Retail Money Funds At High

“Davidson” submits:

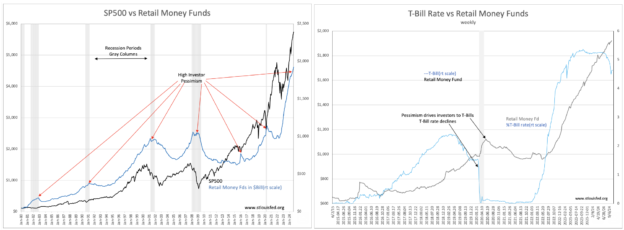

Retail Money Funds are reported at new high. The monthly long-term and weekly near-term history of Retail Money Funds shows they peak near the end of recessions as the headlines improve market psychology. This peak has always coincided with a low in T-Bill rates as the flow of capital into T-Bills(3mos Treasuries) forced rates lower. The last 30mos, from Jun 2022, has shown an opposite impact. While Retail Money Funds soared more than 100%, T-Bill rates have also risen from 1% range to more than 5%. Retail Money Funds are still rising.

Normally, capital shifting into T-Bills drives rates lower, but the opposite effect strongly suggests a countervailing institutional shorting of T-Bills which forced rates higher.. The Fed followed with Fed Funds and did not lead this rate rise. Institutions favored buying longer-dated Treasuries i.e., 5yr and 10yr, which could generate decent capital gains as rates declined in an anticipated recession. This produced a record Yield Curve inversion, 10yr minus 3mos Treasury, near -2.00%. That recession has not occurred, recession forecasts are now giving way to expectations of economic growth. The recent dip in T-Bill rate and rises in longer-dated Treasuries suggest institutions are reversing this recession hedge. Retail investors will lag as usual in shifting back towards equities.

The SP500 continues to price record highs but the earlier push by the Magnificent 7 issues has been tempered. The so-called Mag 7 have gone from outperformers on recession fears to market performers as investors anticipate broad economic growth. The Mag 7 are no longer solely responsible for SP500 performance.

The reversal of institutional recession hedges should force T-Bill rates lower as longer-dated Treasury rates rise.

More By This Author:

Real Personal Income Continues To Rise

Government Hiring Clouds True Jobs Picture

PMI Says Recession, Reality Says Otherwise

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more