Rates Spark: Tame Inflation Still Not Enough To Trigger A March Rate Cut

US 5yr auction was rough, but Thursday's core PCE should be tame – what then? Likely yields lower, but only temporarily. The ECB takes centre stage with Lagarde anticipated to push back against early rate cut pricing. That may just mean staying away from speculating on timing entirely. What could be a bear flattening impetus if Lagarde disappoints markets.

Image Source: Unsplash

US 5yr auction was rough, but Thursday's core PCE should be tame – what then?

The US 5yr auction tailed, badly. By 2bp (so, it was done at 2bp above subsequent market levels, with a slight lag). The indirect bid (includes central banks) was decent, if not spectacular. The 5yr area is rich to the curve, by some 20bp to an interpolated line between the 2yr and 10yr yields, mostly reflecting a notable inversion along the 2/5yr segment. Still, this is a bit of a disappointment following yesterday's decent 2yr auction.

It's also a bit of a reminder of the refunding announcement due on Monday, which is likely to be heavy, with only some morphing of issuance away from longer dates there to take some of the heat away. And we have 7's tomorrow. Should really do better than 5's did, as at least it's higher yielding. Market reaction to the 5yr has been to nudge yields higher. They have been on the turn anyway, post the brief break back below 4% for the 10yr Wednesday morning, and some reasonable ISM data.

The 10yr yield moved back up above 4.15%. We still think it gets to the 4.25% area as the March rate cut expectation continues to unwind itself. But Thursday is a day that brings the biggest excuse for yields to test the downside. Our view is if core PCE comes in as expected, it deserves to be met with some downside to yields, as it validates a good reading (2% inflation). But it needs to be better than expected to negate our underlying tactically bearish view. If not, we re-drift higher subsequently, even if that has to wait till next week.

ECB pushback against front-end pricing anticipated

The European Central Bank is the key event for European rates markets this week. No one sees a change of policies this time around, so the focus will be entirely on the communication surrounding the eventual turn of the interest rate cycle.

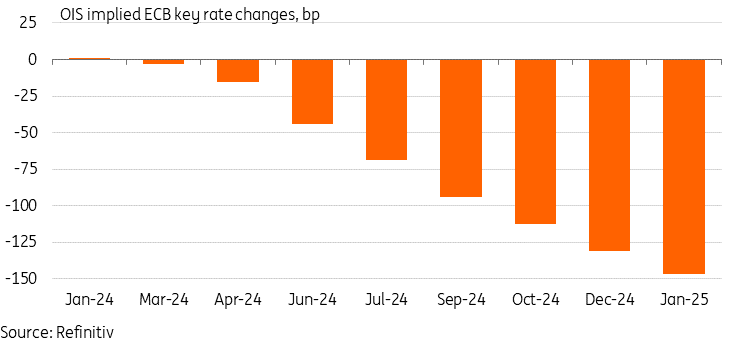

With regards to the expectations of first rate cuts, pricing has moderated a little from the end of last week with the implied probability of a first cut by April now around 70% compared to around 80%. In our view that still looks elevated and is something that most analysts also expect that the ECB will push back against in the press conference. At the same time market pricing for total easing this year hasn't changed that much with still slightly more than 130bp being discounted.

Last week the ECB had diminished the impact of its pushback against early pricing by starting to bring up the topic of potential rate cuts in summer. Of course, all these comments came with the large caveats attached pointing to the general data dependency, which the markets seem to conveniently overlook. The outcome of wage negotiations especially still ranks high on things to monitor for ECB officials to make sure inflation will return to target. Just yesterday the eurozone PMIs also showed that price pressures in the services sector were firm and on the rise again.

President Lagarde could reiterate that aggressive pricing of early cuts can have the counter-effect of making them less likely as financial conditions are effectively eased. Keep in mind, the ECB’s December forecasts were based on market rates with a cut-off of 23 November. At that point the December 2024 ECB OIS forward was trading with an implied rate of 3.2% versus 2.6% currently.

One effective way to push back against early market pricing would be for the ECB to not even delve into any speculation on when first rate cuts will happen. Markets would not get the confirmation they are looking for and probably pare some of their early pricing further, posing the risk of a bear flattening impact on the curve as a whole. However, we cannot guarantee that in the wake of the ECB meeting officials will stick to this script once they are allowed to talk freely again.

Markets are still seeing good chances for earlier ECB cuts

Thursday’s events and market view

There will be data to watch such as the German Ifo, but it is clearly the ECB meeting that takes centre stage for EUR rates on Thursday, posing upside risks especially to front-end rates.

But shortly before President Lagarde starts the press conference, the US will also release the first reading of its fourth quarter GDP data, including a quarterly core PCE rate likely at the Fed’s 2% again. That may confirm the markets' benign inflation outlook, but at the same time the macro back drop is looking more upbeat as indicated also by the US PMIs yesterday. Other data coming out at the same time are the durable goods orders as well as the initial jobless claims. The latter had surprised by dipping below 200k last week.

Thursday’s primary markets will have Italy selling shorter dated bonds as well as inflation linked bonds. The US Treasury will sell new 7Y notes.

More By This Author:

Canada Edges Towards A Rate Cut In The Second QuarterUK PMIs Point To Brighter Growth Outlook But Stubborn Inflation

The Commodities Feed: EU Sanction Plans On Russian Aluminium

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more