Retail Sales Surge 0.6 Percent, Beating Economist’s Expectations

(Click on image to enlarge)

Retail sales numbers from the commerce department. Real sales adjusted for inflation by the CPI is a Mish calculation.

Advance Retail Sales for December

The Commerce Department reports the Advance Estimates of U.S. Retail and Food Services for December.

- Advance estimates of U.S. retail and food services sales for December 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.9 billion, up 0.6 percent (±0.5 percent) from the previous month, and up 5.6 percent (±0.7 percent) above December 2022.

- Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022. Total sales for the October 2023 through December 2023 period were up 3.9 percent (±0.4 percent) from the same period a year ago.

- The October 2023 to November 2023 percent change was unrevised from up 0.3 percent (±0.3 percent)*. Retail trade sales were up 0.6 percent (±0.5 percent) from November 2023, and up 4.8 percent (±0.5 percent) above last year.

- Nonstore retailers were up 9.7 percent (±1.6 percent) from last year, while food services and drinking places were up 11.1 percent (±2.3 percent) from December 2022.

Real vs Nominal Advance Retail Sales Month-Over-Month

The key phrase in the report is “adjusted for seasonal variation and holiday and trading-day differences, but not for price changes.”

It’s real (inflation-adjusted sales) that matter to GDP. The Commerce Department does not provide that calculation but I do.

Real vs Nominal Advance Retail Sales Since 1992

(Click on image to enlarge)

Real retail sales peaked in April of 2022 (yellow highlight).

Real vs Nominal Advance Retail Sales Detail

(Click on image to enlarge)

Retail vs Nominal Chart Notes (Millions of Dollars)

- Real retail sales peaked in April of 2022 at 234,190. They are now 229,840. That’s a decline of 1.8 percent.

- Nominal retail sales were 675,899 in April of 2022. They are now 709,890. That’s a rise of 5.0 percent.

In the last 20 months, nominal sales are up 5.0 percent but real sales are down 1.8 percent.

Great Consumer Demand?

What appears to be great consumer demand is mostly an inflationary mirage.

The situation looks better on a year-over-year basis.

Real vs Nominal Retail Sales Percent Change From Year Ago

(Click on image to enlarge)

Retail sales are up 5.59 percent from a year ago. Real sales are up a reasonably strong 2,21 percent.

Most of that is a strong December on top of a very easy year-over-year comparison.

Fueled by Debt

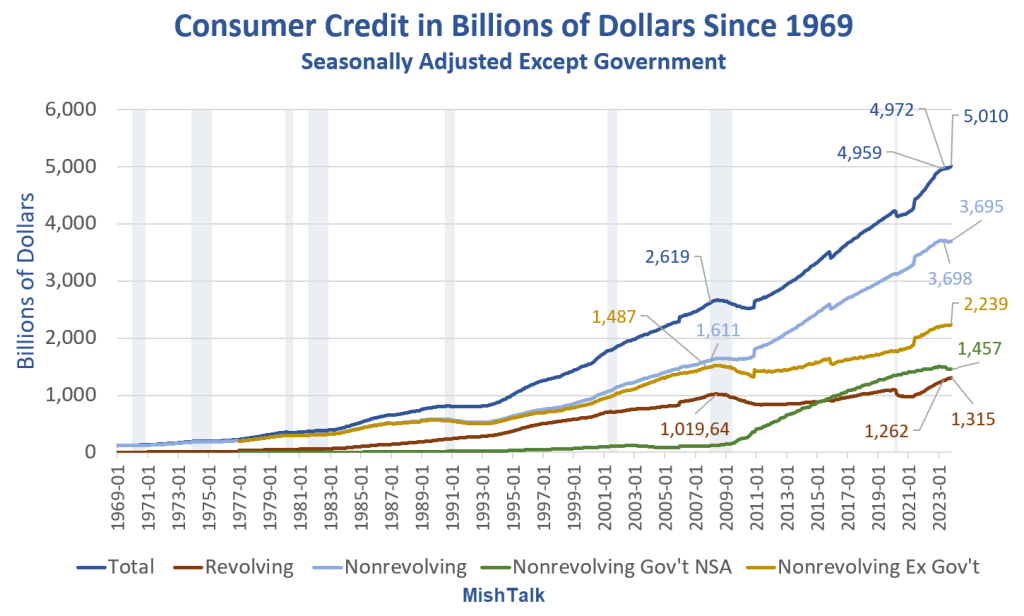

Total consumer credit, revolving credit, and credit card interest rates all hit new record highs in November.

(Click on image to enlarge)

Consumer credit data from the Fed, chart by Mish

Consumer Credit Hits Record $5 Trillion

To explain the apparent strength in retail sales, please note Consumer Credit Hits Record $5 Trillion, Credit Card Rates Also Record High

Revolving (mostly credit card debt) is at a record high. For discussion, including a calculation of real, inflation-adjusted debt, please click on the above link.

More By This Author:

Biden Weighs Banning Natural Gas Exports To Save The ClimateThe GOP Supports A Child Tax Credit Boost And Affordable Housing Expansion

Empire State Manufacturing Index Stunning Drop To -43.7, New Orders -49.4

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more