Real Personal Income Revised Higher

“Davidson” submits:

Most smaller cos remain deeply undervalued in my view.

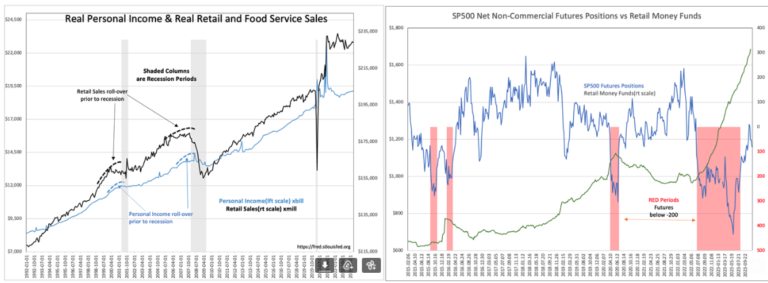

The bullish case for equities remains intact as Real Personal Income-revised (1st chart), continues to outpace inflation. Economic data is plodding and captures little focus with most headlines on whether or not the current release is better or not than expectations or the prior release. No headlines highlight the revisions!. It is the headlines which drive the algorithms short-term and individual investing longer-term. In response, pessimistic retail investors have created an accelerated uptrend in Retail Money Funds (2nd chart) in recent weeks. This series soared to a new record of $1.686Bill($1.686Trillion).

(Click on image to enlarge)

High retail pessimism with rising trends in basic economic indicators has always been positive for economically sensitive equites despite few analysts expressing positive guidance. The positive reports and guidance stand out in stark contrast to market opinion.

Buy equities of the best-managed companies which remain discounted to historical Pr/Sales valuations.

More By This Author:

Pessimism Continues To Fall

Construction Spending Rises

Self-Employment Falls

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more