Scary Headlines Abound As Dow Knocks On 50-Thou…What Now?

Image Source: Pixabay

The Dow Jones Industrial Average first crossed the 40,000 milestone in mid-2024 (see Investing Caffeine – Dow 40,000), yet barely 18 months later, the index has notched another record closing high and is now knocking on the door of 50,000.

For the most recent month:

Dow Jones: +1.7%

S&P 500: +1.4%

NASDAQ: +1.0%

Remarkably, as we enter 2026 flirting with these major milestones, this marks the third consecutive year of double-digit gains across the major stock indices—despite what feels like a nonstop barrage of alarming and often unimaginable headlines.

And that’s the key point.

A World on Fire… According to the Headlines

• Greenland Takeover Threat: Over a year ago, President Trump declared U.S. control of Greenland an “absolute necessity” for national security amid rising Russian and Chinese Arctic influence. Last month, tensions escalated when a proposed tariff regime—starting at 10% and rising to 25%—was announced against Denmark and several European allies. Markets ultimately breathed a sigh of relief after tariffs and military threats were reversed following the announcement of a negotiated framework.

• Venezuelan Invasion: In early January, U.S. forces executed a high-precision raid of the Venezuelan capital of Caracas in the middle of the night, when President Nicolas Maduro was successfully extracted without any Americans killed. Maduro now faces narcoterrorism and corruption charges in federal court in Brooklyn. Meanwhile, Secretary of State Marco Rubio has spearheaded a plan that prioritizes the rebuilding of Venezuela’s oil infrastructure by seizing tankers and millions of barrels of sanctioned crude oil to finance the reconstruction.

• ICE Protests in Minnesota Turn Deadly: Immigration protests in Minnesota escalated last month, resulting in two high-profile fatalities as demonstrators clashed with federal ICE authorities (Immigration and Customs Enforcement).

• Government Shutdown (Again): A partial government shutdown began January 31, 2026, after six of twelve appropriations bills expired. Political gridlock—particularly surrounding DHS (Department of Homeland Security) and ICE funding—has once again sidelined Washington as lawmakers attempt to negotiate a resolution. House members gather back from recess on February 2nd in an attempt to end the budget standoff.

• Federal Reserve Leadership Uncertainty: Fed Chair Jerome Powell’s term expires in May. President Trump has nominated Kevin Warsh as his successor, criticizing “Too Late” Powell’s pace of rate cuts for years. Warsh, a former Fed Governor during the 2008 Financial Crisis, is widely respected but faces scrutiny regarding Fed independence, in part because he shares the President’s view that interest rates should be lower in the current environment. His Senate confirmation remains pending.

• Middle East Tensions in Iran: Following last year’s U.S. strikes on Iranian nuclear facilities, tensions have reignited amid reports of mass protester killings by Iran’s IRGC (Islamic Revolutionary Guard Corps). The U.S. has since mobilized substantial regional military assets, signaling possible intervention in support of regime change.

• Supreme Court Tariff Ruling Looms: The Supreme Court has yet to rule on the administration’s use of the International Emergency Economic Powers Act (IEEPA) of 1977 to impose sweeping global tariffs. A ruling against the government could trigger over $100 billion in retroactive refunds. The next decision window is February 20, 2026.

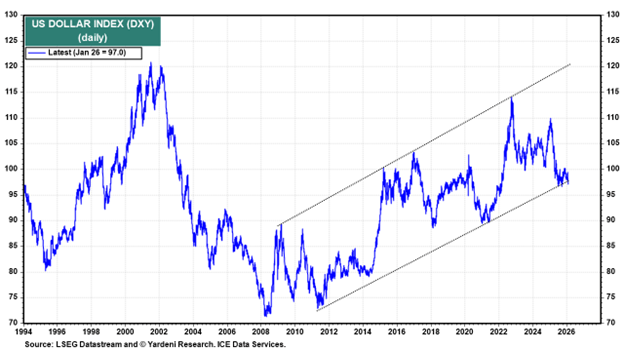

• U.S. Dollar Weakness: After declining roughly 10% in 2025, the dollar continued to weaken in January 2026 (-1%) – see chart below. Precious metals surged alongside the move—gold up +12% and silver +17% for the month—despite sharp end-of-month pullbacks.

• Cryptocurrency Collapse: Bitcoin has fallen roughly -38% from its October 2025 peak near $126,000 to about $78,000, once again challenging its “digital gold” and “store-of-value” narrative.

• Ongoing Ukraine War and Gaza Conflict: The Russia-Ukraine conflict drags into its fifth year, while violence persists in Gaza despite a loosely agreed ceasefire, with casualties continuing to rise.

Source: Yardeni Research

Don’t Believe the Hype

That’s a staggering amount of uncertainty. So how has the stock market responded?

By soaring.

S&P 500 Returns:

2023: +24.2%

2024: +23.3%

2025: +16.4%

The verdict on 2026 remains unwritten—but so far, the trend remains intact.

For most of my professional career, I’ve urged investors to tune out fear-driven media narratives (see Turn Off the TV). History repeatedly shows there is little correlation between scary headlines and long-term stock prices.

In fact, I’ve argued before that bad news can often be good news for markets (see Bad News is Good News). Conversely, in 2022 we witnessed strong employment and solid economic growth—yet both stocks and bonds suffered significant losses.

What Actually Moves Markets (“The Stool”)

Rather than reacting to noise, investors should focus on what truly drives long-term returns. At Sidoxia Capital Management, we emphasize four foundational forces (see Don’t Be a Fool, Follow the Stool):

1. Profits

2. Interest Rates

3. Sentiment

4. Valuations

These four legs of the “Sidoxia Stool” exert far more influence over market direction than daily headlines ever will.

While the current environment presents a mixed picture across these factors, monitoring them—rather than reacting emotionally to media narratives—offers investors far greater clarity on where markets may head next. And whether the Dow reaches 50,000… or 100,000 likely won’t be decided by headlines. It will be decided by fundamentals.

More By This Author:

Green Lights Everywhere… But Is It Time To Tap The Brakes?

Rational Or Irrational Exuberance?

Markets Surge Higher Despite Shutdown Anxiety Fire

Disclosure: Sidoxia Capital Management (SCM) and some of its clients hold positions and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other ...

more