Replacing Stocks With Volatility?

Stock replacement strategies attempt to replicate equity performance without directly investing in the stocks they seek to replace. A popular example of this is buying deep-in-the-money call options (or 1.00 delta options) such that the price of the options will increase by $1 for every $1 increase in the underlying stock price. In-the-money options can in this way deliver the same type of exposure to a stock for a lower upfront cost than actually buying the underlying stocks, and can simultaneously reduce the risk exposure of a portfolio. Imagine a $20 strike call option on a $50 stock; if the stock were to fall to zero, the $20 strike option in the stock replacement strategy would only stand to lose its premium (say $35), while a traditional long stock position would lose its entire $50 value.

But option buying is not the only way to gain equity type exposure while managing risk. Another less known strategy is to replace equity exposure in a portfolio with a smaller, Beta-adjusted exposure to a high Beta stock. For example, trading in the VelocityShares Daily Inverse VIX ST ETN (XIV) has grown in popularity as it has considerably outperformed major US equity indexes in the present bull market. Presently XIV’s 5-year monthly Beta to the S&P 500 is 4.78, which given its significant outperformance, seems to make sense.[1]

But let us look a little closer at the XIV vs. equity performance. In making a comparison I’ll use the S&P 500 Total Return Index (SPTR) rather than the S&P 500 Index (SPX) because over a 5-year period the value of the dividends from the SPX do make a meaningful difference to the investment’s performance. Over the last five years, the SPTR has gained 93%, while over the same period the XIV has gained around 456% - a return very close to what the Beta to the SPX would suggest.[2] So could an investor with $100 invested in the SPTR have done better with $21 (beta adjustment of 100/4.78) invested in XIV? Well, possibly.

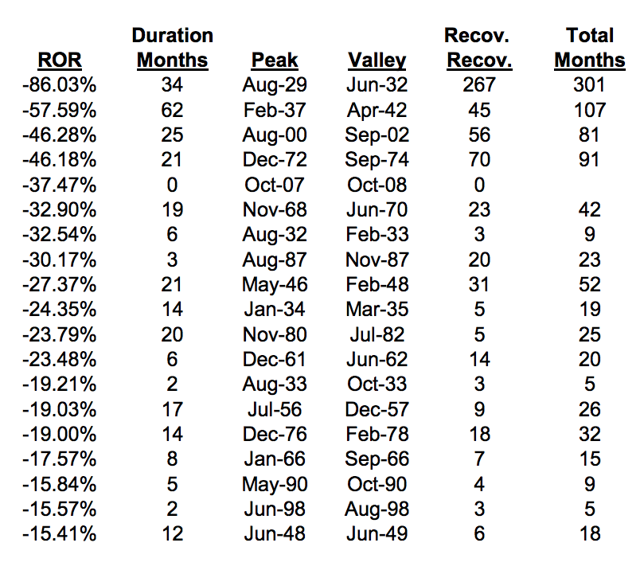

One advantage of the XIV stock replacement strategy would have been that only $21 rather than $100 would have been put at risk, and the investor’s maximum downside would, therefore, have been limited to $21 in the most extreme case. This is an important observation, because while it is easy in an extended bull market to forget, 21% drawdowns in the equity market are not that uncommon, and have actually happened 12 times since 1929.[3] Limiting maximum drawdown could, therefore, be seen as a key advantage of this kind of strategy by some risk-averse investors.

S&P 500 Drawdown and return statistics[4]

But XIV’s headline return over the last five years only tells us part of the story. While XIV may have outperformed the SPTR by more than 5x, XIV’s daily volatility may have proved difficult for some investors to stomach. Over the same period that the SPTR rose 93%, it suffered a maximum drawdown measured daily of just 13%, while over the same period, XIV suffered a more nerve-racking 67.8% drawdown.[5]

But what if this drawdown could have been reduced? What if the advantages of limiting maximum drawdown to just 21% could have been enhanced by employing some sort of dynamic XIV strategy rather than simply buying and holding the ETN?

Numerous XIV strategies exist, and many can be found for sale online – providers like VIX Strategies and Volatility Trading Strategies being among the leaders. Many of these strategies are based on one or another interpretation of Tony Cooper’s seminal 2013 paper ‘Easy Volatility Investing’, and while I won't go into the details of Cooper's strategies, I do encourage everyone to read his paper and have included a link to it here.[6] In that paper, Cooper points out four competing approaches that he argues might outperform a buy and hold XIV strategy - approaches he categorizes as 'Momentum,' 'Roll Yield,' 'Volatility Risk Premium,' and 'Hedged.' Indeed, many of these strategies would have outperformed XIV considerably, and some could even have been considered less risky than buying and holding XIV.

So what if a conservative version of Cooper’s strategies could be used as a stock replacement strategy instead of XIV? Well, if that were the case, and a small allocation to a conservative Volatility Risk Premium (VRP) strategy could be used to replace some or all of a stock portfolio, an investor might be able to maintain stock-like exposure in a bull market, but at the same time benefit from a reduced – as well as predefined - exposure to a sharp downturn.

While the VRP market is still only a tiny fraction of the total stock market, the concept is worth thinking about, and as interest in volatility investing grows it is likely volatility stock replacement strategy will grow to form a significant part of that market.

[1] Reported by Google Finance as Beta = 4.78 on October 6

th 2017.

[2] Data from Yahoo Finance. Performance of S&P500TR and XIV 10/5/12 – 10/4/17.

[3] Trend Following, S&P 500 Drawdown and return statistics, available here.

[4] Trend Following, S&P 500 Drawdown and return statistics, available here.

[5] Importantly, given a beta-adjusted portfolio, this drawdown would only have had a -14% impact on the portfolio it replaced. Beta adjusted 67%/4.78 = 14%.

[6] Cooper Tony (2013) Easy Volatility Investing. Available here: Invest in Vol - The Volatility RIA

[7] Cooper Tony (2013) Easy Volatility Investing, pg. 4.

[8] May 31, 2017 to October 4, 2017. Invest in Vol and Yahoo Finance.

[9] May 31, 2017 to October 4, 2017. Invest in Vol and Yahoo Finance.

Disclosure: This is not, and should not be considered investment advice. Investing involves risk, including the possible loss of principal. Carefully consider the Strategy's investment ...

more