Russell 2000 Again Keeps Up The Fight For Bulls Seeking A Low

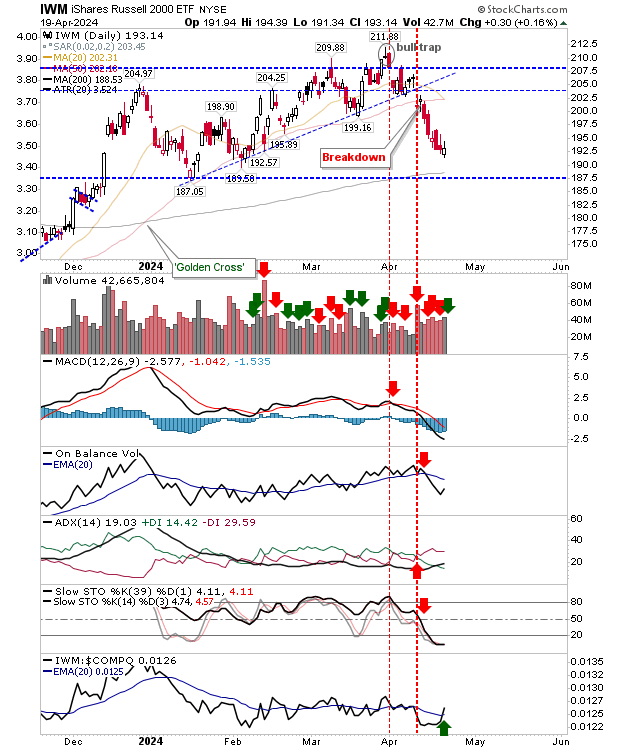

The divergence in the action between the Russell 2000 (IWM), and the S&P and Nasdaq continues.

If the Russell 2000 could go on to tag its 200-day MA, particularly if it's done on a bullish reversal candlestick, then there would be a good trade opportunity on offer here. Even a rally from here might be enough if there is a tight stop.

There is less joy to be found in the S&P. Fibonacci retracement levels haven't offered much support yet and the 200-day MA is a long, long way away. Despite that, the index has still managed to surge in relative performance against the Nasdaq...

The Nasdaq accelerated its losses with a 2% loss. Support at 15,150 may offer a respite, but bulls would need to bid this up early in the week if this was to play as support.

There isn't a whole lot on offer for optimists, but if the Russell 2000 can stick around current levels there may be a trade opportunity. It will probably take some stop-gap candlestick in the S&P and Nasdaq to offer the incentive for the Small Cap trade. When this time comes, lows for new trading ranges will be established across these lead indices.

More By This Author:

Russell 2000 Resists Extending Losses As Crash Conditions ReachedFifty-Day MAs Offer Little Support As Indices Seek Swing Lows

Apple Comes In From The Cold

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more