Real Consumer Spending Slumps In May With Significant Negative Revisions

(Click on image to enlarge)

Image from BEA’s Personal Income and Outlays report, annotations by Mish.

Chart Notes

- Real (chained dollars) means inflation-adjusted. The base year is 2012.

- PCE stands for Personal Consumption Expenditures.

- The Fed is watching core PCE which excludes food and energy. PCE was only up 0.1 percent but much of that was a decline in the price of gasoline. The price of rent continues to rise. Rent increases are sticky, gasoline prices aren’t.

Negative Revisions

Last month I commented Real Disposable Income is Flat, But Real Spending Jumps 0.5 Percent

Strike that.

The BEA revised real spending for April from 0.5 percent down to 0.2 percent, and real Disposable Personal Income (DPI) from 0.0 percent to -0.1 percent.

Real Disposable Personal Income and Real PCE

(Click on image to enlarge)

Real Disposable Income and real PCE data from the BEA, chart by Mish.

Real DPI Chart Notes

- The red highlights show the three rounds of fiscal stimulus, the last by President Biden was totally unwarranted and fueled a spike in inflation.

- Transfer payments include Social Security, Medicare, Medicaid, and the three rounds of fiscal stimulus.

- The National Bureau of Economic Research (NBER) is the official arbiter of recessions. Real Personal Income Excluding Transfers (RPIET) is a component of the NBER’s recession decision process.

RPIET is weak. It was $14.415 trillion in February of 2020, pre-pandemic, and is $14.703 trillion now. That’s a total rise 2.0 percent in over three years. Since January, RPIET is up a mere 0.5 percent, a very weak rise in income. And most of that increase is due to a drop in PCE rather than core PCE.

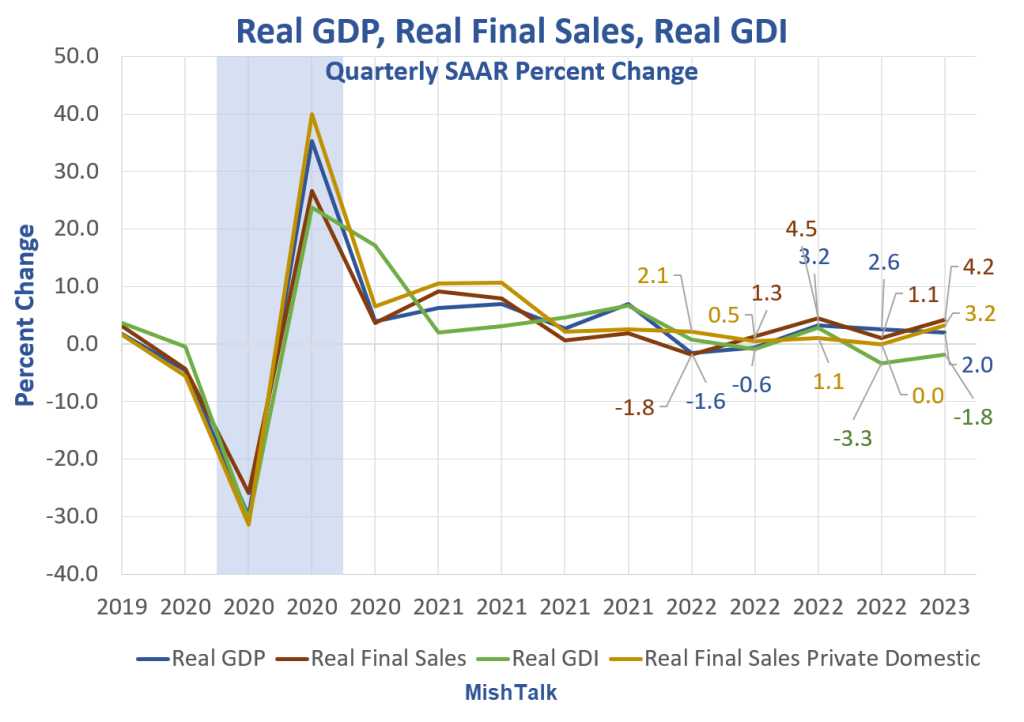

GDP vs GDI

(Click on image to enlarge)

Real GDP, Real Final Sales, and Real GDI data from BEA, chart by Mish

Gross Domestic Product (GDP) and Gross Domestic Income (GDI) are two measures of the same thing. They are supposed to match, and will over time, with revisions in at least one of the measures.

Real Final Sales is the bottom line estimate of Real GDP. Yesterday, the BEA released its Third Estimate of First Quarter 2023 GDP and an update on GDI as well.

BEA Highlights

- Real GDP increased at an annual rate of 2.0 percent in the first quarter of 2023 according to the “third” estimate released by the Bureau of Economic Analysis.

- Real gross domestic income (GDI) decreased 1.8 percent in the first quarter, an upward revision of 0.5 percentage point from the previous estimate.

- The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 0.1 percent in the first quarter, an upward revision of 0.6 percentage point from the previous estimate.

The BEA averages GDP and GDI on the basis that it does not know which measure is more accurate. The NBER, the official arbiter of US recessions does the same thing.

However, the NBER is so late in issuing its recession calls, it will be clear which one of the current estimates is more accurate.

Largest Discrepancy in at Least 20 Years

Over the last two quarters GDP has grown at a 2.3% annual rate while GDI has fallen at a 2.6% annual rate.

The weak growth in Real Personal Income Excluding Transfers is supportive of the GDI view of things. A major discrepancy between jobs and employment also supports the GDI view. So does a a significant decline in the average work week.

For discussion of these discrepancies and why the GDI view seems more reasonable, please see Largest Discrepancy Between GDP and GDI in 20 Years

Major evidence, including this report, supports the GDI view, not the robust GDP view.

More By This Author:

Largest Discrepancy Between GDP And GDI In 20 YearsFed Chair Jerome Powell Hints At No Interest Rate Cuts Until 2025

Ford To Layoff At Least 1,000 Workers, EV Startup Lordstown Motors Dies

Disclaimer: Click here to read the full disclaimer.