Russell 2000 Recovers Intraday In Preperation For Upside Follow Through

Image Source: Unsplash

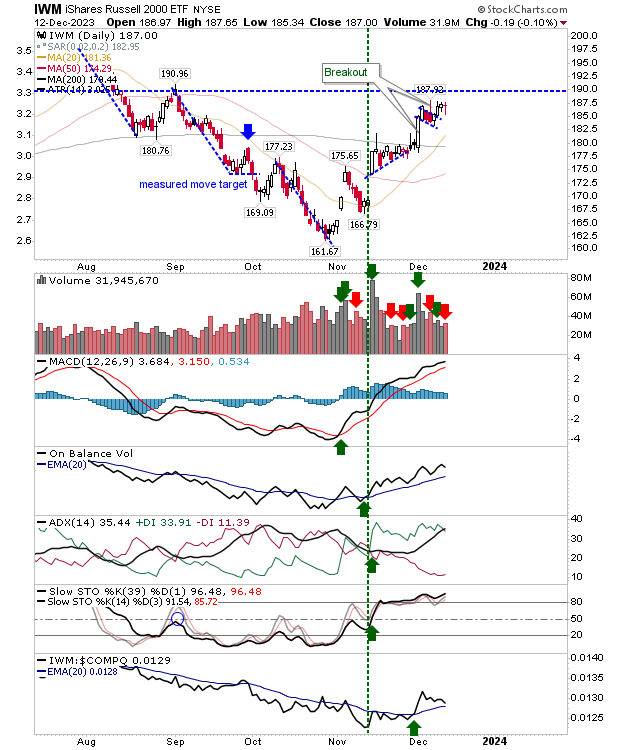

I'm doing a bit of intraday trading as part of TopStep's Trading Combine just to see how feasible day trading is. One thing I have been waiting for is the upside follow-through in the Russell 2000 (IWM). I have watched as sellers have attempted, and failed, to undercut the swing low of the 'bull flag'. I have so far managed to stay on the right side of the intraday trend, although it feels like a decent push higher is not far away. Technicals are all net positive and the index is outperforming peer indices.

Action for other indices has been more clear-cut, the Nasdaq managed to close at a new high on the fourth day of gains. Buying volume has dropped a little on today's action and we still await a new 'buy' trigger in the MACD.

The S&P also closed at its highs, but did at least manage a new MACD trigger 'buy'.

If there is a warning for bulls it's that breadth metrics like the Percentage of Nasdaq Stocks Above their 50-day MA have moved to a 'sell' trigger. Overbought-bready metrics like these are good warning signs for pending tops, so caution is advised if long.

When we do get some selling it's going to be hard, but until we do, markets will keep pushing higher.

More By This Author:

Markets Inch Higher As Semiconductors Make All The Running

Strong Finish To The Week Across All Indices

Tight Trading Near Highs Keeps Momentum Bullish For Indices

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more