Rates Spark: A Week Of Decisive US Data Ahead

Will the Fed be able to catch the economy and how decisive will it have to act this month? These are the questions markets seek the answer to in this week’s data, culminating in Friday’s jobs report. Left to their own devices, EUR rates nudged higher on Monday, likely also driven by a brisk resumption of issuance after the summer break.

US data this week will be key to the sizing of the Fed's upcoming rate cut

EUR rates nudge higher as focus turns to the US

It’s a decisive week for rates given the data that is lined up in the US. Releases will kick off with the ISM manufacturing today, which is seen improving slightly but staying in contractionary territory. The focus is especially on the employment component ahead of the payrolls figure later this week. With the inflation issue seen as largely tackled, it is the state of the jobs market that will determine the rates outlook, and the more near term is the size of the Fed’s first rate cut that is expected this month – a 25bp is the market's base case, but there is still a 25-30% chance of a larger 50bp cut in the pricing.

Monday of course was a US holiday. And left to their own devices EUR rates nudged up by 4bp with the 10Y Bund yield above 2.34% again, the highest since late July. Front-end rates still rose by 2-3bp, including the pricing for the October rate cut, where the probability for a consecutive cut following one in September was pared back to below 40%. Given the ECB’s emphasis on relying more on its forecasts again, we still think this is exaggerating the chances of that happening.

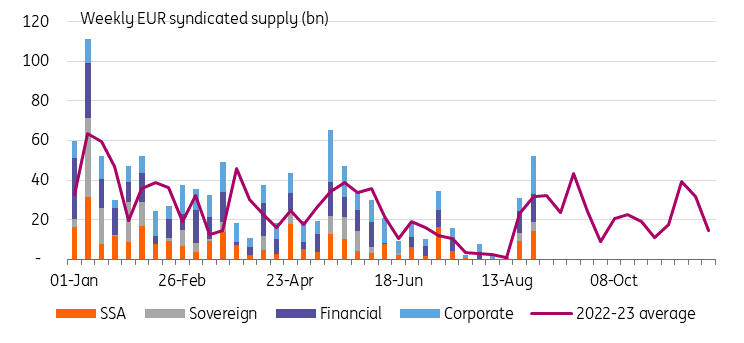

In terms of eurozone data, we saw some upwardly revised manufacturing PMIs, but observing the slight bear steepening of the curve we think the busy primary markets could be more to blame. This year's issuance activities have picked up somewhat earlier than usual after the summer break with the past one to two weeks seeing a busy slate of issuance across sectors. In Govies and SSAs we saw Finland and Austria come to the market with new bonds last month. In SSAs, we saw ESM yesterday and EFSF the week with both now having completed their funding for 2024.

Issuance kicked off earlier post summer break

Source: BondRadar, ING

Today's events and market view

US ISM data will be today’s highlight. The manufacturing component is expected to nudge up from 46.8 to 47.5. The consensus sees the prices paid index fall slightly from 52.9 to 52.0, which reflects easing price pressures. From the eurozone, we have the change in Spanish unemployment for August and the ECB’s Joachim Nagel will speak at a banking event.

Issuance includes Austria auctioning a 9Y and a 62Y ultra-long RAGB, totalling €1.4bn. From Germany, we have €4.5bn worth of 2Y Schatz.

More By This Author:

Italian GDP Growth Confirmed At 0.2% In Second QuarterFX Daily: An Important Week For The Dollar

The Commodities Feed: OPEC+ Leaning Towards Unwinding Cuts

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more