Review 2011: Not Crisis But Chronic

Ever since the Reserve Primary fund broke the buck on September 17, 2008, policymakers have been quick to demonize money market funds as the weakness in an otherwise sound regulatory regime. MMF’s are a sort of deadzone for regulatory treatment, just beyond the reaches of depository rules but still within reach of some efforts including, it was believed, monetary policy settings. For that reason, money market funds were treated until 2008 as an annoyance when they should have been appreciated for what they were – the private and massive response to banking already existing in the shadows for decades by then.

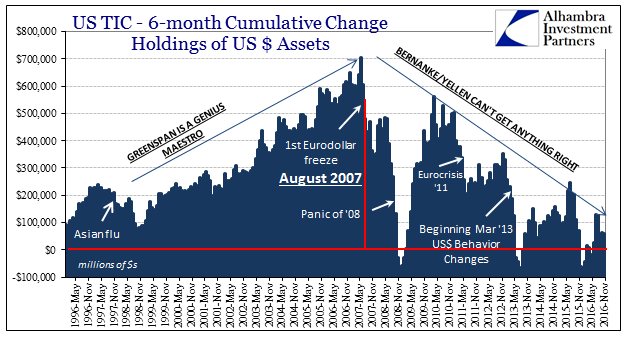

By this mistaken regime, regulators have been trying to “fix” symptoms, as if blaming a sneeze or a cough for the condition of a flu-ridden patient. In 2011, once more took money market funds took center stage (and, obviously, not for the last time). Withdrawing funds from especially European borrowers, “dollars” came to be in short supply all over the world all over again. The S&P downgrade of US sovereign debt combined with “shocking” downgrades to US and global growth were simply more than the fragile interbank system could bear.

There were two policy meetings in August 2011, one scheduled and one unscheduled, where discussions were held over the possible Fed responses should the debt ceiling negotiations and then votes break down. These were some of the most pivotal policy talks in recent economic history, yet so little effort is dedicated to examining the period and the huge mistakes made in them. I wrote earlier about the economic implications and channel for this breakdown, this piece will be dedicated to the monetary end.

It starts with then-Chairman Bernanke declaring in no uncertain terms his disdain:

CHAIRMAN BERNANKE. Finally, just a word about money market mutual funds. They should not exist. Unfortunately, they do.

Again, the problem wasn’t so much money market funds but them as the visible representative for monetary evolution tracing back to at least the 1960’s. Federal Reserve policy never solved their existence nor was it able to reconcile them to orthodox theories about money. Instead, under interest rate targeting (of the federal funds rate) monetary officials simply decided they didn’t need to. The result was more than a trivial incongruity, which was raised in possibility all over again, just as 2008, as the FOMC debated about what it might or should do as funding strains unexpectedly re-emerged.

WILLIAM ENGLISH, SECRETARY AND ECONOMIST. The situation came close to that envisioned for action 6 for a time, with repo rates around zero, but over the past week, as Brian described in his briefing, the second scenario emerged; the repo rate rose to about 20 basis points on Friday and was even higher this morning. With the funds rate up only a few basis points over the same period, a natural question is whether the repo rate has idiosyncratically diverged from the overall constellation of money market rates or whether it is a symptom of broad dislocations in money markets that could interfere with the transmission of the Committee’s intended monetary policy stance. There were signs of those wider dislocations late last week, with rates on Treasury bills and agency discount notes up significantly and contacts reporting that conditions in the commercial paper market had also deteriorated notably. Moreover, the repo market is about $2 trillion in size, vastly larger than the federal funds market, and a significant increase in the rate on such transactions could have a substantial effect on broader financial conditions.

What Mr. English was alluding to was the fact that federal funds were behaving normally, as you would expect given the Fed’s balance sheet size, but nothing else, especially repo, was. As I highlighted this morning on the economic side, Open Market Operations Manager Brian Sack reiterated the disparity again on August 9:

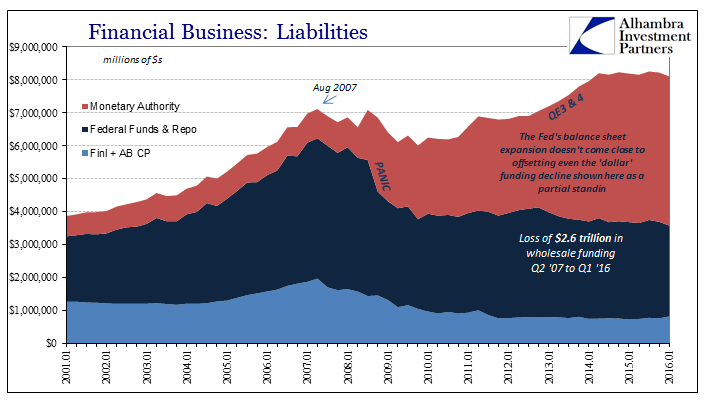

MR. SACK. Can I add a comment? In terms of your question about reserves, as I noted in the briefing, we are seeing funding pressures emerge. We are seeing a lot more discussion about the potential need for liquidity facilities. I mentioned in my briefing that the FX swap lines could be used, but we’ve seen discussions of TAF-type facilities in market write-ups. So the liquidity pressures are pretty substantial. And I think it’s worth pointing out that this is all happening with $1.6 trillion of reserves in the system. [emphasis added]

What the FOMC had come to contemplate, especially on August 1, was several options quite outside their operational mandates (if not their legal ones). Essentially, with regard to repo, they were presented with Option 6 (the first five were more traditional, familiar methods) called “RRPs to Address Negative Treasury Bill and Repo Rates” and Option 7 “RPs to Address Pressures in the Treasury Repo Market.” Reverse repos by their nature are essentially collateral leasing, and therefore combined Options 6 & 7 were different sides of the same coin – RRP’s to open up UST holdings in SOMA for emergency use to alleviate the acute collateral shortage (T-bill rates in March 2011 had fallen in equivalent yield to near zero), while simultaneously using RP’s (cash) to bring down the GC repo rate as a means to ensure federal funds targets were communicating an actual monetary policy stance rather than a theoretical one (this should sound familiar).

In the bigger picture, the FOMC was really contemplating the fact that their monetary regime wasn’t a full description and, as noted in the $2 trillion figure above regarding the relative size of repo versus federal funds, maybe even so small as to be, if only at times, irrelevant. Chairman Bernanke himself acknowledged the limitation:

CHAIRMAN BERNANKE. I think a point that was somewhat underemphasized is that our transmission of monetary policy is an issue here as well. So to take an example, doing repos to keep the RP rate from uncoupling from the federal funds rate, arguably there are issues there relating to transmission. There’s nothing magic about the federal funds rate. It’s our indicator of the stance of monetary policy, but presumably we’re aiming at financial conditions more broadly. If there’s a decoupling of other short rates from the fed funds rate, I think a monetary policy–dual mandate motivation might support some of those actions.

This was in the discussion of the legality and statutory authority for things like Options 6 and 7 (as well as several others beyond #7), but perhaps lost in that focus is what is being recognized at the start of his statement – “transmission of monetary policy is an issue here as well.” This is the entire issue of 2011, 2008, and much more beyond those two crises; it is the whole thing wrapped up neatly and summarized sufficiently. As I wrote in March 2016 in remembrance and appreciation of 2011:

Obviously we are missing “something.” M1 money supply, which includes all of M0 “base money” like bank reserves at the Fed, had grown from $1.767 trillion at the start of QE2 in November 2010 to $2.11 trillion when two undisclosed European banks were suddenly and again near the brink. Which was more monetary: bank reserves that increased as the SFA declined, or the SFA collateral in repo? It is debatable, of course, but the events of that summer come down far more in favor of the latter.

As we now know, even the FOMC agreed with my view. They were at the time debating, essentially, a repo market intervention on both sides (collateral as well as cash) despite the massive swelling of bank reserves through two prior, completed QE’s that in the public were treated as “money printing.” They did not comprehend it in the same way (“dollars”) as I did and do, of course, but in reality that is exactly what they were contemplating even if they didn’t at the time (or at any time afterward) realize it.

So why didn’t they investigate this further? Obviously they hadn’t because just over a year later the Committee opted for QE3 even though questions surrounding what it accomplished had to have been still fresh in their minds. Brian Sack at the August 1, 2011, meeting previewed their rationale:

MR. SACK. You could argue for not pulling the trigger immediately in order to see if markets calm down and the repo rates return back into the range of 0 to 25. I guess I was curious if the Committee has decided that it isn’t concerned about repo rates, if it has decided that it is concerned about elevated repo rates but wants to allow more time to see if they come back down, or if it wants to go ahead and lean toward some kind of an action in that direction.

Repo markets did, in fact, calm down later in August – but the damage was already done. Repo markets were, again, just the visible portion of the “dollar” spectrum then in turmoil, and when repo GC rates came back below 25 bps the Fed simply interpreted it as the whole problem, a temporary disruption solved of its own accord. Had they actually looked closer and outside of their dogmatic doctrines, they might have seen that 2011 was much, much more than just one repo negation to bank “reserves”, for though the repo market appeared calm again it would not stay that way (quoting again from my March 2016 article):

The debt ceiling drama and uncertainty was resolved on July 31, 2011. In the midst of that, asset markets had already been under pressure, with even US stocks enduring what looked like another systemic liquidation into early August. Then in early September, US “dollar” repo markets suddenly braced for perhaps a secondary systemic event, with fails surging to $462 billion, ten times the amount from early July and comparable only to 2008 and 2009 (without factoring the 3% fails penalty). The same exact week, the Swiss National Bank shocked the world by pegging the franc to the euro, which doesn’t seem much to do with dollars. The week after that, however, the ECB, the Bank of Japan, the Bank of England, the Swiss National Bank and the Fed announced a coordinated “auction” of “dollars” in three-month maturities at “full allotment.”

Brian Sack even predicted as much, at least that last part about dollar auctions, at the August 9 scheduled meeting in review of global funding.

MR. SACK. The pullback of investors from providing funding to these institutions is also apparent in the upward pressure observed in dollar funding rates. As shown to the right, the three-month LIBOR has remained low, but the rate obtained by borrowing in euros and swapping to dollars, a funding practice used by many European institutions, has risen markedly. If the cost of dollar funding achieved through the FX swaps market continues to rise, we could see some use of the liquidity swap arrangements with other central banks, which provide dollar funding at a backstop rate of 100 basis points above the OIS rate.

It is not immediately apparent why repo problems would translate to FX problems until you realize money isn’t bank reserves, cash, or even collateral, but rather all of those are specific categories within the whole of bank balance sheet attributes. Thus, a systemic repo market problem, even in isolation, is indicative of balance sheet problems that could, especially over time, crop up somewhere else in some other market. The same holds for FX swaps where nobody seems to want (or be able) to arbitrage negative premiums (in the case of a “dollar” shortage) despite huge “riskless” profit opportunities to do so.

In short, the FOMC looked at repo rates and collateral in early August 2011 as repo rates and collateral relating only to early August 2011. It’s as if monetary officials actually believe in the random walk, where prices today are by this theory completely unrelated to prices yesterday.

A building rarely if ever simply collapses; there are always warning signs. These usually take the form of unusual and observable cracks in support pillars or at structural joints. That was the repo market in 2011 and long before that July and August, as in FX markets for “dollars” as well as “euros.” The Fed, however, treated these as isolated circumstances unrelated to a comprehensive whole. Because of this, they thought by mid-August it was all over, just as in mid-2008 after Bear Stearns they made the same determination.

Part of the reason for this inertia has to be attributed to the bureaucracy of not just the Fed but any central bank. This is not to say I have sympathy for them because of this, but there are times when it is painfully clear that many of those (maybe a supermajority) who are charged with these vital tasks are the last people who should be given such power and authority. I am speaking of the empty suits who in these situations tend to reveal themselves as such:

MR. FISHER. I just want to get oriented here. I’ve been out of the country for a little bit, but when we last met as a Federal Open Market Committee, I think excess reserves were running around $900 billion—am I correct that they’re currently running about $1.24 trillion? Does anybody, Brian or anybody else, have a sense of those numbers?

MR. ENGLISH. Excess reserves are about $1.6 trillion, I believe, and they were at the time of the last meeting as well.

MR. FISHER. So we haven’t seen it all run into excess reserves then. That’s the point. There’s not much of a change.

MR. ENGLISH. Well, as Brian noted earlier, our operations determine the amount of reserves. So once we completed our purchase program at the end of June, reserves were whatever they were, and since then reserves have moved around, but they have not increased.

It isn’t a good sign when a voting member, a prominent anti-inflation one, no less, doesn’t even know how the level of bank reserves is determined, and that it is regulated solely by the programs that he voted for. I wish it was the only instance of monetary ignorance, even in just traditional monetary terms, but it is not.

In philosophical terms I keep coming back to is Plato’s allegory of the cave, where he described Socrates talking about the human struggle over the difference between worldly “knowledge” and true knowledge of the philosophers. In Economics, we have been conditioned to believe that it is especially the central bankers who have attained the true knowledge that laypeople cannot comprehend. This is false and in demonstrated (repeatedly) reality totally backwards, as it is central bankers who are stuck trying to decipher what they see as the shadows on the side of the cave and never being able to do so.

Just as in economic terms, in monetary terms they really don’t know what they are doing. They never have, but since the eurodollar system stopped functioning it actually matters in the more immediate senses and more than occasionally. The events of 2011 were not really a recurrence of crisis at all, but rather the latest in a series of related tremors that killed any notion of recovery or possibility for economic health. It was never strictly a matter of money market funds or repo market function, the problems were (and are) much deeper than all that and as a practical matter have never been solved going all the way back to August 9, 2007.Officials all over the world keep treating these as isolated outbreaks, when they are in fact a single outbreak (“dollar shortage”) of variable intensity and symptoms.

Disclosure:

This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation ...

more