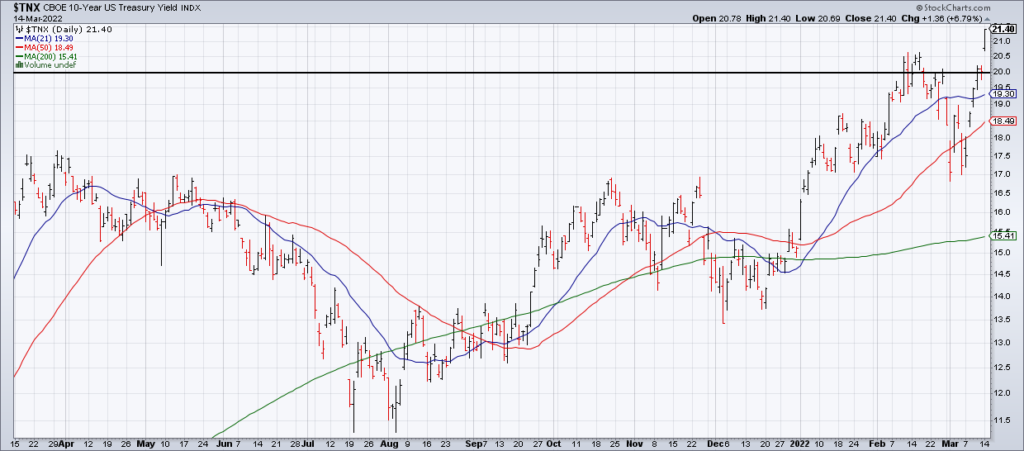

Rising Interest Rates Hammer Tech

(Click on image to enlarge)

After a correction in the wake of Russia’s invasion of Ukraine, interest rates have resumed their uptrend with the 10-year Treasury yield jumping 14 basis points to a 52-week high of 2.14% Monday.

Does $QQQ hold here? pic.twitter.com/Q6ixVBL4I8

— David Rath (@DJwrath) March 14, 2022

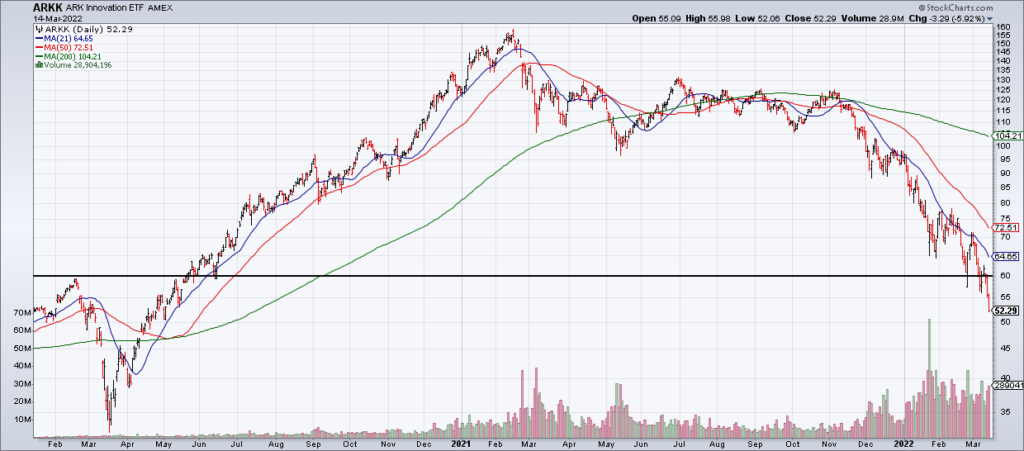

(Click on image to enlarge)

As I’ve discussed many times of late, rising interest rates are especially bad for growth stocks because it increases the discount rate at which their future earnings – where most of their intrinsic value is – are valued. Therefore, it’s no surprise that tech stocks led to the downside Monday with QQQ -1.92% and ARKK -5.92%.

Of note to me personally is that my bifurcated market thesis is not playing out at the moment as early-stage growth continues to get whacked even harder than mature growth. For example, Snapchat (SNAP) was -6.82% and DoorDash (DASH) -12.54%. This is why I emphasized on Friday night that you must go small and be dynamic in early stage growth right now. I still see an opportunity here but it’s going to be volatile and big moves to the upside are many years away.

It appears that we will see some continuation at the open Tuesday as well with European stocks and US Futures currently (5:30 am EST) at their lows of the session with the latter off about 70 basis points.