Revised US Q2 GDP Estimate Eases To Match Q1’s Sluggish Pace

The US economy is still on track to expand in the upcoming second-quarter GDP report, but today’s revised estimate marks a slowdown from recent nowcasts, based on the median estimate via several sources compiled by CapitalSpectator.com

Q2 output is now on track to rise 1.3% (seasonally adjusted annual rate for GDP). The projection matches the 1.3% gain reported for Q1. The Bureau of Economic Analysis will publish its initial Q2 estimate for GDP on July 27.

Today’s 1.3% Q2 nowcast marks a downshift from the 2.0% median estimate published on June 6. The question is how will incoming data influence the evolving nowcast in the final weeks ahead of the government’s July 27 GDP release?

Short of a sharp (and at this point unexpected) downturn in economic data that will arrive in the weeks ahead, US economic activity is still on track to avoid a recession in Q2. The second half of the year, by contrast, is still open for debate as various risk factors continue to swirl, including expectations that the Federal Reserve will continue to lift interest rates to combat inflation.

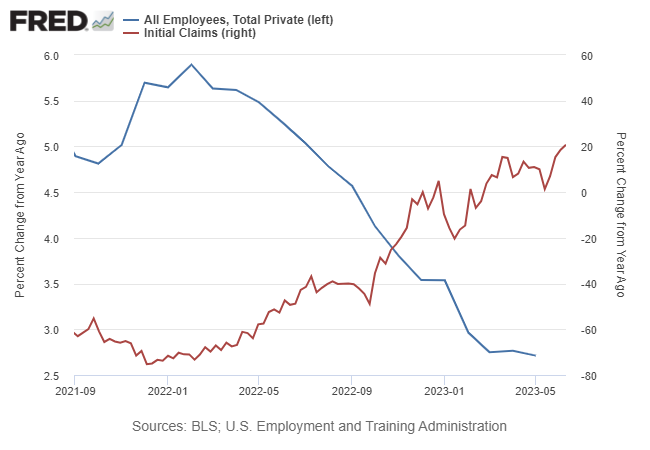

Perhaps the key indicators to watch are those that focus on the labor market. The resiliency of hiring has been a critical factor that’s kept the US economy from slipping into a recession lately. But the headwinds for payrolls appear to be strengthening. Notably, the year-over-year trend for new jobs has been easing while the number of new filings for unemployment benefits has been rising. Although neither has crossed a line that signals a clear recession warning for the immediate future, the recent shift in directional momentum for these data sets may be a warning flag for 2023’s second half if the numbers continue to deteriorate.

If the US economy is slowing, which it appears to be, the key question is: By how much? Does the slowdown accelerate into a recession or stabilize at a sluggish pace for the near term. Unclear at this point. The future’s always cloudy, of course, but mapping the outlook is unusually challenging at this stage given the fluid decisions for Fed policy, the ongoing war in Ukraine, strained US-China relations and elevated inflation that’s eased at a slower pace than recently expected. Mounting evidence that China’s economy is slowing, which has prompted interest rate cuts, isn’t helping either.

A real-time US recession indicator updated weekly in The US Business Cycle Risk Report continues to estimate a low probability that the economy is contracting (12% as of June 16).

If and when the economy rolls over decisively, the Composite Recession Probability Index will reflect the shift relatively quickly. Meantime, a cautious, wary optimism prevails.

More By This Author:

Commodities Rose Sharply Last Week But Remain Range Bound10-Year Treasury Yield Surges Over Stock Market’s Dividend Yield

Will Sticky Core PCE Inflation Ease In Months Ahead?

Disclosure: None.