Russell 2000 Set Up For Breakout

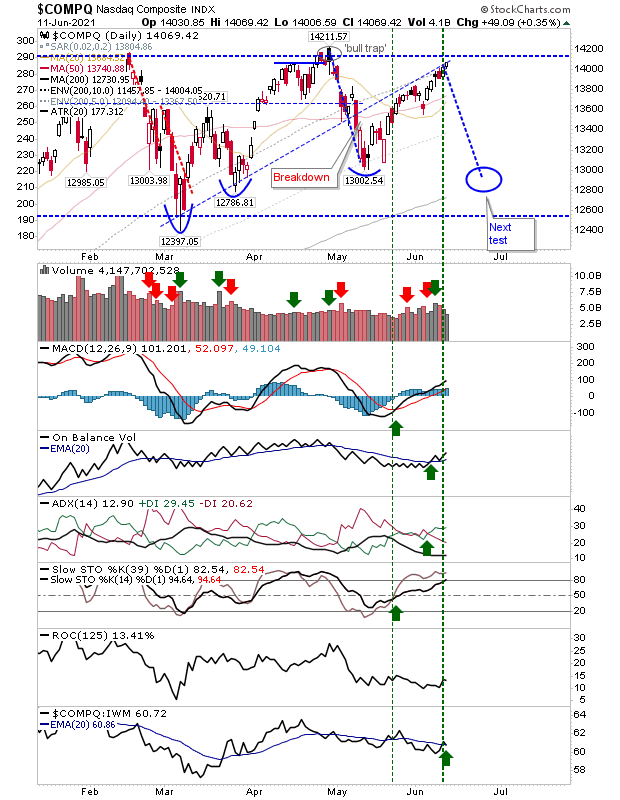

Friday didn't offer a whole lot for Large Caps or Tech Indices; volume was down and the net position for the indices was unchanged. The Nasdaq is caught below internal base resistance (anchored by the March swing lows).

The S&P had already edged a breakout, but it wasn't able to add to its gains on Friday.

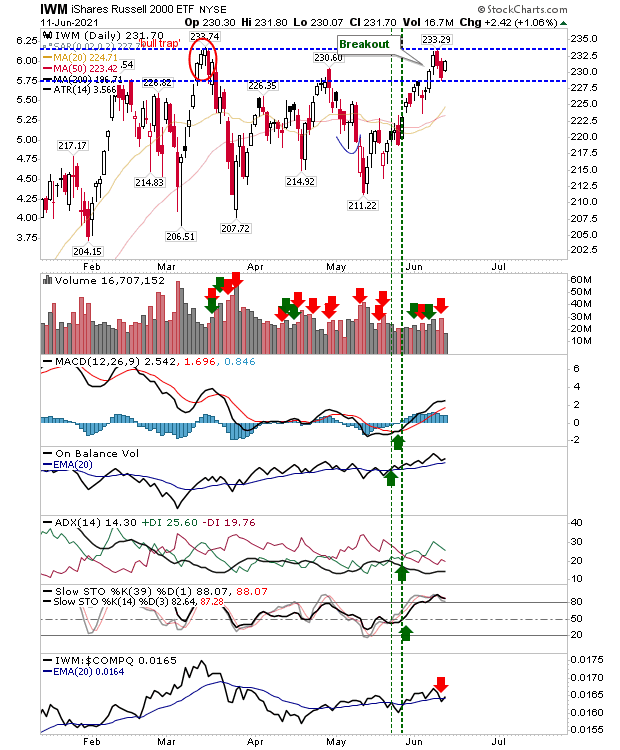

The Russell 2000 has perhaps the best of Friday's action as it recovered some of Thursday's losses. It's nicely positioned to challenge $233.74 ($IWM) with the index ticking up relative to the Nasdaq.

The only bearish index to watch is the Dow Jones Industrial Average. The two gravestone doji as a double top are still in play. A loss of 33,600 will confirm, but a loss of the rising support line would likely be enough to create a short play - note, the accelerating loss in relative performance (to the Nasdaq 100).

So, we have a potential bullish play in the Russell 2000 and a bearish one in the Dow Jones Industrial.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more