Regional Fed Surveys Show Prices Jumping As Business Outlooks Slump

Image Source: Pexels

This morning's headline October flash PMI data surprised everyone (to the upside) with both Manufacturing and Services jumping back above 50 (into expansion) despite hard data having been hammered during the month and numerous regional Fed surveys signaling quite the opposite.

A few recent examples include:

-

Philly Fed Future Expectations For Shipments/CapEx Near 'Worst Since Lehman' Levels

-

NY Fed Survey Finds Surge In Household Delinquency Expectations, Worst Since April 2020 Covid Crash

-

"The Outlook Is Dismal" - Dallas Fed Surveys Signal Stagflation Threat In September

And now we have two more - signaling the exact opposite to S&P Global's PMI from the Philadelphia and Richmond Feds.

In the Richmond District, service sector firms grew more pessimistic about local business conditions as that index fell from −5 in September to −15 in October.

The index for expected local business conditions also declined, from 4 in September to −22 in October.

Additionally, the average growth in prices paid increased and respondents firms expect to increase spending in the next six months.

Expectations indexes for future revenue and demand also decreased notably.

So slower growth and higher prices - the exact opposite of S&P Global's PMI data.

The Philadelphia Fed Services survey was even uglier

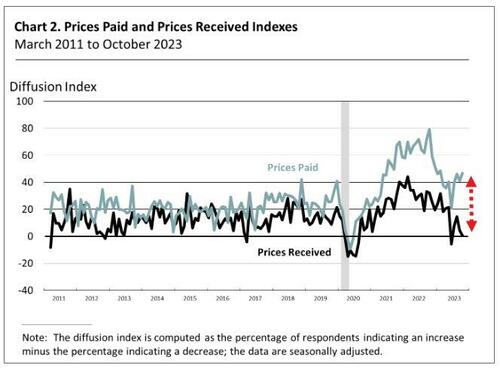

The prices paid index increased 5 points to 46.6 in October as almost 47% of the firms reported increases in prices paid (and worse still for margins, prices received fell 4 points to 0.5)...

New orders index declined 7 points this month to -16.1, undoing its increase from last month and registering its fifth consecutive negative reading as the sales/revenues index recorded its third consecutive decline.

Finally, on balance, a larger share of firms expects a decrease in capital expenditures in 2024 than an increase.

Let's see what that all looks like...

We've seen this kind of decoupling before... and it didn't end well then.

More By This Author:

China Kicks Fiscal Stimulus Into Overdrive With Deficit-Busting 1 Trillion Yuan In New Debt

Alphabet Plunges 6% After Google Cloud Results Disappoint

Microsoft Soars As 'Everything Beats', Azure Growth Re-Accelerates

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more