Retail Sales Were Stronger Than Expected In October Despite Weak Motor Vehicles

Nominal retail sales data from the commerce department, chart by Mish

Advance Retail Sales

- Advance estimates of U.S. retail and food services sales for October 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $705.0 billion, down 0.1 percent (±0.5 percent) from the previous month, and up 2.5 percent (±0.7 percent) above October 2022.

- Motor vehicles declined 1.0 percent. Part of this is strike related and part general weakness.

- Excluding motor vehicles and gasoline, sales were a barely positive 0.1 percent.

- Food surged 0.6 percent and nonstore sales (think Amazon) rose 0.2 percent.

- Total sales for the August 2023 through October 2023 period were up 3.1 percent (±0.4 percent) from the same period a year ago.

- The August 2023 to September 2023 percent change was revised from up 0.7 percent (±0.5 percent) to up 0.9 percent (±0.2 percent).

- Retail trade sales were down 0.2 percent (±0.5 percent) from September 2023, and up 1.6 percent (±0.5 percent) above last year.

- Gasoline Stations were down 7.5 percent (±1.1 percent) from last year, while nonstore retailers were up 7.6 percent (±1.6 percent) from October 2022.

Real vs Nominal Advance Retail Sales Percent Change From Month Ago

It’s real spending that drives GDP. Real sales fell 0.1 percent in nominal terms but 0.2 percent in real (inflation-adjusted) terms.

Real vs Nominal Advance Retail Sales Percent Change From Year Ago

Adjusted for inflation, retail spending has not exactly been on a tear.

Real vs Nominal Retail Sales Since 1992

Real vs Nominal Advance Retail Sales Detail

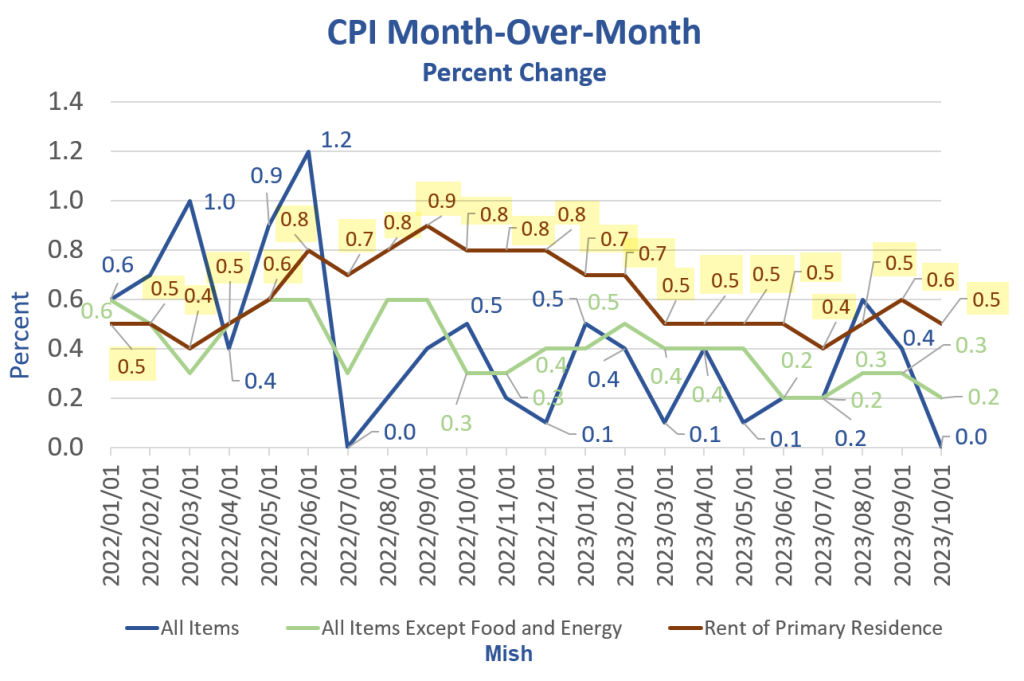

CPI Unchanged Thanks to Decline in Energy, but Rent Jumps 0.5 Percent

A 2.5 percent decline in energy smoothed the CPI. But for the 27th straight month, the cost of rent rose at least 0.4 percent.

CPI month-over-month data from the BLS, chart by Mish

For details, please see CPI Unchanged Thanks to Decline in Energy, but Rent Jumps 0.5 Percent

And what about food? Talk of a tame CPI report this month is entirely an energy mirage and easy year-over-year comparisons. Food is a particular case in point.

The Average Increase in the Price of Food Every Month for 32 Months is 0.6 Percent

CPI data from the BLS, chart by Mish

For details and discussion, please see The Average Increase in the Price of Food Every Month for 32 Months is 0.6 Percent

Weakness in Cars Explained

Weak retail car sales are largely due to falling demand for EVs. For discussion, please see Wake Up Mr. President, Consumers Want Hybrids, Not EVs

A better title would have been, Wake Up Mr. President, Consumers Don’t Want EVs.

Key Idea of the Day

Perceived overall strength in retail sales is nothing more than actual strength in inflation.

More By This Author:

The Average Increase In The Price Of Food Every Month For 32 Months Is 0.6 PercentCPI Unchanged Thanks To Decline In Energy, But Rent Jumps 0.5 Percent

Interesting Tweet Reading to Start the Week: Tesla, Inflation, Delinquent CRE, More

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more