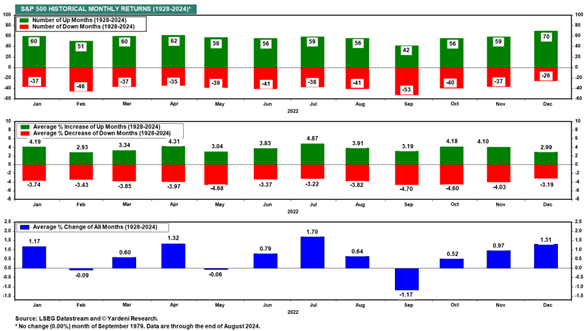

September Is Historically The Market's Worst Month. Will Things Be Different In '24?

September has a history of being the worst month of the year for the stock market. But it's hard to imagine that it will be a bad one this year since the Fed is widely expected to start its latest monetary easing cycle on September 18 with a 25-basis point cut in the federal funds rate, writes Ed Yardeni, editor of Yardeni QuickTakes..

In addition, the FOMC will release its latest Summary of Economic Projections on that date. It is widely expected to confirm that the Fed intends to cut the FFR several times in coming months.

Then again, the S&P 500 is up more than 18% year-to-date. So, it seems to have discounted lots of good news. It's certainly too early to discount a bearish political outcome on November 5. In our opinion, that would be a sweep for either of our two political parties since the stock market tends to favor gridlock. However, the market does have a history of doing well no matter which party is in the White House.

Of course, geopolitical developments continue to be risky. They've been getting increasingly so since Russia invaded Ukraine in February 2022. Yet the price of oil remains subdued and stocks have rallied to new highs despite the risks.

Here in the US, the economy is growing at a solid pace and inflation is getting closer to the Fed's 2% target. Analysts' consensus expectations for S&P 500 operating earnings per share this year and over the next two years remain solid. S&P 500 forward earnings is at a record high. However, the S&P 500's valuation multiple is a bit stretched at 21.1.

More By This Author:

From Luxury Cars To Powerful Engines, Rolls-Royce Does It AllSow Good: An Under-The-Radar Food Play Poised For A Resurgence

TJX Companies: An Off-Price Retailer Ringing Up Strong Sales And Profit