Retail Money-Market Inflows Continue As Fed Bank Bailout Facility Usage Rises Again

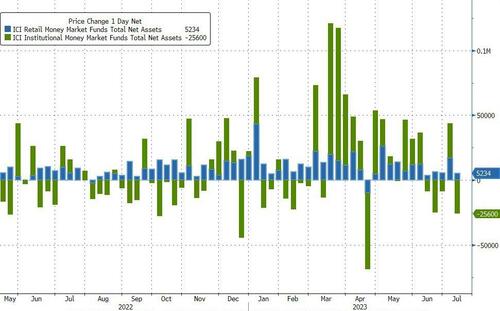

After the prior week's big inflow, money-market funds saw $20.3 billion of OUTFLOWS in the last week, still hovering very close to record highs...

Source: Bloomberg

The outflow was dominated by institutional funds (pulling down $25.6 billion, presumably to buy NVDA calls), while retail funds saw the 12th straight weekly inflow...

Source: Bloomberg

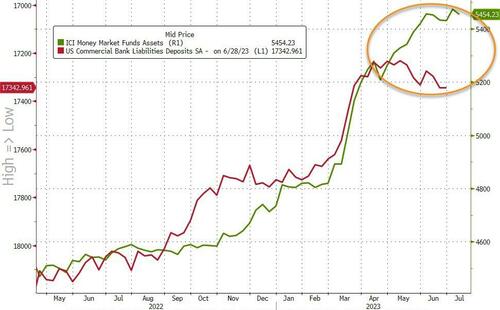

That was the biggest weekly outflow since April 19th (tax-withdrawals), but money-market assets and bank deposits remain decoupled over the last few weeks...

Source: Bloomberg

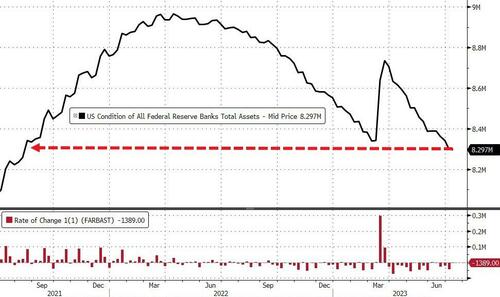

The Fed's balance sheet remains below the pre-SVB spike, shrinking only $1.4 billion last week, but back at the lowest level since Aug 2021

Source: Bloomberg

As far as QT is concerned, it slowed dramatically last week with The Fed selling a mere $2.1 billion...

Source: Bloomberg

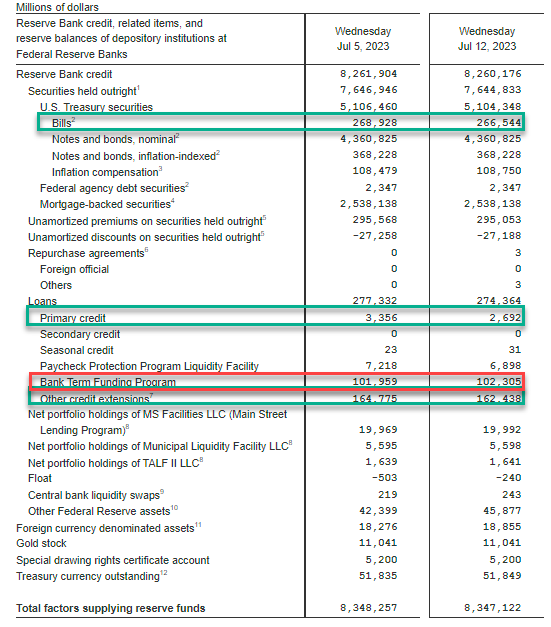

Usage of The Fed's Bank Term Funding Program facility increased on the week...

Source: Bloomberg

The breakdown from The Fed's H.4.1 table...

- QT: Basically unch

- Discount window: down $0.7BN to $2.7BN

- BTFP: up $0.4BN to $102.3BN, new record

- Other credit extensions (FDIC loans): down $2.3BN to $162.4BN

And the US equity market continues to decouple higher from the declining trend in bank reserves at The Fed...

Source: Bloomberg

Finally, after all the big banks passed the stress test with flying colors, we remind readers that banks have 8 months left under the original 12-month BTFP Fed bailout program to find a way to stabilize their balance sheets.

Not only have they failed to do so, usage of the BTFP facility remains near record highs. On the bright side, yields are falling, so MTM losses don't look so bad.

More By This Author:

Solid 30Y Auction Tails As Yield Slide AcceleratesExxon Buys Denbury For $4.9 Billion In "Hard To Replicate" CO2 Pipeline Push

US Producer Price Inflation Tumbles To Slowest In 3 Years

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more