Russell 2000 Breaks Free Of Congestion

It was a good day for markets, but it was the Russell 2000 that went on a bender, pushing itself out of its scrappy, multi-week base and slicing through its 200-day MA. Not only that, it managed to clear $180 resistance, which means it's now in the process of shaping a right-hand-side base.

This is important development as other indices are challenging resistance on weekly timeframes. There is room for the Russell 2000 to test support, and an intraday spike below $180 would be acceptable, as long as the index ends the day above $180.

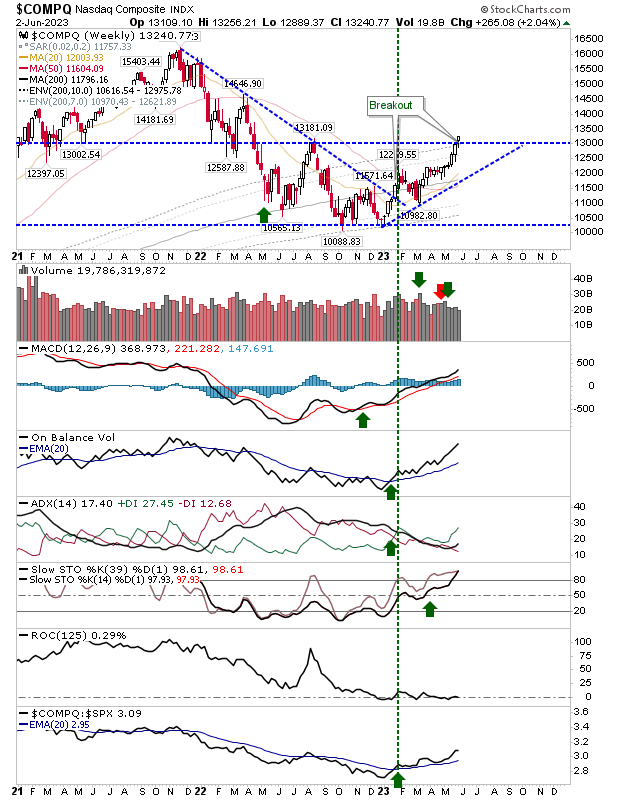

With the Russell 2000 (IWM) making strong gains, we can see key developments in the S&P and Nasdaq. The Nasdaq has managed to clock an end-of-week close above 13,000 resistance, marking its as a breakout, which incidentally was the swing high of last summer. Next up is 14,500 - although it could take until the end of the year before it gets there.

The S&P (SPX) is also challenging last summer's high as it closed the week on resistance. If there is a chance for bears it will be a reversal based on a end-of-week close below 4,300, but with technicals net positive the probability of a resistance reveral is low.

The breakout in the Semiconductor Index (SOX) is consolidating after the initial 15% gain. Assuming it can hold the breakout it will continue to feed the key weekly breakout in the Nasdaq.

The end-of-week finish will be key, particularly for the S&P. With the positive move in the Russell 2000 there isn't a bearish index in the near term, and I suspect, this will evolve into a more bullish stance on longer time frames across all indices.

More By This Author:

S&P "Bull Trap" Negated As Sellers Lose MomentumPeak "Black Candlesticks" Again Offer Cause For Concern

Solid Gains Into Memorial Weekend As Semiconductors Surge

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more