Revisiting James Harden’s Deal With Adidas

Adidas (OTCQX:ADDYY) is set to release its annual report on March 3rd. Last year, Leverage Equity covered the massive James Harden deal with Adidas before the start of the NBA season. Since the article was published in August 2015, Adidas has soared 44.5% and replaced Under Armour (NYSE:UA) as the 2nd biggest Athletic Apparel Company behind Nike (NYSE:NKE). By comparison, during this time frame Nike rose 9.4% and Under Armour has decreased 15.6%. We revisit the James Harden deal and look at how it has performed has gone so far.

Adidas in an attempt to regain traction in the basketball shoe marketplace signed NBA superstar James Harden to a 13-year, $200 million endorsement contract just before 2015-16 NBA season. Adidas lured the Houston Rockets star away from Nike with the massive contract, when Nike decided that it would not be matching the offer made by Adidas. Adidas shifted its basketball strategy by letting its NBA jersey deal lapse in favor for individual player endorsements. Nike has picked up the NBA jersey deal for $1B, which will go into effect in the 2017 season and it will feature a Nike logo on all the new jerseys. This means that even Steph Curry will be sporting a Nike logo on his jersey, a big win for the company and sure to cause some confusion.

It remains to be seen if Harden is the signature athlete Adidas is looking for; the Rockets have struggled significantly this year and could miss the playoffs. Individually Harden has performed quite well, and is just 8 points behind Curry in overall points scored for this season, very impressive considering Curry has increased his scoring per game by over 6 points this season Y/Y a near unprecedented level for a reigning MVP. For this deal to truly pay off Harden will have to win a championship under this deal. Until the company finds a clear-cut athlete to help unite the brand and lead the push to regain traction in the basketball shoe market, Adidas will struggle to compete against Nike and UA.

NKE data by YCharts

Basketball has played a key role in apparel companies growth with flagship athletes LeBron James and Steph Curry leading the way. A big reason for Adidas’ slump was that the company did not possess an elite NBA star that can compete with the likes of James and Curry. Athlete endorsements have been essential to the success Under Armour and Nike has experienced in 2015. Adidas has been lacking particularly in the basketball, a highly profitable segment where Nike pulled in $3.7 billion in sales in 2015. Basketball is arguably the most key segment for these three companies, and has translated to an increase in sales for both Nike and Under Armour.

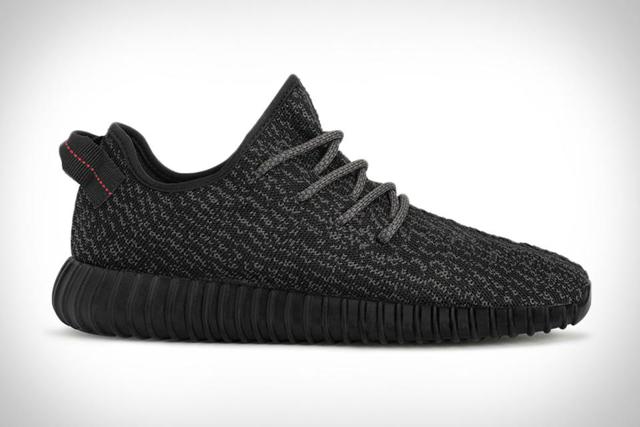

Just recently, Adidas retook the 2nd place spot behind Nike surpassing UA. This is more than likely not because of Harden however (we are yet to see a signature Harden shoe line), but due to Kanye West Adidas signature shoe line, the Yeezy Boosts. Kanye is creating a lot of buzz for Adidas and reinventing the brands image in the process, a company with a long history in rap culture.

(Adidas Yeezy Boost 350)

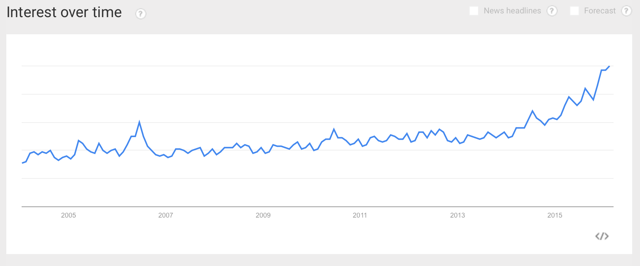

Adidas has been seeing a lot of internet search traffic recently indicating a resurgence of popularity and relevancy in fashion, evidenced by the Google trends chart below.

NBA Endorser Figures

Nike possessed the top selling basketball shoe lines with LeBron James, Kobe Bryant, Kevin Durant, and the Jordan brand in 2014. Much has changed in the NBA since then, and while we wait for the 2015 figures, it is likely to see Steph Curry UA shoe line near the top of the list. Currently 16% of NBA players wear Adidas, compared to 64% that wear Nike. Nike controls over 95.5% of the basketball shoe market as of 2014. Adidas had just a 2.6% market share in 2014 in basketball, down from 5.5% in 2013. With Harden leading the way, these figures should certainly receive a boost over time.

Adidas’ basketball portfolio does offer several other bright spots; the company signed the Rookie of the Year winner Andrew Wiggins in 2014. Adidas also has Damian Lillard who has released his own signature shoe line and John Wall of the Washington Wizards.

While the stock has performing exceptionally well, Adidas is committing to reversing a downward trend the company has been facing with its endorsement contracts. Adidas has made it clear that basketball is a market that Adidas wants to remain competitive in. The company has a strong grassroots presence, but often loses top players to Nike in the long term. So far the James Harden deal looks a bit forced and it until the Harden signature shoe line is released it remains to be seen if this was a good deal for the company.

Still there is much to be bullish about the company as a whole; Adidas has raised its outlook for 2016 twice in the last 4 months. Credit Suisse upgraded the company in January. In August 2015 the company teamed up again with Manchester United with a jersey deal that has seen great demand worldwide. Also in August the company acquired Runtastic, a fitness app with over 70M users that has been incorporated into Adidas product lines. It is widely noted that UA has also made an aggressive push into fitness applications as well. Adidas also replaced its own brand Reebok, with a 7 year NHL jersey deal that begins in 2017. See our article: Adidas NHL Jersey deal is a power play.

While the Harden deal is still a work in progress, there is much to be positive about Adidas moving forward and the company’s yearly report on March 3rd should solidify investor sentiment surrounding the worlds 2nd biggest Athletic Company.

Disclosure: Follow our Blog at: www.LeverageEquityResearch.com.

$ADDYY has definitely scored big with the Harden deal and this closes the gap between them and $NKE