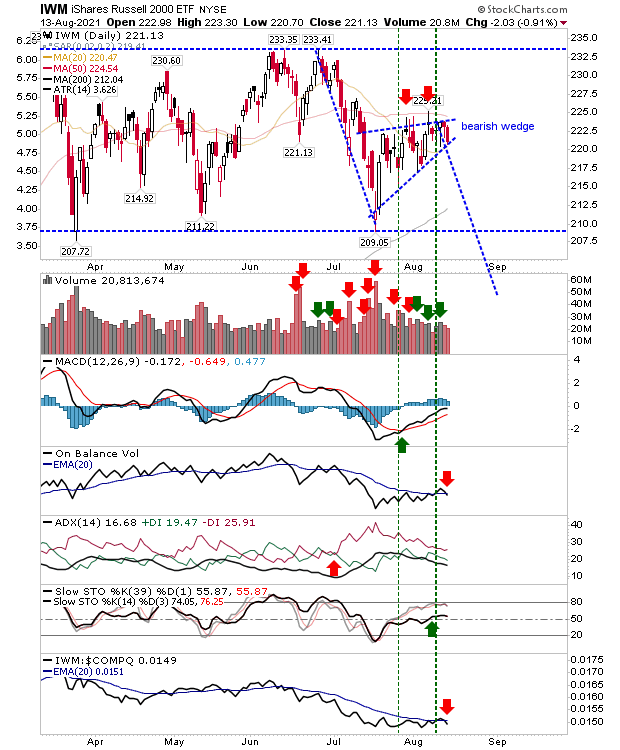

Russell 2000 Takes Biggest Loss But Trading Range Unchallenged

Only one index suffered a loss of potential consequence, but given the Russell 2000 is range bound the near 1% loss didn't do a whole lot of damage. The 50-day MA remains as uncharacteristic resistance in a range bound scenario, but it makes tracking supply relatively easy as long as it stays as resistance. I have drawn in a bearish wedge, with a measured move target down to monitor.

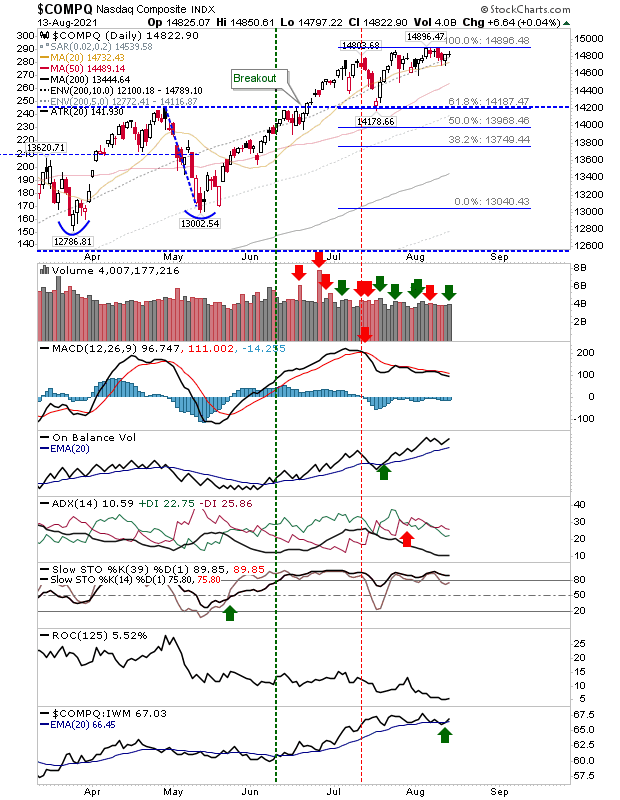

The Nasdaq closed with a narrow doji on higher volume acccumulation. The 20-day MA continues as support with the MACD and ADX still on 'sell' triggers.

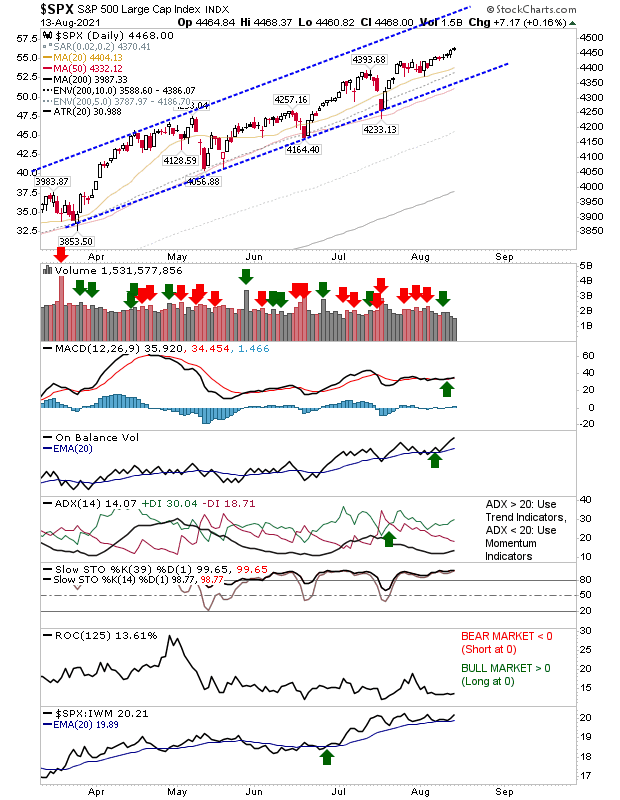

The S&P managed a new high in both price and On-Balance-Volume, although there is little information to trade on. The index is in the middle of the rising channel with technicals net bullish it's a safe 'hold'.

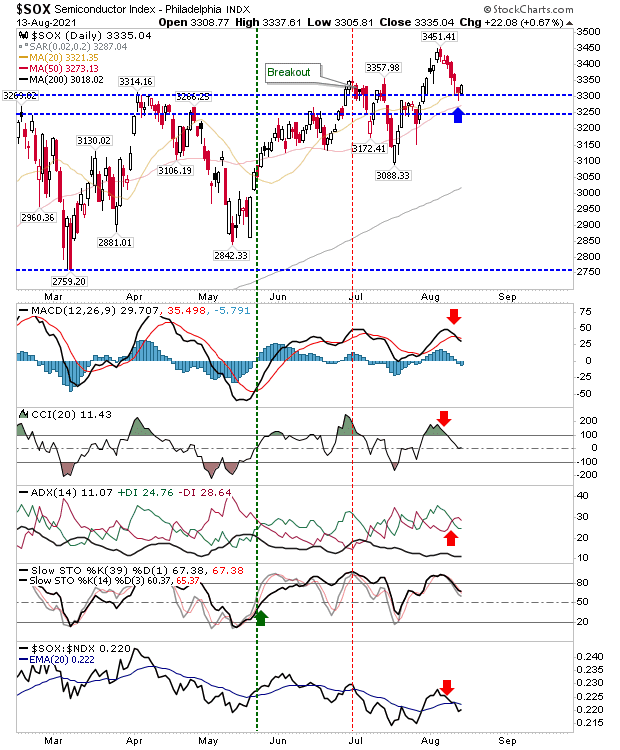

The Semiconductor Index is at an interesting juncture as it makes a positive test of breakout support, although supporting technicals are mostly bearish - only stochastics [39,1] are bullish. The index is also underpeforming the Nasdaq 100, which may be a warning for worse to come - but price will always be the lead.

Holiday trading continues with modest gains keeping bulls happy, but those looking for a pullback to buy are left wanting. The Russell 2000 is caught in limbo, which helps neither bulls nor bears.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more