Real Income Jumps 0.3 Percent Thanks To No Reported Inflation

(Click on image to enlarge)

Personal income and outlays from the BEA, annotations by Mish.

Chart Notes

- PCE stands for Personal Consumption Expenditures (consumer spending)

- The PCE price index is the BEA’s estimate of price inflation

- Chained dollars means inflation adjusted by the PCE price index withe the base year set at 2017 but it does not matter what the base year is.

With those explanations out of the way, let’s discuss the Personal Income and Outlays report for October.

Personal Consumption Expenditures

- PCE rose $41.2 billion.

- PCE services increased $53.1 billion partly offset by a $11.9 billion decrease in spending for goods.

- Within services, the largest contributors to the increase were health care (led by hospital and nursing home services), housing and utilities (led by housing), and other services (led by international travel).

- Within goods, the largest contributors to the decrease were motor vehicles and parts (led by new motor vehicles) and gasoline and other energy goods.

Personal Outlays

- Personal outlays, the sum of PCE, personal interest payments, and personal current transfer payments, increased $43.8 billion in October.

- Personal saving was $768.6 billion in October and the personal saving rate—personal saving as a percentage of disposable personal income—was 3.8 percent.

- Transfer payments are income items for which no work was performed. Examples include Medicare, Medicaid, Food Stamps, and Social Security.

Month-Over-Month Prices

- From the preceding month, the PCE price index for October increased less than 0.1 percent.

- Prices for goods decreased 0.3 percent and prices for services increased 0.2 percent.

- Food prices increased 0.2 percent and energy prices decreased 2.6 percent.

- Excluding food and energy, the PCE price index increased 0.2 percent.

Year-Over-Year Prices

- From the same month one year ago, the PCE price index for October increased 3.0 percent.

- Prices for goods increased 0.2 percent and prices for services increased 4.4 percent.

- Food prices increased 2.4 percent and energy prices decreased 4.8 percent.

- Excluding food and energy, the PCE price index increased 3.5 percent from one year ago.

Key Points

- The price of services is what’s driving reported inflation.

- A huge decline in the price of energy kept reported PCE price inflation to zero percent. The same thing happened with the CPI.

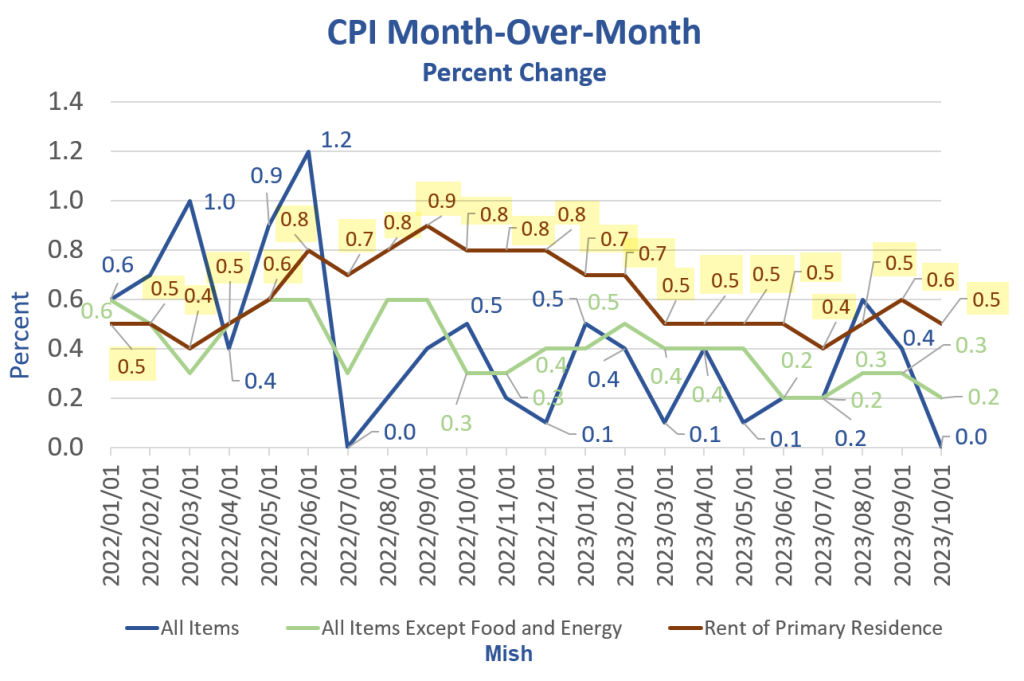

CPI Unchanged Thanks to Decline in Energy, but Rent Jumps 0.5 Percent

A 2.5 percent decline in energy smoothed the CPI. But for the 27th straight month, the cost of rent rose at least 0.4 percent.

(Click on image to enlarge)

CPI month-over-month data from the BLS, chart by Mish

On November 14, I reported CPI Unchanged Thanks to Decline in Energy, but Rent Jumps 0.5 Percent

Groundhog Day for Rent

I repeat my core key theme for two years now. People keep telling me rents are falling, I keep saying they aren’t.

Rent of primary residence, the cost that best equates to the rent people pay, jumped 0.5 percent. Rent of primary residence has gone up at least 0.4 percent for 27 consecutive months!

All these “rents are falling” projections have been based on the price of new leases, but existing leases, vastly more important, keep rising.

Why Are Americans in Such a Rotten Mood? Biden Blames the Media

For discussion, please see Why Are Americans in Such a Rotten Mood? Biden Blames the Media

For discussion of the latest polls, please see Five Alarm Bell – Biden Trails Trump in Five of Six Battleground States

On November 8, I reported Credit Card Delinquencies Surge as Consumer Debt Tops $17 Trillion

Perhaps you do not believe there was no inflation in October. If so, you may be in a sour mood too.

More By This Author:

Hoot Of The Day: Biden Creates A New Economic Council On Supply ChainsLet’s Discuss The Claim Home Prices Fell 17.6 Percent In the Last Year

Huge Discrepancy Between GDP +5.2 Percent And GDI +1.5 Percent Accelerates

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more