Return Of The Memes

Image Source: Unsplash

I’m sure there is a shopping center somewhere that hosts locations of both GameStop (GME) and Kohl’s (KSS).I’d love to know where that might be, because it seems that some GME shoppers moved across the parking lot to KSS recently.

It’s not every day that we see a stock more than double on scant news, but that was the case with KSS this morning. I received plenty of questions as the stock zoomed in the pre-market, especially because there was no obvious story that might justify a huge rally.Indeed, a major firm upgraded its price target for KSS from $5 to $7, but since the stock closed above $10 yesterday, that would have little, if any impact.Instead, there was a plethora of bullish social media chatter, most of it focused upon KSS’ heavy short interest.

Indeed, KSS showed a short interest of about 53 million shares in the most recent report, as of June 30th.That’s quite substantial to say the least.While it is below the peak 57 million in the May 15th report, it still represents about 7X KSS’ average daily volume and just over 49% of the stock’s float.In other words, about half the available KSS shares have been sold short.Social media chatter seized upon that factor in recent days, and it metastasized into a huge move this morning.

If this sounds at all familiar, a short squeeze was a key factor in igniting the GME frenzy of 2021.That said, the 50% short interest in KSS pales in comparison to the most extreme levels reached in GME – roughly 144%!(We explained in detail how that could occur in January 2021). However, we see that KSS has been steadily rising since bottoming in April.We also saw options volume increasing in recent sessions.There was enough demand to get the stock to close a gap that was created in early March, and then off it went.

KSS 6-Months, Daily Candles

(Click on image to enlarge)

Source: Interactive Brokers

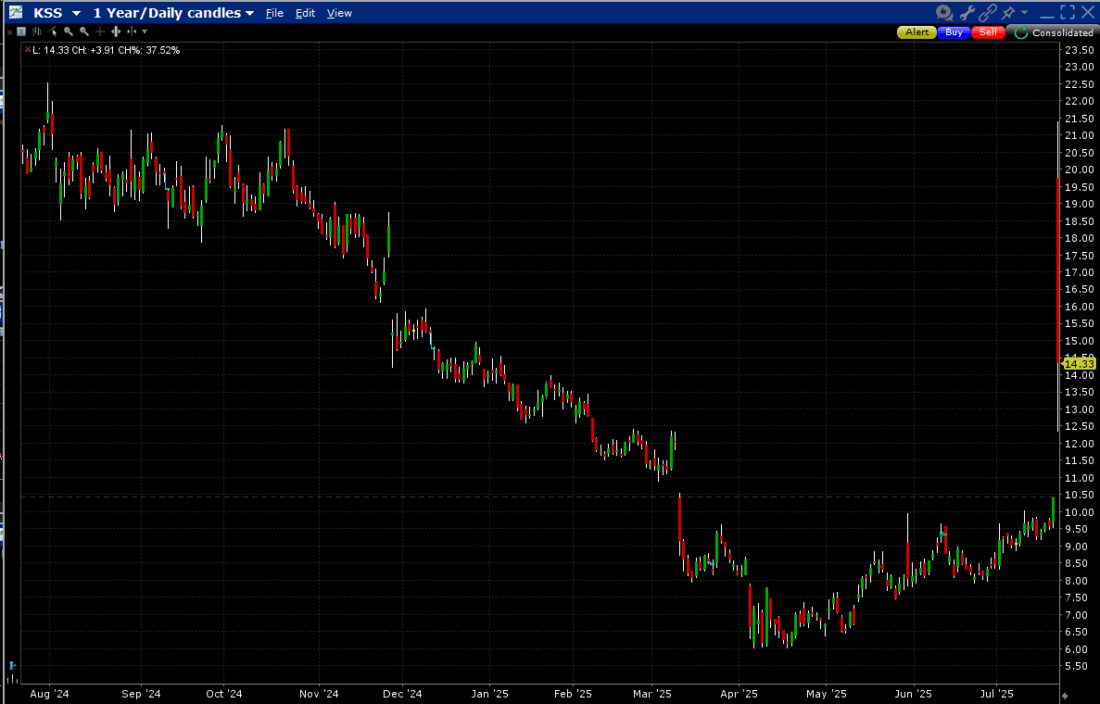

Despite the stock’s recent resurgence, a longer-term chart shows KSS’ relative demise since last autumn. Even this morning’s brief doubling only brought it back to the levels that prevailed in October:

KSS 1-Year, Daily Candles

(Click on image to enlarge)

Source: Interactive Brokers

We’ve certainly seen a resurgence in stocks that have been heavily fueled by social media chatter.Stocks like Opendoor Technologies (OPEN), BitMine Inversion Technologies (BMNR), and Sharplink Gaming (SBET) have seen huge advances on high volume because of their ability to capture the public’s imagination.And a feature of the current market environment is that once the public gets involved in a high volatility, high volume situation, these situations can persist with a life of their own.

That last feature is reminiscent of the meme-stock era.So too were short-squeezes, abetted by heavy call option volume that created somewhat self-fulfilling gamma squeezes. But there are some differences.Much of the original meme craze was focused upon companies that offered nostalgia for traders stuck at home during covid.Maybe some of today’s buyers were nostalgic for KSS, but that doesn’t seem particularly likely.Also, the moves in GME, AMC and others took on a manic life of their own; KSS’ bounce doesn’t seem as exciting.

There is a cautionary element in the KSS situation, however.The shorts, while vulnerable to a painful and expensive squeeze, were there for a reason.Most of KSS’ bonds are trading well below par.Remember, bond traders are only concerned with getting paid back in full, and the prices of KSS bonds tell us that there are serious doubts about that likelihood.And if bondholders don’t get paid in full, there’s nothing left for stockholders.The short sales might have been hedging bonds or credit default swaps based upon KSS.That trade made plenty of sense – until it didn’t!

More By This Author:

August 1st Is The New July 9th; Tesla VigilantesMOMO And FOMO Power A Wild Q2

Was There Really Any Doubt?

Disclosure: Short Selling

Short selling is an advanced trading strategy involving potentially unlimited risks and must be done in a margin account.

Margin Trading

Trading on ...

more