Rising Rate Of Subprime Credit Card Delinquencies And Charge-offs… An Economic Canary In The Coal Mine?

Photo by jmegjmeg

As a title insurance company, our business relies on a robust commercial and residential real estate market that’s being spurred on by a strong consumer!

A consumer who’s confident about the country’s (and their own) economic prospects!

Certainly, we have seen good recent economic growth as measured by GDP, but post-tax cut have we already seen the best or is the best yet to come…

Source: MarketWatch

Consumer Health, Consumer Debt And U.S. Economic Strength Measured Through Credit Card Delinquencies And Charge-offs

During the 2008 financial crisis, many consumers faced unmanageable levels of debt that led to real estate foreclosures, an inability to pay other debt and ultimately bankruptcy filings.

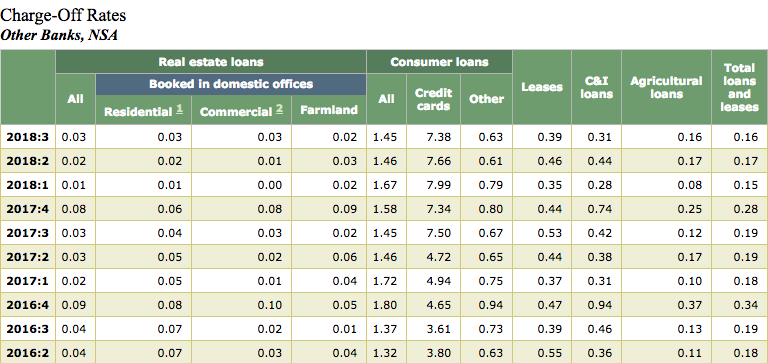

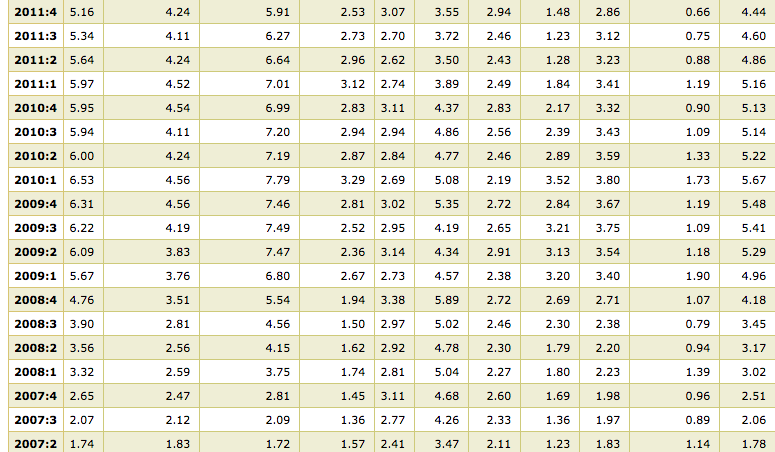

The charts below show how those rates began to spike in 2008 at the banks outside of the largest 100, then declined and now are once again on the rise. Some consider that these smaller banks, who cannot necessarily compete with the largest banks for customers, have more of a subprime customer base.

So is the financial angst being felt in the other-than prime borrower segment a signal of a consumer that’s weaker than the pundits and ‘talking heads’ are telling us or, is this no issue at all?

Historical Credit Card Charge-off Rates (Source: Federal Reserve)

Historical Credit Card Delinquency Rates (Source: Federal Reserve)

Disclosure: None.