Rates Spark: Bear Steepening Momentum Is Unbroken

The bear steepening of curves resumed after a US government shutdown was averted and accelerated after better data. Cut discounts are pared as central banks play it safe on inflation. In Europe, Italian spreads recover amid a strong showing on the first day of its retail bond sale.

No excuses to end bear steepening of curves

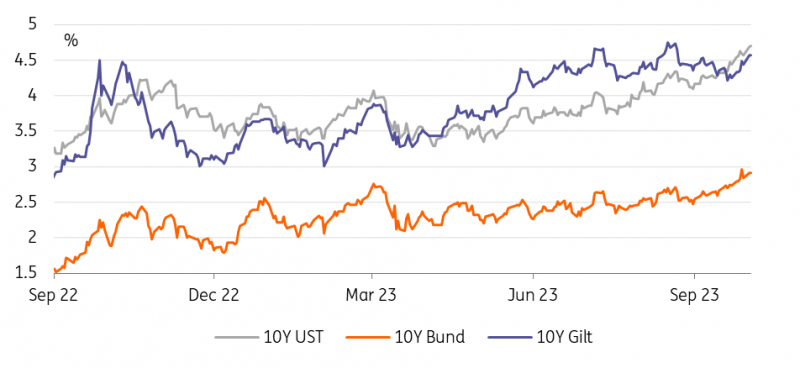

The bear steepening of yield curves has resumed this week. A US government shutdown – which could have provided some excuse for rates to retrace lower – was averted over the weekend. This has meant riskier assets had started off on a firmer footing, but at the same time, higher yields. The 10Y UST rose towards a new cycle high of 4.7% and in Europe, the 10Y Bund yield rose above 2.9%. Obviously, a better-than-anticipated ISM manufacturing as well as some upward revisions in eurozone regional PMIs also helped, but it seems only a matter of time before the 5% and 3% marks respectively are reached.

The shutdown story was noise, and though it might still come back to haunt markets later in November, the overarching narrative is that we are still in an environment of elevated inflation. Despite improvements, last week’s core PCE release for September was still close to 4% and the core CPI estimate for the eurozone even a tad higher at 4.5%. With activity not collapsing and labour markets resilient, central banks will try to brush away any hint of rate cuts discussion.

5% UST yield and 3% Bund seem only a matter of time

Refinitiv, ING

ECB still rather safe than sorry on inflation, Italian spreads recover on retail bond sale

The European Central Bank’s Vice President Luis de Guindos basically confirmed this position in an interview yesterday. Starting to talk about rate cuts was premature, he argued. While (headline) inflation has been brought down from over 10% to 4.3%, the final stretch will be the most difficult one. And he also pointed to the increased oil price posing a potential challenge if it feeds through to inflation expectations for households and corporates. We would note that, as far as market expectations are concerned, there has been some easing in longer-dated inflation swaps. The 5y5y inflation forward has dropped to the lowest levels since July.

While he also suggested the ECB was content with the level of interest rates it had reached he alluded to ending the reinvestments of the pandemic emergency purchase programme (PEPP) portfolio as a next step. While there has not been a formal discussion in the Council, this “will arrive sooner or later”. But the ECB is aware of the backstop the flexible reinvestments of the PEPP still pose for sovereign spreads as a first line of defence, and the temporary widening of the key 10Y spread of Italian government bonds over Bunds to over 200bp will have had ECB officials looking up.

That said, Italian government bond spreads have recovered over yesterday's session despite overall market rates rising, thus budging the recent directionality of the spread. The spread fell below 190bp, tightening close to 6bp versus Friday’s close. One reason cited is the strong showing of the BTP Valore sale on its first day, attracting demand of close to €5 billion, which suggests the overall size could rise towards €15 billion over the course of the next few days.

Today’s events and market view

The bear-steepening momentum seems unbroken and is only accelerated by better-than-expected data, such as yesterday's ISM manufacturing. Today's main data release is the US job opening numbers (JOLTS), an important gauge for the health of the labour market. There is no data of note to be released in the eurozone, but we will have public appearances by ECB officials Philip Lane and Francois Villeroy de Galhau. Note that Germany also observes its reunification national holiday.

In government bond primary markets, Austria sells 10Y and 30Y bonds today, while the UK sells 30Y green gilts.

More By This Author:

Asia Morning Bites - Tuesday, October 3The Commodities Feed: It’s All About The Yields

U.S. Production Boosts Case For 4% GDP Growth

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more