Round 2 For The Bearish "Black" Candlestick In S&P And Nasdaq

The Nasdaq started brightly but ended up closing below its open price but above yesterday's close. The S&P did something similar, although the intraday range is narrower. These two setups are somewhat complicated by the new 'buy' triggers in On-Balance-Volume for both the Nasdaq and S&P. And the new MACD trigger 'buy' for the S&P. Price action is key, so I would expect the candlestick to trump the technical picture; watch for lower prices tomorrow.

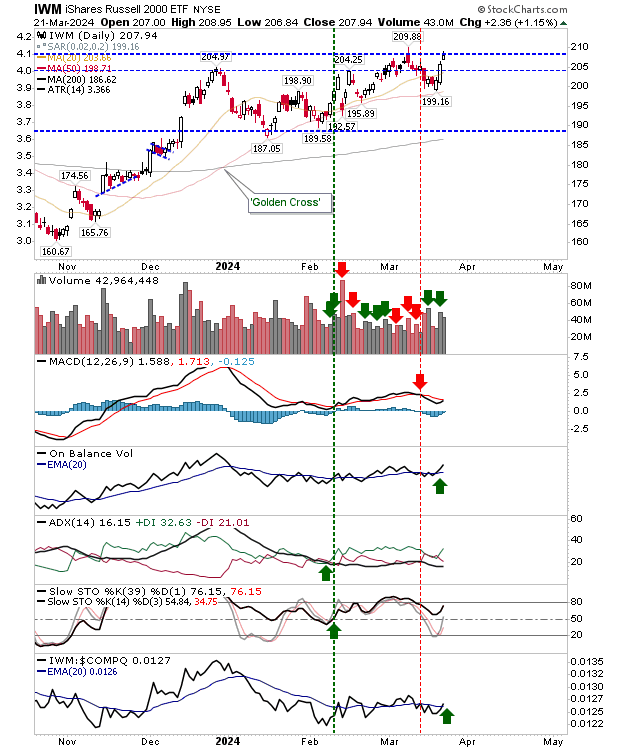

The S&P posted a relative bearish shift versus the Russell 2000 (IWM) but the trend is firmly bullish.

The Russell 2000 (IWM) gapped higher but stalled out at resistance. As with peer indices there was an acceleration in On-Balance-Volume accumulation, but there is also the existing 'sell' trigger in the MACD. The setup is not as bearish as for the Nasdaq and S&P, and there is potential for a breakout.

Given the relative divergence between action in the Russell 2000 (IWM) and S&P and Nasdaq, the probable net result will be a flat day where indices go nowhere. Let's see what the market brings.

More By This Author:

Bearish Engulfing Pattern Eats Into Friday's Russell 2000 BuyingHigher Volume Buying Doesn't Negate Russell 2000 Bull Trap

Modest Losses Keeps Indices Near Highs

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more