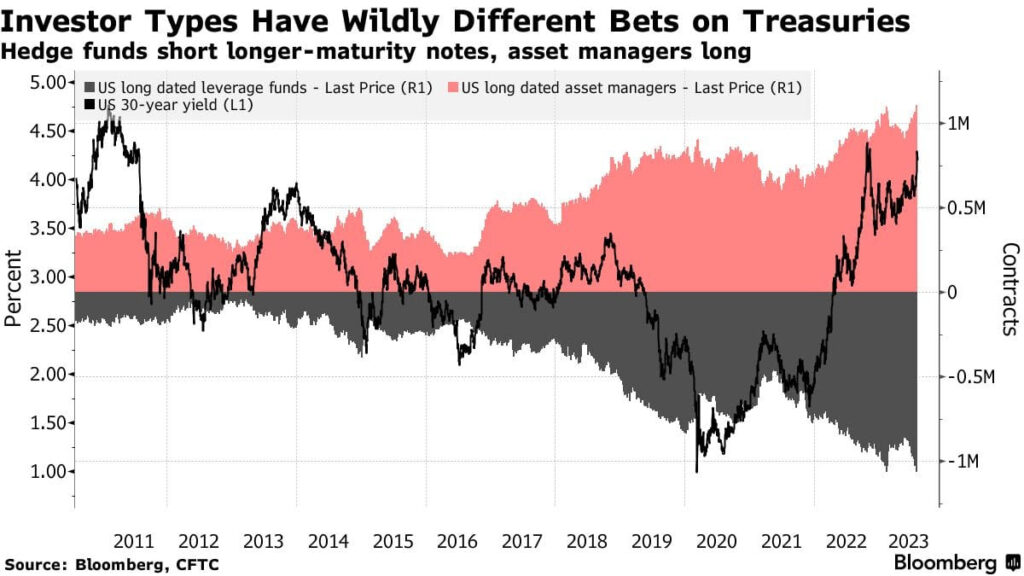

🆚 Hedge Funds vs. Asset Managers

The division between hedge funds and asset managers over long-dated Treasuries’ yields has intensified. Hedge funds have increased their shorts to the most since 2010, while asset managers have taken the opposite stance. The looming question is whether yields will continue to rise or concerns about economic growth will force rates down.

(Click on image to enlarge)

⛽ Bullish Bets on Gasoline

Traders have upped their bets on gasoline to the most bullish level since Russia invaded Ukraine. The positioning coincides with the U.S. entering its busy summer driving season, coupled with record heat over the Atlantic Ocean, increasing the odds of hurricane-related disruptions.

Earnings and Corporate News

📊 Palantir Technologies

Palantir Technologies reported in line with expectations, with $0.05 EPS and $533 million in sales. The company announced its first buyback program of up to $1 billion and issued guidance exceeding Wall Street’s expectations. This points to a possible reacceleration in revenue and Palantir’s potential eligibility for inclusion in the S&P 500.

More By This Author:

The Economic Scene: Housing Woes, BofA’s Predictions, And OPEC’s MovementsCelebrating Economic Recovery: GDP Soars And Equity Demand Surges

A Peek Into The Fed’s Rate Hike And The Thriving Stock Market

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more