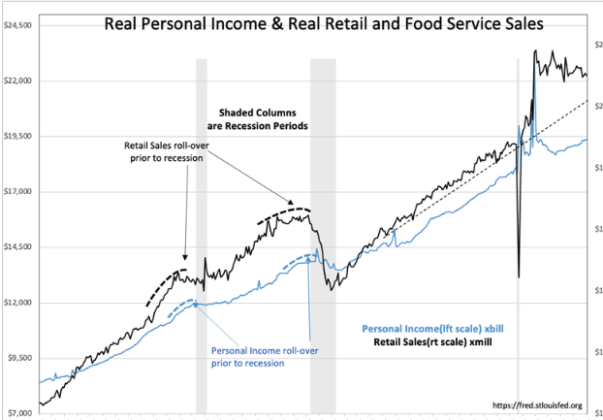

Real Personal Income Rising, But Being Spent Less

The issue seems to be, according to Bank of America is that we are spending less.

“U.S. consumers and businesses alike have turned cautious about spending this year because of elevated inflation and interest rates, according to Bank of America CEO Brian Moynihan.

Whether it’s households or small- to medium-sized businesses, Bank of America clients are slowing down the rate of purchases made for everything from hard goods to software, Moynihan said Thursday at a financial conference held in New York.”

“Davidson” submits:

Real Personal Income continues in an uptrend. Even with revisions that can confuse month-to-month commentary, the net of the current report is Real Personal Income is not displaying weakness typical of pending economic corrections. Other hard measures of economic activity agree with the many quarterly reports of continued growth in the US economy.

Consumer spending via card payments, checks and ATM withdrawals has grown about 3.5% this year to roughly $4 trillion, Moynihan said. That’s a sharp slowdown from the nearly 10% growth rate seen in May 2023, he said.”

More By This Author:

Durable Goods Orders Holding - Wednesday, May 29“Sentiment” Indicators... Ignore Them

Consumer Delinquencies Rising

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more