Recession Watch: How Is This Economy Still Growing?

The stock market is a pretty good barometer of economic health…except when it’s contradicted by employment. Currently, even profitable companies aren’t hiring:

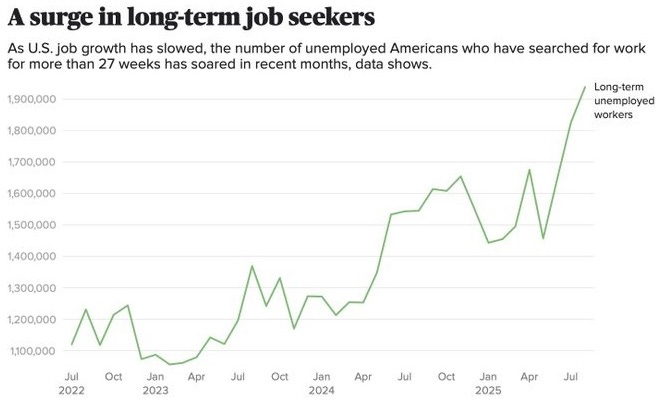

When job openings dry up, the unemployed stay that way for longer:

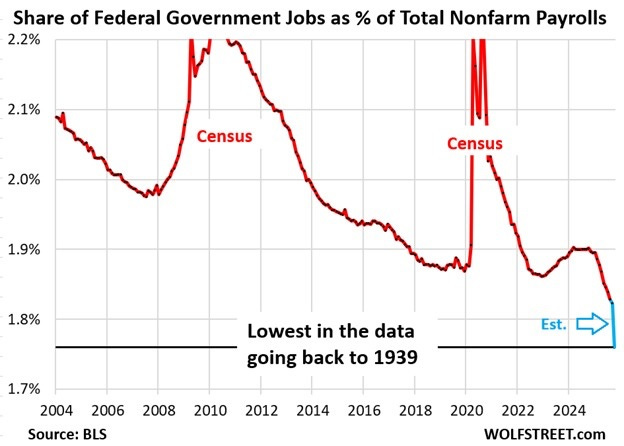

Government hiring usually counteracts weakness in the private sector. But not this time:

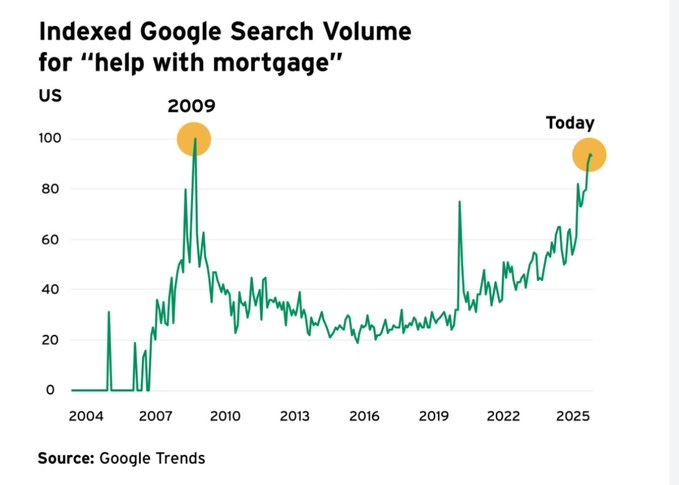

The longer someone is unemployed, the harder it is to manage their debts:

Including their mortgages:

The further down one is on the economic ladder, the harder the hit:

McDonald’s CEO says lower-income customers are skipping breakfast

(MSN) - In an interview with CNBC on September 3, Kempczinski highlighted that traffic for lower-income customers is “down double digits.”

“And it’s because people are either choosing to skip a meal — so we’re seeing breakfast, people are actually skipping breakfast — or they’re choosing to just eat at home.”

Delaying the Inevitable

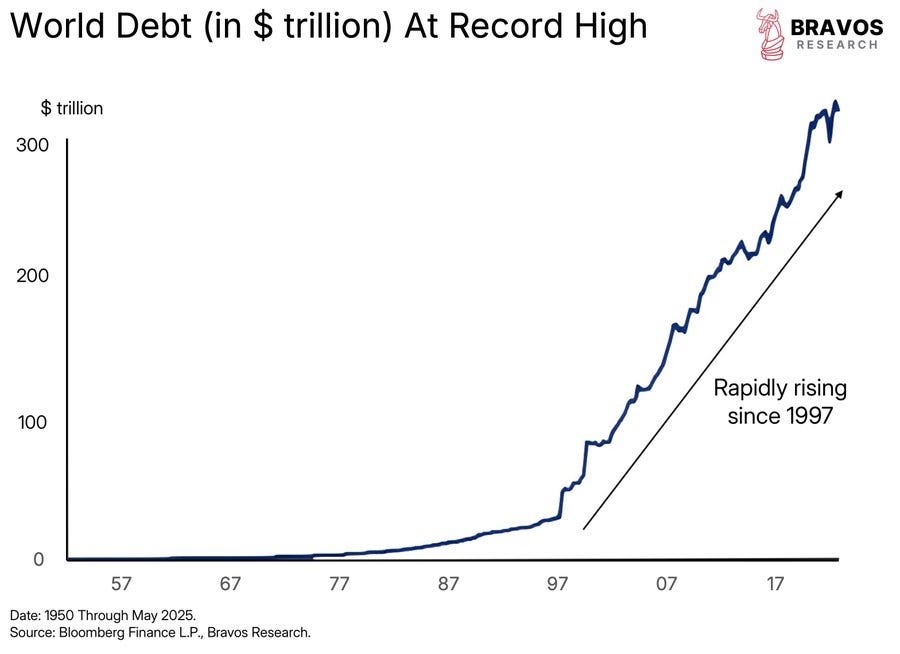

So why isn’t the US already in a deep recession? Because governments are borrowing record amounts of money and spending it on social programs, weapons procurement, and infrastructure. This keeps people spending, but at the cost of soaring debt:

Why can’t governments just keep doing this? Because the bond markets won’t let them. Below are the 10-year government bond yields for Japan and France. Note that while their debt is soaring, their interest costs are rising even faster as bond investors demand higher yields.

(Click on image to enlarge)

This, in short, is a classic setup for a financial death spiral.

More By This Author:

The Fed Cuts Interest Rates... And Money Gets TighterDon't Forget Uranium

Will Demographics Fix Inequality?