Repricing America

Image Source: Unsplash

DEATH CROSSED: WALL STREET’S CALM WEEK ENDS WITH A TECHNICAL WARNING SHOT

Equity markets were a mixed bag this week, riding a relatively quiet stretch on the tariff front — but calm didn’t mean constructive. The S&P 500 shed 1.5%, dragged down by tech and consumer discretionary, both off more than 3% on the week.

Technically speaking, things aren’t looking great either. The infamous death cross just showed up on the charts — with the 50-day moving average dipping below the 200-day. That’s a momentum red flag, even as headline volatility cooled. Stabilization or not, the tape is flashing caution.

PARKING IN THE DOLLAR LOT? BIG TRADING HOUSES ARE EYEING THE EXIT

The trade war is no longer just about supply chains or reshoring—it’s morphing into a full-frontal assault on dollar dominance. With tariffs now carpet-bombing entire sectors and allies getting swept into the blast radius, the greenback isn’t looking quite so bulletproof anymore.

What’s changed? It’s not just the tariffs—it’s the whiplash policymaking, the erosion of U.S. institutional credibility, and the sheer unpredictability of it all. Investors aren’t pricing outcomes anymore—they’re pricing in chaos. And the result? A creeping rotation out of U.S. assets and a subtle, but steady, rethink of the dollar as the default global parking spot.

For years, capital from Europe, Japan, and beyond flooded into U.S. assets like it was a one-way trade. Strong returns, yield differentials, relative political stability—check, check, check. But that game’s breaking down. Now, you’ve got a cocktail of squeezed profit margins, crunched real incomes, and consumers facing higher sticker shock from tariff pass-throughs. That’s not a recipe for exceptionalism—it’s a slow burn toward mediocrity.

And when the U.S. consumer starts taking it on the chin, you better believe the dollar’s next in line. The trade-weighted dollar is starting to roll over, and barring a major surprise, this is likely to continue. A 10% slide over the next year vs. the euro, yen, and pound wouldn’t shock me. The writing’s on the wall.

We’re also seeing the kind of de-dollarization behavior that used to live in fringe blogs now creeping into official playbooks. Fewer FX reserves in dollars, less foreign buying of Treasuries, more bilateral deals in local currencies. It’s not a stampede—but it’s a shift. The official sector is stepping back, and if private investors start sniffing the same trend, the unwind could accelerate fast.

And let’s be honest—these blanket tariffs don’t just hit imports; they hit U.S. purchasing power. When you slap 10% duties on everything that moves, you’re not bullying foreign producers into submission—you’re passing the buck to your own consumers and firms. And if U.S. producers can’t pivot or negotiate, the dollar does the adjusting. That’s just how terms of trade math works.

Put simply: if the rest of the world raises prices and the U.S. economy can’t absorb it without flinching, the buck weakens. It’s not about punishment—it’s about equilibrium. The old assumption was that the U.S. could always strong-arm the supply chain. This time, the globe is pushing back.

We’re not calling for a dollar collapse—but we are saying the era of unchecked dollar strength looks cooked. The more Washington weaponizes tariffs without a Plan B, the more likely FX markets are to call the bluff. This isn’t Trump 1.0 where you could pivot supply chains and skirt China. This time it’s everyone. This time it bites.

WHEN TARIFFS FLY, COMMODITIES CRY: THE REAL-TIME RISK TRADE

With the U.S.–China trade war now fully weaponized and tariff shrapnel flying across sectors, commodities are taking the brunt of the damage. What started as policy brinkmanship has become a full-blown macro disruptor. Executive orders and retaliatory duties have pushed the weighted U.S. tariff rate to nearly 25% — a staggering leap from just 2.4% last year. That’s not just policy tightening — it’s a market shock, blowing past worst-case forecasts and triggering a domino effect across global trade, manufacturing, and price expectations.

Crude Oil: The World’s Most Political Barrel

Crude oil, the world’s most politically sensitive commodity, is feeling it hard. However, we had a counterintuitive bounce this week. New OPEC+ compensation quotas, tighter US sanctions on Iran, hopes for trade deals, and relatively upbeat March macro data have all boosted sentiment in the short term. However, further tariff escalation could upset the proverbial apple cart.

Growth is slowing, the macro pulse is flatlining, and demand forecasts from the IEA (+730 kb/d) and EIA (+900 kb/d) still look comically optimistic. We’re pegging the real number closer to +500 kb/d — and that’s still hanging by a thread thanks to tariff noise and recession risk. But the real curveball came from OPEC+. Instead of a soft unwind, the cartel just torched its script — accelerating the rollback of 2.2 mb/d in voluntary cuts down to 411 kb/d starting in May. The market didn’t see that coming. And let’s not kid ourselves — this has Trump’s fingerprints all over it. With pump prices in play for political optics, the White House is pushing the narrative, and OPEC+ seems to be obliging.

Supply discipline is fading, demand is uncertain, and speculative positioning is fragile. Any bounce without a real macro catalyst looks ripe to fade.

Canadian Lumber: Back in the Woodshed

Lumber’s taking friendly fire too — and Canada is back in the U.S. trade crosshairs. AD/CV duties have been ramped up to 34.5%, and Section 232 could tack on another 25% tariff in the name of national security. That would bring the total tax load to nearly 60% on Canadian softwood. For a sector that sends 60% of its output south of the border — and for a U.S. market that sources 75% of its lumber imports from Canada — that’s not just inflationary, it’s destabilizing. Supply chains can’t retool that quickly, and the result will be price volatility, policy tension, and more friction ahead of the fall construction season.

U.S. Ag: Political Football in the Corn Belt

Meanwhile, U.S. agriculture has become a political football. With 30% of crop sales heading overseas — and 8% of that going to China — America’s farmers are obvious soft targets in this tariff war. And they’re feeling it. Benchmark prices for wheat and soybeans are stuck under pressure ($5.80/bushel and $10.60, respectively), despite decent growing conditions. Why? Because even a bumper harvest means little if your largest customers are slamming the door shut. The ag tape has been whipsawing — up on relief chatter, down on retaliation rumors — but the trend is soft. Farmers know they’re being used as leverage, and so do the markets.

Base Metals: Tariff Whipsaws and Supply Squeezes

Base metals haven’t escaped the carnage either. Prices across the LME complex were crushed post–Liberation Day, and while copper has clawed back to near flat on the year (+4.5% YTD), it’s still trading at a premium on COMEX thanks to tariff fears. Section 232 threats remain active, and if copper gets slapped with a 25% import tax, U.S. buyers will be paying a premium no matter where the LME settles. And remember, the U.S. imports about half its annual copper needs — mostly from Chile, Canada, and Peru. Treatment charges are dropping in China, inventories are thinning globally, and yet copper still can’t break out. The macro drag is just too heavy. We’re holding to our $4.20/lb forecast for now, but risks are leaning south.

Gold: The Undisputed Alpha Hedge

The one asset that’s basking in this chaos? Gold. It’s not just winning — it’s dominating. Up 24% YTD, breaking above $3,300/oz, and obliterating inflation-adjusted highs. With the dollar wobbling, real yields easing, and risk appetite evaporating, gold has reclaimed its title as king of the hedges. Central bank buying, dedollarization flows, geopolitical anxiety, and looming rate cuts have all lit a fire under the metal.

Silver’s been lagging, but don’t sleep on it. The gold/silver ratio is flirting with 100 — an outlier that screams potential mean reversion. If the reflation trade finds footing or if risk rotates into industrial hedges, silver’s got room to move.

The bottom line? This isn’t just a tariff cycle — it’s a commodities reckoning. Crude’s political, lumber’s weaponized, crops are exposed, metals are choppy, and gold is surging. Tariffs aren’t just taxes — they’re turning the global supply chain inside out. And for traders? This is where the real game begins. Stay sharp, stay flexible — the macro’s in motion, and the next headline could hit like a freight train.

VIETNAM’S DIPLOMATIC FLEX: RED CARPET FOR XI, TRADE CARDS FOR TRUMP

While it might read like a curveball to Beltway pundits or headline writers in Midtown, there’s nothing surprising here for anyone who's spent serious time in Southeast Asia or paid attention to how power really flows on the ground. Vietnam’s latest diplomatic pivot isn’t some anomaly — it’s textbook ASEAN statecraft: hedge your bets, keep your options open, and extract maximum leverage from both sides.

Just days after Xi Jinping’s heavily choreographed visit, Vietnam’s Prime Minister Pham Minh Chinh turned around and called the U.S.–Vietnam relationship a “unique bond” during talks with Warburg Pincus CEO Jeffrey Perlman and U.S. Ambassador Marc Knapper. And let’s not ignore the optics — this wasn’t some low-level trade attaché handshake. It was a high-visibility statement, clearly timed to send a message.

The subtext? Vietnam knows how to play the game. Xi got the red carpet. Trump got trade talks, narrative control, and a symbolic boost ahead of potential tariff de-escalation. That’s not fence-sitting — that’s surgical diplomacy.

And you could almost hear the editorial gears grinding in the Bloomberg newsroom. The tone of their coverage carried a hint of buried shock — the kind that bubbles up when a long-held narrative starts to crack. Let’s be honest: they’ve spent the last year churning out soft-focus, rah-rah takes on China’s “Asia Family” charm push while treating any positive traction Trump gets in the region as either improbable or unworthy of analysis.

But the reality on the ground is messier — and far more interesting. Trump, for all the baggage, commands real leverage and genuine alignment across parts of Asia. That’s something Western press often underestimates. You don’t have to like the man — but ignoring the geopolitical gravity he’s pulling in this region is a mistake.

Vietnam, for its part, isn’t cheerleading anyone. It’s executing. The message to Washington was clear: we’ve heard your concerns, we’re dialing up U.S. imports, and we’re ready to talk. All while keeping Beijing close enough to maintain strategic ambiguity.

And this didn’t happen in a vacuum. After Trump granted a 90-day tariff reprieve — dialing a punitive 46% duty down to 10% — Hanoi moved quickly. That’s not just engagement. That’s choreography. It was a play to lock in trade concessions without getting dragged into ideological trench warfare.

The kicker? Chinh framed the trade relationship as “sustainable and balanced” — a carefully chosen phrase just ahead of Vietnam’s Liberation Day on April 30, the 50-year anniversary of the war’s end with the U.S. That’s a statement with long memory and short patience for idealistic takes from the sidelines.

So what’s the market read?

Vietnam isn’t picking sides — it’s picking timing. And right now, it’s staying close to the U.S. economic engine without burning bridges to China. That means Vietnam remains solidly in the friend-shoring column. It also means a tariff reset with Washington is no longer a long shot — it’s increasingly probable.

For anyone reading tea leaves in trade flows and FX trends, this isn’t about optics — it’s about alignment, leverage, and market access. And Vietnam just made it clear: it’s here to play the game, not be played.

CHARTS OF THE WEEK

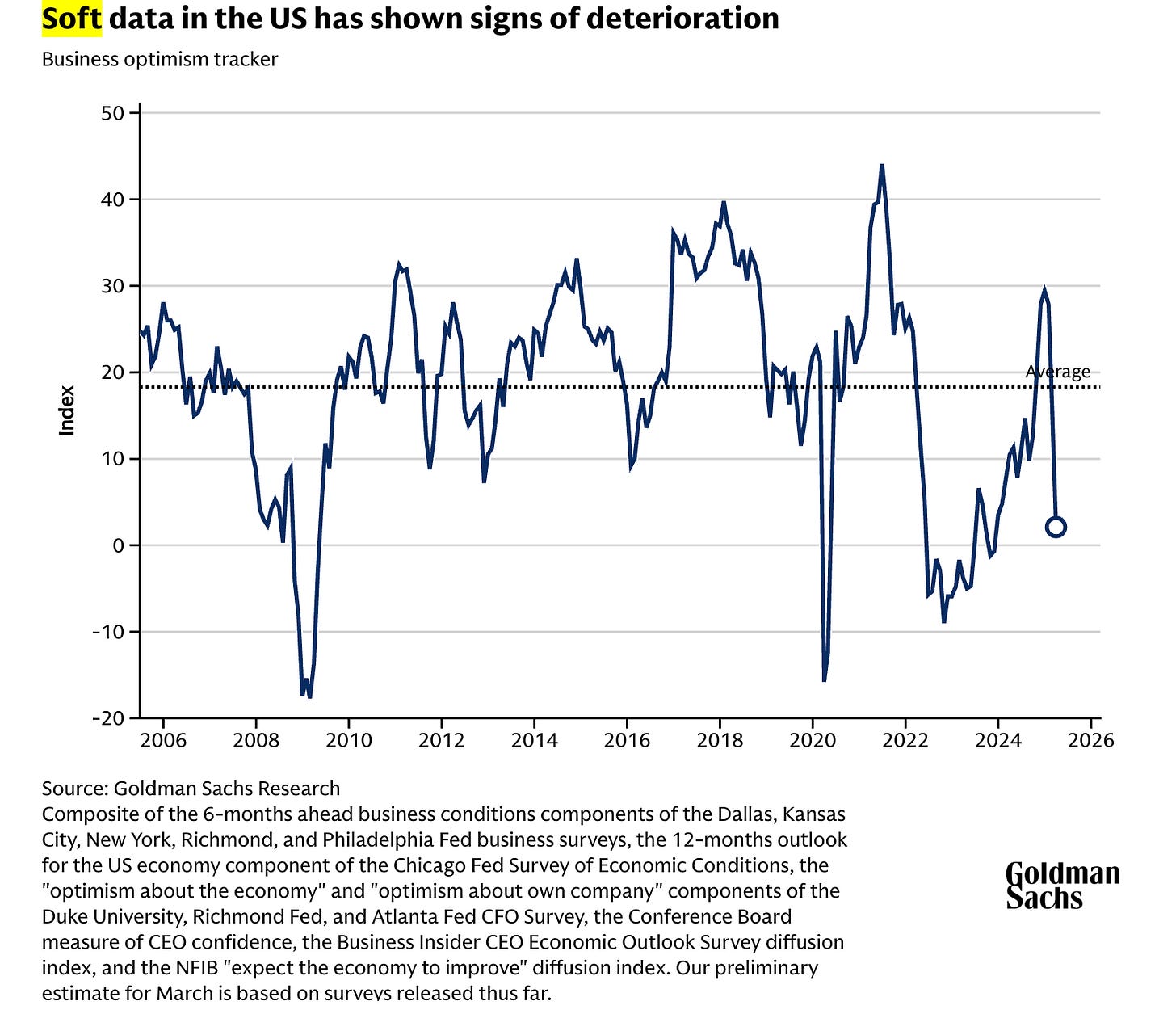

Soft Data Cracking

Previously, the market consensus leaned heavily on the idea that trade-related uncertainty would hit foreign economies harder than the U.S. The assumption was simple: the U.S. could absorb the shock, while others flinched.

But that narrative’s cracking.

Soft U.S. data is starting to pile up — and not in a good way. Consumer sentiment’s wobbling, labor market signals are flashing early-stage fatigue, and the fiscal drag from spending cuts is starting to bite. Meanwhile, Europe, surprisingly, is holding up better than expected — especially considering how exposed it is to global trade flows.

Tariff policy is the wildcard in the mix. It’s not just another headline risk — it’s now an embedded structural headwind. Layer it on top of domestic uncertainty, and suddenly the U.S. outlook isn’t so invincible. What was once a story of American resilience versus foreign vulnerability is fast becoming a tale of mutual fragility — and that changes how the market prices everything from the dollar to duration.

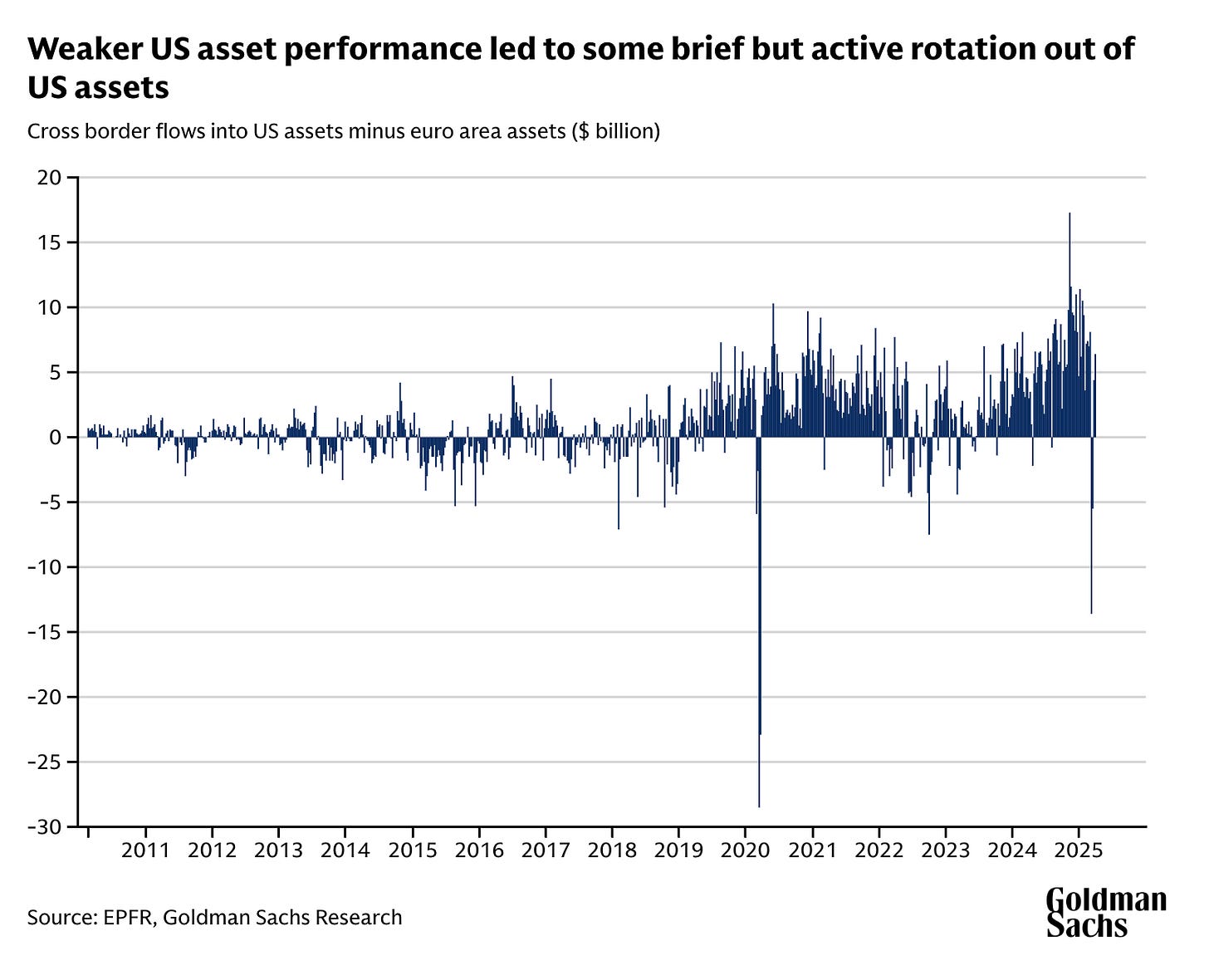

Active Rotation Out of US Assets

The U.S. has entered a notable phase of active rotation out of its own assets — and the momentum has picked up ever since soft data started to show real cracks in the armor. What began as a trickle is becoming a more coordinated rethink of U.S. exposure, and last week marked a key inflection point: U.S. Treasuries lost their reflexivity.

For years, Treasuries acted as the ultimate safety valve — when risk sold off, bonds bid; when growth slowed, yields fell. That reflexive relationship between macro stress and Treasury demand was gospel. But last week, we saw something shift. Soft U.S. data came in, but bonds didn’t rally. Instead, yields held firm or even pushed higher. That’s not just a technical divergence — it’s a signal that confidence in the U.S. duration story is eroding.

Why? Because it’s no longer just about growth — it’s about credibility. With inflation sticky, fiscal policy directionless, and political volatility on full display, investors are starting to question whether Treasuries still offer true protection. Add in foreign selling — particularly from Asian reserve managers adjusting to shifting trade dynamics — and you’ve got the makings of a broader rotation.

The flow is increasingly toward neutral havens and less U.S.-centric exposures. That includes gold, select EM FX with strong terms of trade, and even EU assets where growth has surprised to the upside. It’s not a fire sale — yet — but it’s clear the old knee-jerk reaction to pile into U.S. paper at the first sign of weakness is no longer automatic.

And when U.S. bonds stop acting like bonds — it forces every other allocation decision to adjust.

More By This Author:

These Aren’t Normal Times — It’s Macro Theater, And Everyone Forgot The Script

Welcome To The Stagflation Vortex — Powell Whiffs As Trade War Goes Full Metal Jacket

Calm Before The Counteroffer: Markets Brace As Trade Talks Move From Fire To Fog