Rates Spark: Science Fiction?

The 10Y UST yield is closing in on the 4% mark as if a weak jobs report tomorrow was a given. But underlying is also a further slide of inflation expectations. The front end is lagging, however, and being already priced aggressively for cuts, it will probably need these to become more imminent to rally further.

Rates continue to decline but the front end is lagging

Market yields continued to drop with the 10y UST sinking to 4.11% and 10Y Bund to 2.2% yesterday. The driver was a weaker ADP private payrolls report, though some will point out that the correlation with the official payrolls data that is due tomorrow is actually negative. Possibly more relevant for the broader picture was the 5.2% figure for third-quarter productivity growth. It facilitated a 1.2% fall in unit labour costs, which is a positive impulse for a Fed still showing concern on inflation. Another supporting factor was a further decline in oil prices, which saw WTI fall below US$70/bbl.

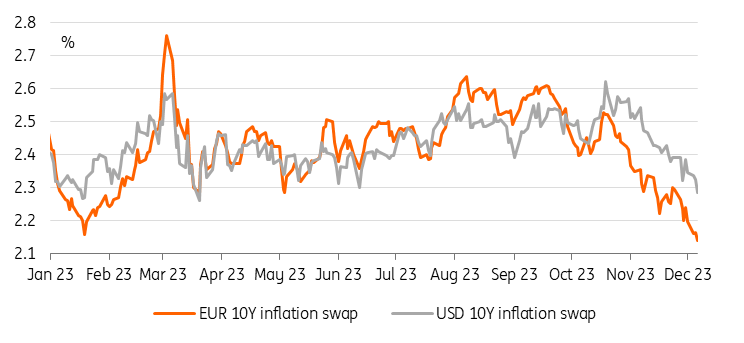

This picture of a reassessment of inflation as a driver does gel with a further slide in inflation swaps, in the US by more than 7bp in 2Y and close to 5bp in 10Y. In EUR the drop today was less pronounced, but the overall drop of the 2y for instance from a range around 2.65% over the summer months to now 1.8% speaks volumes.

It is notable in yesterday's session that the already aggressive rate cut discount is struggling to deepen further meaning that curves are inverting more as rates decline. The US saw 2Y UST yields even rising somewhat to 4.6%. Front end EUR rates also moved marginally higher.

There was some pushback from the European Central Bank’s Kazimir who called expectations of a March rate cut “science fiction”. And a little earlier, the ECB’s Kazaks, who doesn’t see the need for cuts in the first half of next year, did acknowledge that if the situation changes, so might decisions. This is what Executive Board member Schnabel had hinted at as well earlier this week. At the moment the ECB is probably just as smart as the market as it will have to rely on the data. The ECB is right to signal caution and highlight lingering risks, but trying to micro manage now may only add to market volatility.

Inflation expectations have been sliding over recent weeks

Refinitiv, ING

Today’s events and market view

The 10yr UST yield came close to 4.10% and knocking on the door of the big figure 4% yesterday, before being nudged higher overnight by a weaker 10Y Japanes government bond auction. Still, the market continues to be expecting Friday's payrolls report to be weak – the softer ADP pointed in the right direction, but markets appear to be overlooking its poor forecasting track record this time around.

There are more US job market indicators to digest today with initial and continuing jobless claims as well as the Challenger job cut numbers. The former may be subject to seasonal volatility around the Thanksgiving holiday season.

In Europe we will be looking at final third-quarter GDP data as well as scheduled appearances by the ECB’s Holzmann and Elderson.

In government bond primary markets the focus is on the final French and Spanish bond auction for the year. Note that in the US we are still looking at upcoming 3Y, 10Y and 30Y bond sales next week.

More By This Author:

Eurozone Retail Trade Ticks Up Slightly In OctoberBank Of Canada Retains Its Hawkish Bias

The Commodities Feed: Oil Under Pressure, Again

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more