Sell The Bonds, Sell The Stocks, Sell The House — Dread The Fed!

There is going to be carnage in the casino, and the proof lies in the transcript of Janet Yellen’s press conference. She did not say one word about the real world; it was all about the hypothecated world embedded in the Fed’s tinker toy model of the US economy.

Yes, tinker toys are what kids used to play with back in the 1950s and 1960s, and that’s when Janet acquired her school-girl model of the nation’s economy.

But since that model is so frightfully primitive, mechanical, incomplete, stylized and obsolete, it tells almost nothing of relevance about where the markets and economy now stand; or what forces are driving them; or where they are headed in the period just ahead.

In fact, Yellen’s tinker toy model is so deficient as to confirm that she and her posse are essentially flying blind. That alone should give investors pause—especially because Yellen confessed explicitly that “monetary policy is an exercise in forecasting”.

Accordingly, her answers were riddled with ritualistic reminders about all the dashboards, incoming data and economic system telemetry that the Fed is vigilantly monitoring. But all that minding of everybody else’s business is not a virtue—its proof that Yellen is the ultimate Keynesian catechumen.

This stupendously naïve old school marm still believes the received Keynesian scriptures as penned by the 1960s-era apostles James(Tobin), John (Galbraith), Paul (Samuelson) and Walter (Heller).

But c’mon.Those ancient texts have no relevance to the debt-saturated, state-dominated, hideously over-capacitated global economy of 2015. They just convey a stupid little paint-by-the-numbers simulacrum of what a purportedly closed domestic economy looked like even back then.

That is, before Richard Nixon had finally destroyed Bretton Woods and turned over the Fed’s printing presses to power aggrandizing PhDs; and before Mr. Deng had thrown out Mao’s little red book in favor of a central bank based credit Ponzi.

As you listened to Yellen babble on about the purported cyclical “slack” remaining in the US economy, the current unusually low “natural rate” of federal funds, all the numerous and sundry “transient” factors affecting the outlook, and the Fed’s fetishly literal quest for 2.00% inflation (yes, these fools apparently think the can hit their inflation target to the second decimal place), only one conclusion was possible.

To wit, sell the bonds, sell the stocks, sell the house, dread the Fed!

In a global economy that is plunging into an epic deflationary contraction, Yellen & Co still embrace mythical and unmeasurable benchmarks for domestic full employment and other idealized performance targets.

Indeed,since they operate in what amounts to the pseudo-scientific realm of economic policy numerology, their model can be reduced to a voodoo style formula expressed as “2,3,4,5”.

That would be 2% inflation, 3% real growth, 4% normalized Federal funds and 5% unemployment. Any difference between those targets and current readings is defined as “slack” or performance shortfall that the 12 apostles on the FOMC have been mandated to close; and to do so with the blunt force instruments of money market rate pegging, yield curve repression (that’s what QE is) and wealth effects levitation of financial asset prices.

At the end of the day, the only thing worse than Nixon’s final destruction of sound money at Camp David in August 1971 was the passage of the Humphrey-Hawkins Act seven years later.

To be sure, the act itself was an exercise in political messaging that did not delegate open-ended power to a monetary politburo to literally hijack the price-setting process in the entire financial system. Instead, it was a rubbery sense of congress resolution that encompassed unquantified and purely aspirational goals for maximum employment and price stability.

It was the power-hungry academics and policy apparatchiks like Alan Greenspan, Alan Blinder, Ben Bernanke, Janet Yellen and the B-Dud who turned it into today’s Keynesian model numerology.

The hard core reality, however, is that the very foundations of the Keynesian full employment model cannot be measured, specified, validated or achieved. For all practical purposes there is no such thing in today’s world as potential GDP, full-employment, a natural rate of Federal funds, NARU (natural rate of unemployment) or quantifiable price stability.

These are all self-serving fictions fabricated by a small community of monetary central planners and their Wall Street henchmen. And they do one big but destructive thing: Namely, they are used to justify endless manipulation and falsification of the single most important set of prices in all of capitalism—the price of money and financial assets.

Consider Yellen’s absolutely foolish discussion of the 2% inflation target, the transient factors currently impacting it and the Fed’s insistence on symmetry between under-shooting and over-shooting the target.

In the first place, by one good measure of consumer inflation—the 16% Trimmed Mean CPI—the Fed has been hitting its target all along. To hit the magic 2.00%, the monthly change needs to be in the 0.16% range; and, as shown below, its pretty hard to see that they have missed by much, or that their is any kind of worsening trend during the last five years of so-called recovery.

But then, of course, Yellen actually swatted away a questioner’s observation that the Fed was already at its 2% target based on a similar median CPI published by the Cleveland Fed.

Why, no, our intrepid school marm replied—here in the Eccles Building we hold strictly to high church liturgy. Nothing less than the PCE deflator will do when it comes to the sacrosanct inflation target.

I’m sorry but that’s obscurantist malarkey of the first order. Over any reasonable period of time there is not a dimes worth of difference between the various measures of consumer inflation on goods and services. And that’s ignoring the fact that they all under measure it, anyway.

As shown below, the 16-year CAGR since October 2000 was 1.82% for the Yellen’s PCE deflator, 1.92% for the CPI less food and energy and 2.12% for the regular consumer price index for all urban consumers. Only in the Fed’s tinker toy model of the world could those fractional decimal points of difference actually make any difference.

Indeed, neither the centered 2% trend of all three indices since the year 2000 nor the short-term divergences among them during that period have anything to do with real GDP growth. On an LTM basis, the latter ranged from a positive 5% run rate to a negative 3% rate, but there is absolutely no correlation with the modest oscillations and divergences of reported consumer inflation during the period.

So what was Yellen obsessing about? Well, on a one-year basis, the PCE index is up 0.2%, the CPI has gained 0.1%, the PCE less food and energy is higher by 1.4% and the CPI less food and energy is up by 1.9%.

So what? Can you say global oil and commodity price collapse?

The essence of Yellen’s “transient” factor discussion is that the lower right-hand readings for October/November are the bottoms for iron ore, copper, crude oil and the other commodities; that these plot points will anniversary next fall; and that the year-on-year inflation rate thereafter will normalize toward 2%.

Yes, and a blind squirrel occasional finds an acorn! Yellen & Co have no clue as to when the current massive commodity gluts will be absorbed or how the leads and lags in the global commodity price equations will play out.

In fact, since we are dealing with massive over-investment in shale, tar sands, iron ore mines, aluminum smelters, bulk carriers etc. it appears that supply could still be rising for several year as cheap creditfueled projects come on stream while global demand falters owing to collapse incomes and wage bills in the primary materials and goods sectors.

So it could be years before Yellen’s mechanical anniversary factor shows up in the inflation indices. At the same time, the flow-through impact of still lower commodity and processed materials prices on the global manufacturing and consumer goods supply chain is all but impossible to calculate because it’s transmission will be shucked and jived by the currency exchange rate interventions of dozens of significant central banks.

And that points to the larger truth. The whole 2.00% inflation obsession is pointless, and not only because there is no scientific proof anywhere that 2.00% inflation is better for growth than 1.20% or 0.02%. The dispositive point is that the Fed can do virtually nothing about inflation as reflected in the primitive CPI indexes for the domestic economy.

There are actually four relevant components to an honest reckoning of inflation—commodities, tradable goods and services, housing rents and occupancy costs and purely domestic services. None of them lend themselves to Fed micro-management or inflation-pumping.

Housing rents as measured by most private sector indices are running at 3-5% annually. There is no inflation deficiency there.

Likewise, the BLS measures of purely domestic services are a second cousin of random noise. Does anyone really believe that medical care costs have rising at only a 2.9% annual rate since Obamacare incepted in 2011? Or that education bills have risen at only a 3.5% rate during the past three years.

And how do you measure price change for services provided by yoga studios, gardeners, delivery boys, home cleaning vendors, tutors and trainers etc. when there is no standard unit of product? The BLS numbers are a random approximation, and the inflation rate of domestic services need not be managed by the Fed anyway.

Tens of millions of consumers will slice, dice, repackage and substitute their way to a satisfactory solution with no help whatsoever from the Eccles Building.

By the same token, the price of tradable goods and services is being set now, and for a long time to come, by the vast excess of manufacturing and transportation capacity that has been generated by the $185 trillion credit bubble over the last two decades; and by a surfeit of cheap labor that was uprooted from traditional villages and rice paddies by central bank enabled malinvestment.

There is no telling how long it will take to absorb all of these capital and labor excesses or when the price of manufactured goods will get up off the economic floorboards.

Stated differently, the global price of goods and commodities has been baked into the cake by the massive credit and CapEx spree the global economy has experienced since the early 1990s. Whatever the Fed does between monthly meetings or over the course of the next few years is of absolutely no moment.

In the credit swollen global economy of the present era, trying to manage domestic inflation is about as useful as manufacturing buggy whips. And the odds of hitting a 2.00% target are as likely as a room full of monkeys typing the Declaration of Independence.

The only thing that made less sense during Yellen’s blathering was her constant reference to “slack” in the labor market, and the repeated expression of confidence that with a little more expert help from the Eccles Building it will be fully absorbed.

That’s just the 50 year old factory based model of potential GDP and full employment based on a census style count of job holders versus the mainly adult male population. But in today’s world ofglobal labor competition, including out-sources services, and domestic gigs, temp agencies and Wal-Mart style labor scheduling by the hour and time of day, week, month and season the whole idea is a relic. And a stupid one at that.

The only common denominator left if the adult population, which numbers 255 million by headcount and 510 billion by standard work-year hours count.Over and against that, the US economy is currently utilizing about 250 billion labor hours annually according to the BLS.

No, that doesn’t mean that we have a 50% unemployment rate. But it does encompass the fact that in today’s world there are no “natural” or structurally fixed coefficients for withdrawal of hours from the labor force owing to retirement age, disability rates, non-monetized homemaker election, student status, or lifestyle preferences for malingering, begging, free charitable endeavors or asceticism.

Self-evidently, these decrements from the nation’s 250 billion odd un-deployed potential labor hours are effected by tax and welfare policies, accumulated retirement savings and an endless list of cultural and psychological factors.They have little to do with any measurable business cycle, shift and morph steadily over time and in response to new developments, and are utterly beyond the reach of 25 basis points of interest rate increments on the money markets.

In short, there is no bathtub of aggregate demand to be filled to the brim by the monetary central planners in the Eccles Building. Nor is there any inflation and employment numerology that can measure full employment, full inflation (e.g. 2.00%) and full utilization of all other economic resources.

The fact is, you cannot even measure the utilization rate of an auto assembly plant in today’s world. It is all a function of line speed, robot function and capacity and vehicle configuration and complexity; and the latter, in turn, are the result of discretionary choices as to capital investment and vehicle design.

The bottom line is simply. There is no such thing as potential GDP, yet in Yellen’s model that is the only thing.

So as she and her posse of money printers attempt to achieve impossible targets embedded in a tinker toy model of economic reality—look out below.

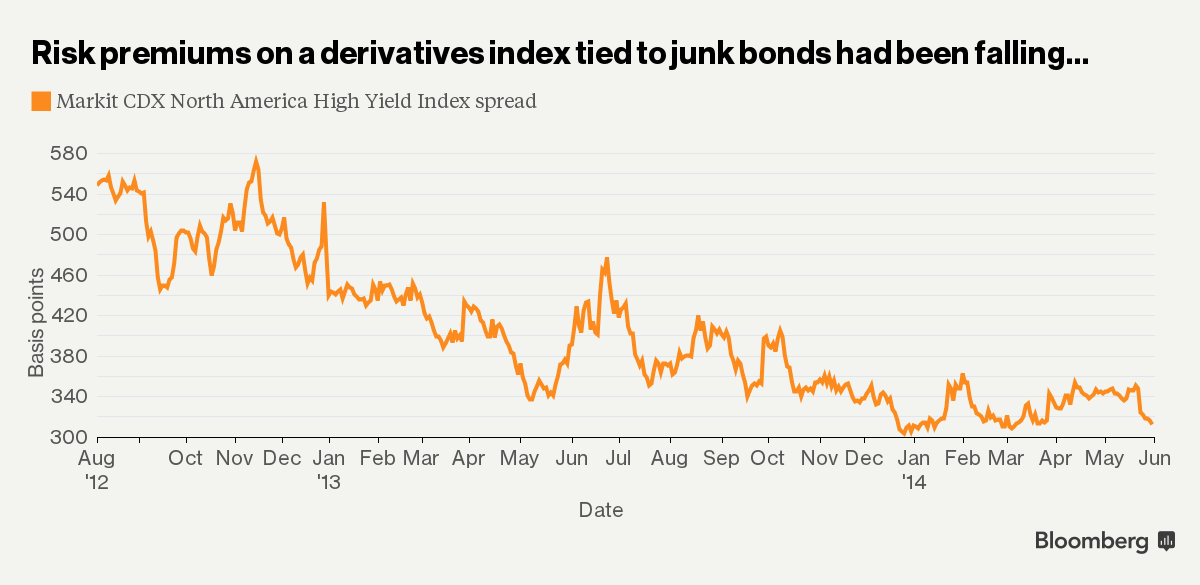

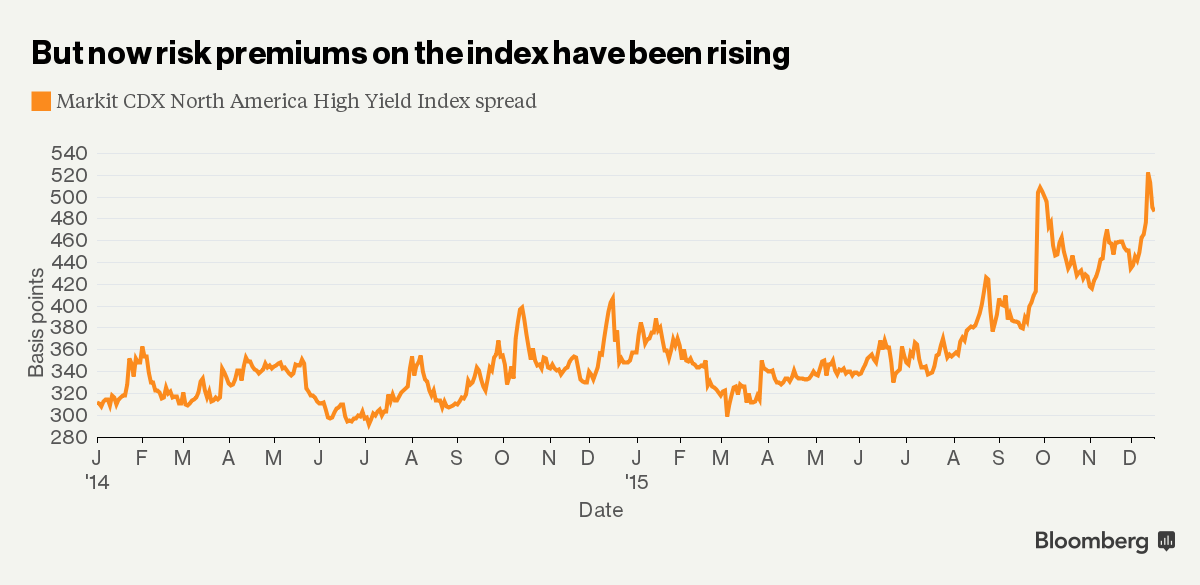

The only thing they are doing is deforming and inflating the Wall Street casino. The march of the junk debt yield curves shown below says it all.

They are fixing to blow the place up for the third time this century, yet Yellen insisted that the Third Avenue credit fund failure this past week was a one-off event.

Now that is the ultimate in clueless.

.

Source: Bloomberg

Disclosure: None.

So, I am no fan of long bonds being used as collateral in the derivatives markets. But what can crash it? I could see the stock market crashing, but seriously, John, you have been talking about the blow up in this convoluted bond market for years. As long as the Fed keeps a lid on the common man and his economic growth, it looks like it is in control. Well, at least until yield scraps below zero. There will likely be a flattening of the yield curve, and then the Fed will probably stop raising rates past 2 percent. Whatever the case, there is a massive demand for long bonds that doesn't look to end soon. Demand up, yield down.