Reasons For Summer Rally

Image Source: Pexels

As the misery that was the stock market in April came to a close, investors couldn't be blamed if they were ready to throw up their hands and embrace the old Wall Street adage, "Sell in May and go away!" (More specifically, move to cash on April 30 and return on November 1.) After all, the market had just given back a healthy chunk the year's gains, with the S&P 500 falling -4.2% during the month. Ouch.

Granted, stocks had been on quite a tear up to that point, sporting a five-month winning streak and a cumulative gain of +26.1% for the S&P over the period. But still, in April, the market felt weak and even our beloved NVDA pulled back nearly -20% from its March highs. Definitely not fun.

So, it wasn't surprising to hear the bears embrace the "Sell in May" mantra. But while there is certainly some historical favor for the strategy, how has heading to cash at the end of April turned out so far? Short answer: Not well.

In fact, the S&P 500 has advanced +7.8% since its March low. And after that scary 20% pullback in NVDA (which growth investors should know is pretty normal for really growthy companies), the world's most important semiconductor maker has gained an eye popping +60.6% through Wednesday. Yowza.

In addition, it is worth noting that the "Sell in May" approach works better in some environments than others. For example, the good folks at Ned Davis Research inform us that using the Presidential Cycle can be a useful guide here. Checking history since 1950, it turns out that in Midterm and Pre-Election years, the S&P 500 does indeed underperform during the April 30th through October 31st period. NDR data shows that stocks lose ground nearly 50% of the time in the May through October periods in Midterm Election years and about 40% of the time in Pre-Election years.

However, during Presidential Election years, the S&P has been higher from May through October nearly 78% of the time. And the median gain for these years has been some 43% higher than average. Oh and for those of you thinking about next year, the median gain for the S&P is best in Post-Election years - sporting a return that is more than double the average for all May through October periods from 1950.

Armed with this data, it is fairly easy to argue that not all "Sell in May" periods should be treated equally. And with the S&P rallying to a fresh all-time high this week and this, of course, being an election year - the historical tendencies would seem to favor the bulls here.

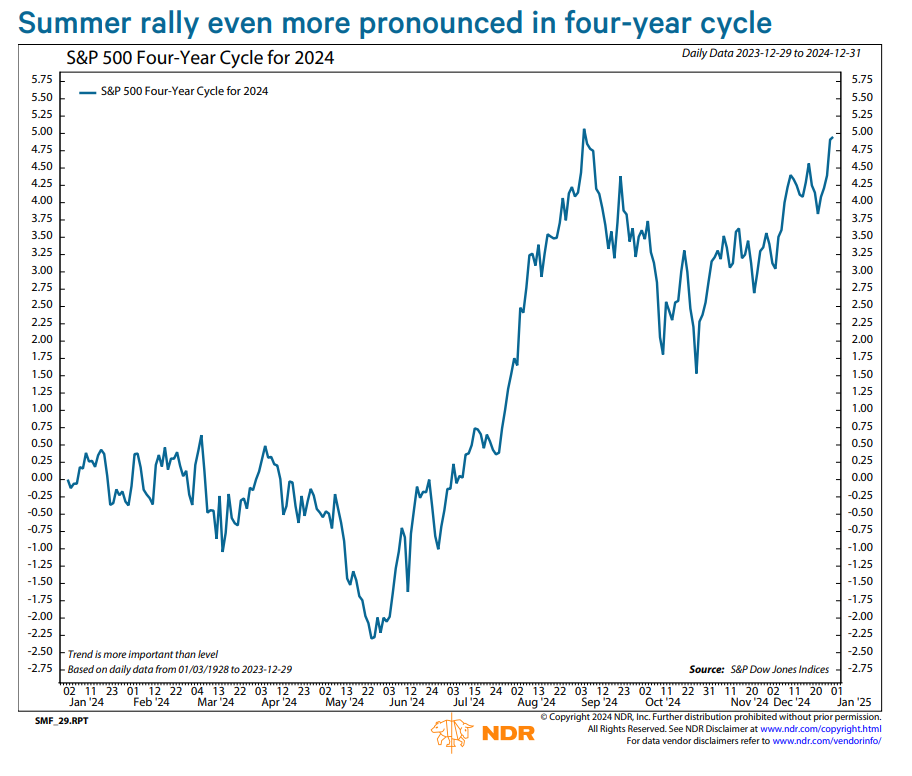

In addition, NDR notes that since 1929, "summer rallies" tend to be significantly more pronounced during Presidential Election years such as 2024. Note the chart below depicting this trend.

(Click on image to enlarge)

* Source: Ned Davis Research

So, with the market moving to new highs, the economy doing "just fine, thank you", earnings expected to print record levels, and inflation moving in the right direction (albeit slowly) it might be a good idea to simply ignore the naysayers this summer.

But wait, there's more. This just in from Goldman's research team: The firm sees a "Wall of Money Fueling Stock Market's Summer Party"

According to GS, a flood of cash from passive equity allocations tends to flow into the stock market in the first half of July. Apparently, the combination of a new quarter and a new half-year causes a lot of money to move into stocks. So much so that according to the firm's research, since 1928, the first 15 days of July have been the best two-week trading period of the year for equities. And this year isn't likely to be different with something along the lines of $26 billion of new money expected, the report says.

Goldman goes on to note that the S&P 500 has been positive for nine straight Julys, "posting an average return of 3.7%. The Nasdaq 100 Index has an even better record, posting gains in 16 straight Julys, with an average return of 4.6%." Not too shabby, eh?

Sure, something can always crop up to spoil the party. At some point, the earnings expectations for firms with AI-induced exponential growth such as NVDA will get fully priced in. We also know that the road in the stock market tends to be more than a little bumpy at times. And it is important to remember that trees don't grow to the sky. But at least in the near term, history suggests we should keep our seats on the Bull train.

More By This Author:

They Were Completely Wrong, But...

Stronger For (How Much) Longer?

Screaming For Attention

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES