Risk For An Economic Slowdown Increasing

Fundamentals

Cathie Wood on Savvy Finance recently focused on the lower-than-expected employment numbers. The lower numbers might be because of the Delta variant, which is supported by the fact that leisure and hospitality areas were flat, even though they had been hiring quickly. Supply chain shortages might be another cause. Computer chip shortages are critical. Manufacturing hours worked were 0.5% down, which is huge, given that is 6% for the year. Construction employment was also down, which can also be caused by supply chain issues.

Image Source: Pexels

Another possibility is that the economy may be slowing. On the positive side, job openings crossed 10 million recently, which means those jobs are open but not filled. They may not pay enough, such as Walmart (NYSE:WMT), which increased pay another $1 an hour to $16 an hour for 500,000 of their employees. Skillset mismatch is another issue. Corporations are going to have to start training more. Initial unemployment claims peaked at 6.1 million claims at the worst of the pandemic last spring. Now we are down to 340,000, which is a huge improvement. We are not that far above levels before the pandemic. Personal income is up 1.1%, which is a nice increase and the savings rate rose to almost 13%. The housing sector is showing good sales. The Purchasing Managers' Index was very strong for August to keep up with consumer demand.

On the negative indicators for the economy, the University of Michigan Consumer Sentiment Index is at its lowest level since 2011, when the European sovereign debt crisis was hitting the news. Retail sales dropped 1.1%, which includes inflation. So, in real terms, the drop was 1.5%, which is a huge drop in one month. Consumers' inflation expectations are increasing, so they feel they are getting less for their money. Real hourly earnings on average year over year are down 1.2%, so the consumer feels that decrease. Gas in California is over $5. Food prices are rising fast.

For precious metals, we are in an environment of the most bullish fundamentals ever, yet the price is now down about $31 for gold to $1802.70. The stimulus package is stalled in Congress, so the markets are almost doing the reverse of what would be expected with such a bill on the horizon.

El Salvador has made Bitcoin legal tender. It is the first country in the world to make this significant first step. If others follow, it will only increase the value and usability of the cryptocurrency.

Courtesy: Diario El Salvador

Mean Reversion Trading Analysis

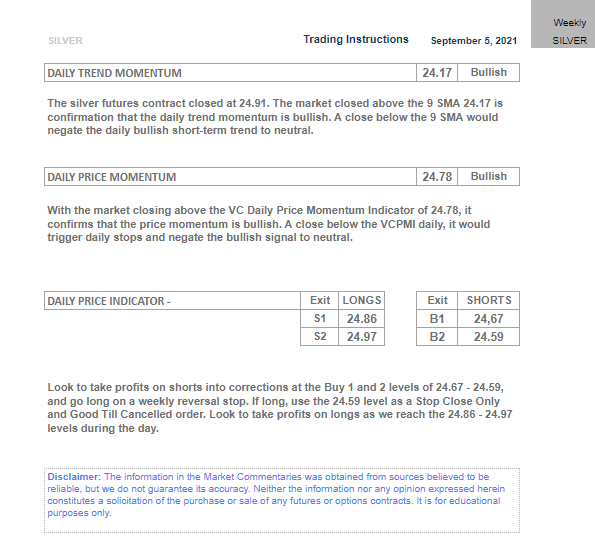

According to Robo advisor AI based on the Variable Changing Price Momentum Indicator (VC PMI), for silver, the trend momentum is bullish. Silver closed above the 9 day moving average, so the daily momentum is bullish. The daily price momentum indicator is $24.78, which confirms that the price momentum is also bullish. A close below $24.78 would negate this bullishness to neutral. The VC PMI Sell 1 level is $24.86 and the Sell 2 level is at $24.97. If you are long, sell at those levels. If you're short, take profits at the VC PMI Buy 1 level is at $24.67 and the Buy 2 level is at $24.59. You can short the market at the sell levels and go long at the buy levels for the highest probability trades. The Sell 1 and Buy 1 levels have a 90% chance and the Sell 2 and Buy 2 levels have a 95% chance of the market reverting from those levels back to the mean.

Silver

Courtesy: ema2trade.com

Silver is at $24.26, which appears to be a level of support. We are extremely oversold on the daily numbers. We have entered the bearish trend momentum on the VC PMI weekly data by trading below the average price of $24.51. The market may come down to the weekly level of support at $24.07 and activate that level of support or it may move up above $24.51 and activate a bullish trend momentum. It doesn't really matter why the market came down to these levels. We use the VC PMI to tell us where the market is likely to go.

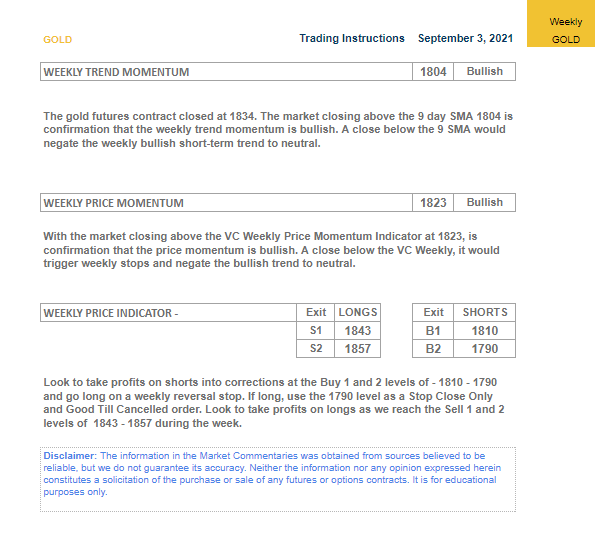

Gold

Courtesy: ema2trade.com

Gold has broken the $1,810 area, which is a major area of support and has entered the weekly VC PMI area of support. It is extremely oversold daily and weekly. You can use $1,810 as a major pivot point. It is difficult to trade this type of market when you have such a major selloff. You don't want to sell into this decline. This is an area of probable accumulation of supply. The mean is $1,823, so the market is at an extreme below the mean and is likely to return to that mean. Buyers are likely to come into the market. The market may fall more, but it is far less likely than the market reverting back to the mean. Gold is down to $1,797. We are holding a long long-term position in gold and we are adding to that position on these pullbacks. You may want to add to your position at these levels, as long as you don't use margin.

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own ...

more