Sellers Hit Out

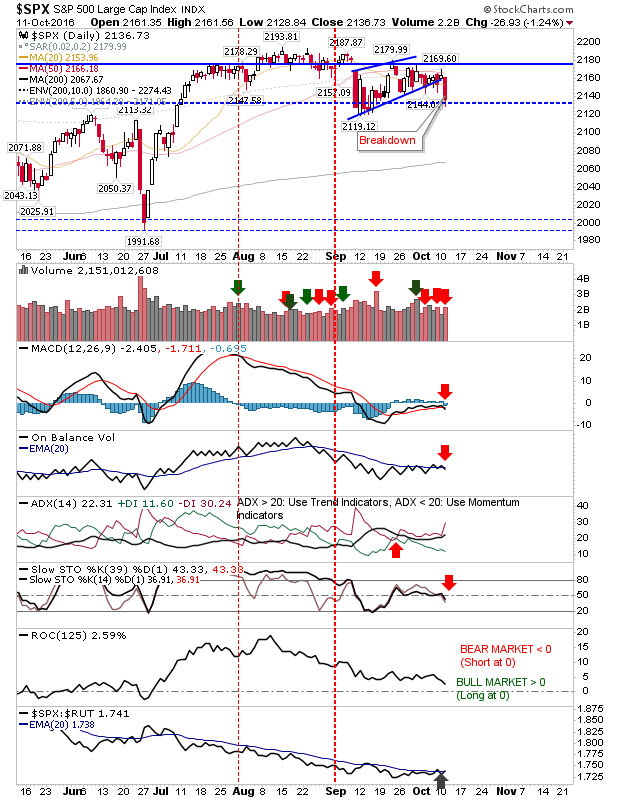

Today had the look of a decisive break down, but the last such breakdown from September's Brexit vote had a similar guise, but it failed to follow through. Volume climbed to register as another distribution day, the second (third for the S&P) such day since the last accumulation day. Tomorrow could be the decider, but it needs to break down right from the open - otherwise the agony will continue.

The S&P is back showing net bearish technicals. However, the index continues to outperform the Russell 2000.

The Russell 2000 finished the day with a 'bull trap', after a positive breakout yesterday. Technicals are mixed, although with relative performance on the wane it would appear bears have the upper hand.

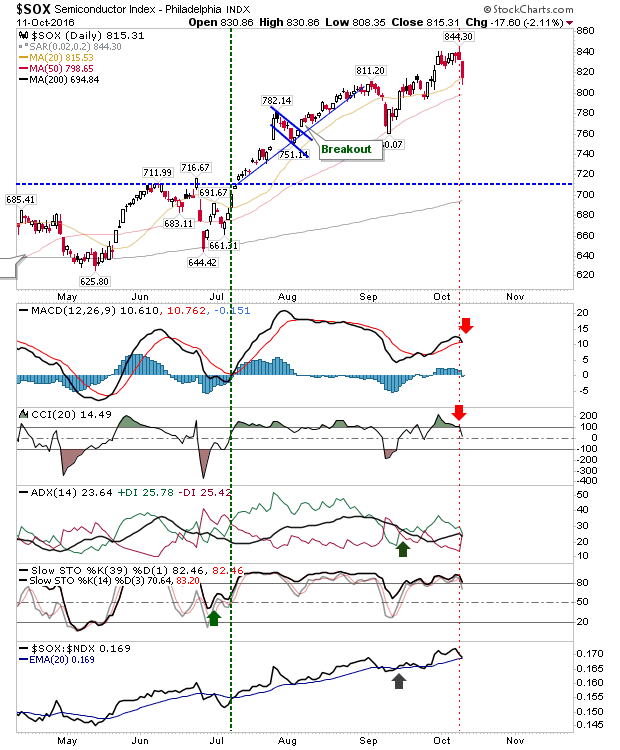

The Semiconductor Index suffered big losses at over 2% for the day. It has been a strong performing index since May's low, but it may find itself experiencing more headwinds now. Technicals are moving into the bear column.

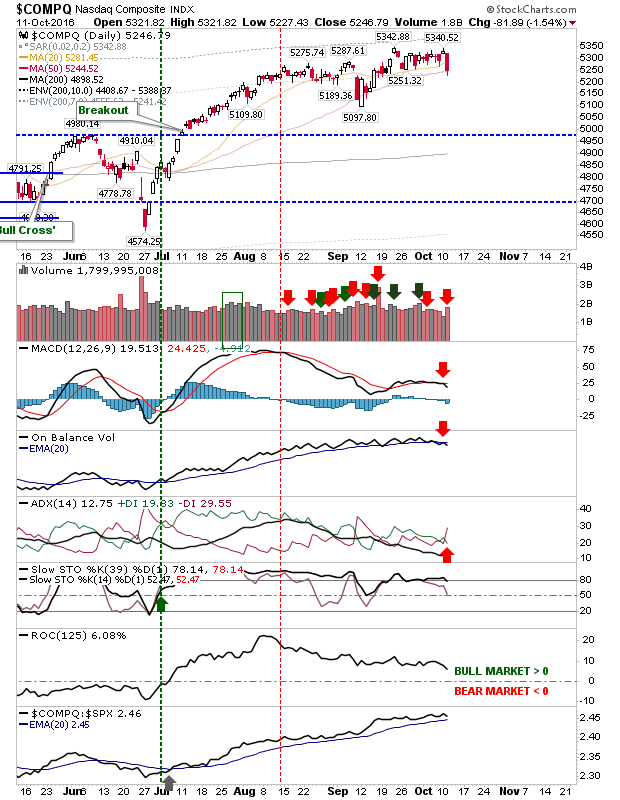

This has had a clear knock on effect on the Nasdaq and Nasdaq 100. The Nasdaq finished on its 50-day MA, much like it did in early September when it was followed by a powerful rally. Bulls may be looking for a gap (down) and rally tomorrow.

Tomorrow needs a bullish reaction, otherwise a move down to June lows becomes the preferred forecast. There is little room for maneuver for bulls after today.

Disclosure: None.

Thanks for sharing