Rates Spark: The Weaker USD, The Fed And Cross Currency

We doubt the Fed will provide enough specifics for USTs to hang onto last week's gains. An ESM request would add a tailwind for Italy, and to the wall of supranational supply about to hit the market. Meanwhile, the weakening USD has impacts on cross-currency overlays that are worthy of note. As always it depends on the color of the exposure.

The weaker USD and XCCY implications

The weakening in USD (UDN) has important implications for cross currency swaps. For investors swapping EUR bonds into synthetic USD bonds, there is a yield pickup that comes from that play. However, that yield pickup is not as generous as it was. Pre-COVID-19, a typical yield pickup in the area of 200bp was the norm. Now that pickup is in the area of 100bp, or often lower. In fact, this is one of the drivers of the weaker USD in the first place.

On top of that, the lower interest rate differential means that the break-even in the FX rate is lower too. In other words, there is less tolerance to big moves in the EUR/USD FX rate. When a player synthetically creates a USD bond, there is an FX settlement at the maturity of the bond that is set equal to the FX rate at instigation of the XCCY swap.

Here, the overall position underperforms when the USD gets weaker. Moreover the advantage in the yield pickup is wiped out if the FX rate moves beyond the breakeven.

This works in the other direction for plays that synthetically create local currency from USD bonds. This is more in play in high beta emerging markets e.g. in TRY or COP. The advantage here is that a weakening USD works in favor of this trade.

Some XCCY players tend to ignore the FX play, especially if the converted funds are fully invested in the synthetic currency. But this is not always the case. And if not, this USD weakening trend can be a significant enhancer or detractor, depending on which side of the trade the player is on.

Fed to be light on specifics

With the Fed’s July meeting fast approaching, USTs are putting in a lackluster performance so far this week, at least compared with European government bonds. We have warned in earlier publications that expectations of a more dovish Fed, and of hints of further easing, might be disappointed. As our economics team has highlighted, this meeting should be light on specifics, leaving all the big decisions to September at the earliest. It thus stands to reason that the bull-flattening witnessed on the US Treasury curve last week is at risk of reversing.

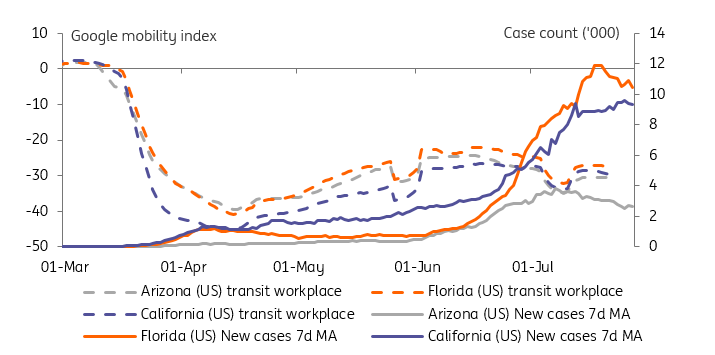

It is also possible that encouraging signs of a plateauing of COVID-19 cases in some states resonates with investors. Today's consumer confidence release is a key contemporaneous indicator of how the COVID-19 second wave is affecting the economy, but a rosier outlook on the epidemic would allow the market to swallow a decline in confidence more easily. So would a US deal stimulus deal. Admittedly, the proposal put forward yesterday was by no mean generous by recent standards, but it would at least amount to a tail risk being removed.

ESM: back to the fore

Italian bonds have failed to benefit from Gentiloni hinting that an ESM emergency credit line request would be beneficial to Italy. Arguably its potential market impact has lessened since the ECB ruled out OMT purchases for recipient countries. Nevertheless, the €36bn or so of European money would take some funding pressure off the national BTP market this year, and add to the wall of supranational debt issuance.

It is still too early to say if Italy, let alone other countries that would benefit from the ESM’s low interest rates, is going to make that request. We would simply stress that with the full benefit of the EU recovery fund likely to accrue over several years, the ESM’s ease to deploy is attractive. It could also be that if one countries decides to use the fund, the perceived stigma will be all the smaller, and will thus boost the likelihood that other countries follow suit.

Today's events: Italian and German supply, US consumer confidence

The main economic releases today is US July consumer confidence. Consensus is for a drop on last month's print, as distancing measures have been reinstated in some parts of the country.

In supply, Italy (2Y zero coupon, 10Y Linker) and Germany (7Y) are due to sell bonds.