Room For The Dollar To Climb Ahead Of The FOMC

While Japan is suspected of intervening in the foreign exchange (FX) market, no official confirmation has been provided yet. Data regarding intervention activities for yesterday will likely be released at the end of May. Additional support for the yen may be necessary, as there are still factors in the market that could drive USD/JPY higher.

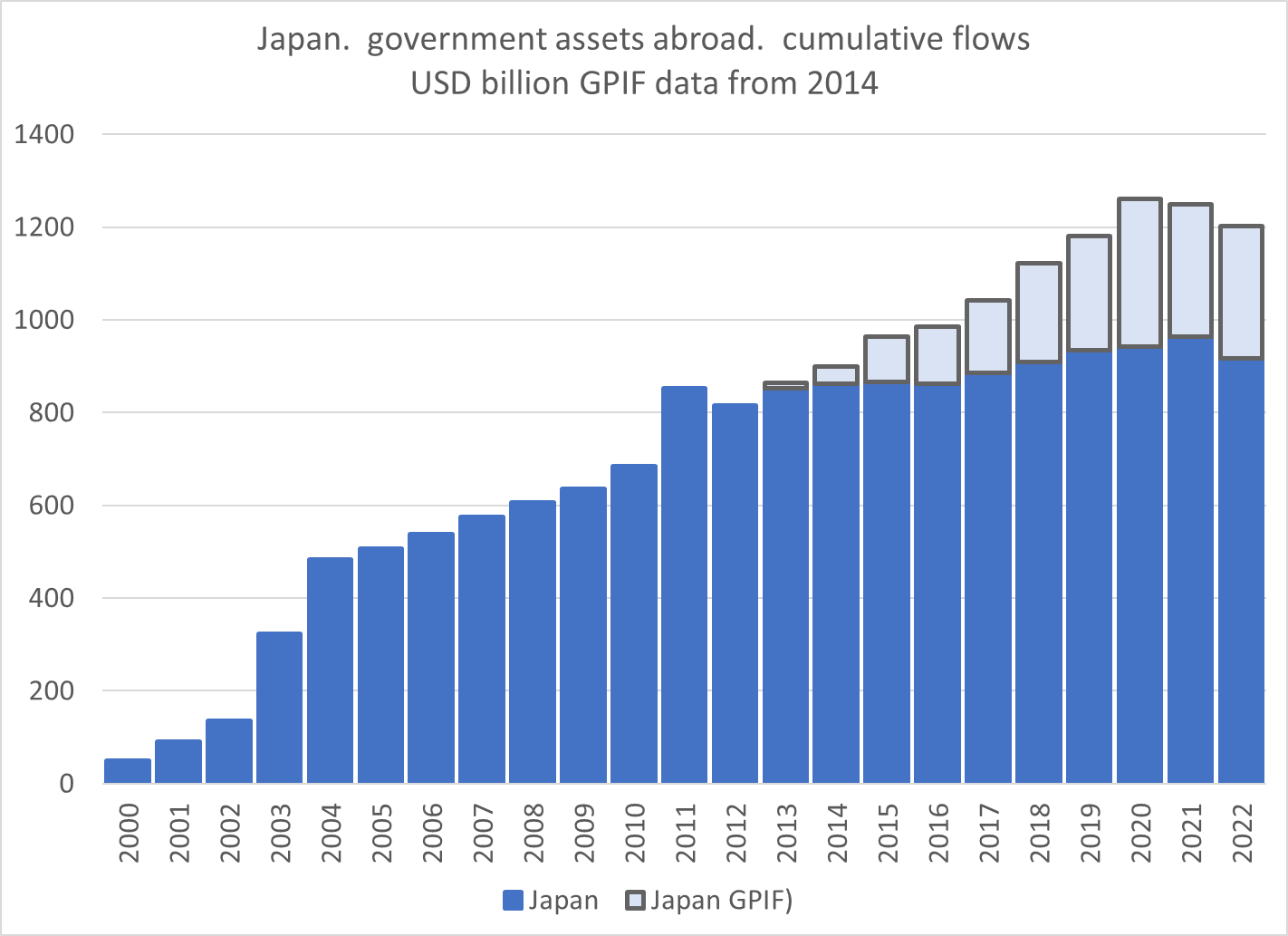

There hasn't been much discussion about the Government Pension Investment Fund (GPIF) taking action in the market. As mentioned previously, the Japanese government has accumulated significant holdings of dollars and euros since 2000, amounting to $1.2 trillion. This has positioned them to potentially realize substantial trading profits from foreign exchange (FX). However, the extent to which the GPIF may consider reducing its exposure to the dollar or euro, as well as the Ministry of Finance's future intervention plans, remains uncertain.

Yesterday saw the dollar facing downward pressure due to Japan's likely intervention to bolster the yen, alongside a favourable day for bonds. However, today, market focus will shift towards data-driven movements in the foreign exchange (FX) market.

With the yen stabilizing and potential acceleration in the employment cost index encouraging bets on a hawkish Fed tomorrow, one would think the dollar has some climb into the Fed.

USD/JPY has found stability around 156/157, mirroring the price action dynamics observed after FX intervention on September 22, 2022 (as mentioned previously). If historical patterns repeat, USD/JPY is poised to gradually climb higher in the upcoming days. This time, the appreciation of USD/JPY may not only align with yield differentials but could also be catalyzed by a potentially more hawkish stance from the Fed tomorrow, although

In the past six months, the market sentiment regarding rate cuts has undergone significant fluctuations, shifting from pricing in multiple cuts to just over one, despite minimal changes in hard data on inflation and growth. Traders seem to be placing large bets on minor fluctuations in decimal points of inflation numbers, leading to swings in rate-cut expectations.

While some argue that these shifts in expectations are based on perceived progress or lack thereof in disinflation, it's hard to believe that traders were so certain about the disinflation trajectory in January, only to drastically revise their forecasts just a few months later.

A more plausible explanation is that traders are essentially playing a speculative game, wagering on how policymakers will interpret and react to economic data, down to the minutest details. The upcoming Fed meeting may shed light on how the central bank views this speculative environment. With rate cuts potentially deferred to the second half of the year, if they occur at all, the anticipation surrounding the May FOMC decision has diminished.

While risks around the Fed's mandate may appear more balanced now compared to the peak of the inflation scare, recent core price growth readings emphasize that inflation remains a primary concern, overshadowing worries about job losses and other economic indicators so there is room for hawks to fly.

And on another currency story that won’t go away…..

While a weak currency may pose challenges for policymakers, it brings significant benefits to exporters. However, this advantage for Japanese exporters could spell trouble for Japan's competitors and has led to speculation about a possible devaluation by China, which could have far-reaching consequences.

The boost in competitiveness for exporters in neighbouring countries is not welcomed news for Beijing, especially amid the ongoing trade tensions with the West. The possibility of a second presidential term for Donald Trump adds further uncertainty to the situation, with potential implications for the intensification of the trade war.

While a yuan devaluation may seem tempting to China to drive exports, it may not be a viable option due to the potential repercussions it could have on capital outflows not to mention the firestorm it would create with the West. China's financial system relies on yuan stability to run smoothly. The People's Bank of China would likely approach any decision regarding currency devaluation with caution, considering the potential for serious geopolitical consequences, especially given the current trade tensions. Beijing is unlikely to pursue such a course of action, at least for now.

The possibility of China hoarding commodities ahead of a potential devaluation is certainly a topic of discussion in the market. If China were to devalue the yuan, it might aim to align it more closely with the CFETS basket, perhaps around 7.30 or 7.35. This adjustment could buy China more time, especially if they anticipate weakening US economic data that might push the US dollar lower. However, a significant devaluation, on the order of 10% to 20%, could lead to substantial capital outflows, potentially causing turmoil in domestic markets.

More By This Author:

Gearing Up For A Busy Week : It Typically Doesn’t Get Any Bigger Than This.

Pre Asia Open: Yet Another Crossroads For Equity Markets

Earnings To The Rescue Amid Rekindled Hope For Inflation Seasonality